We recommend upgrading to the. Your browser is currently not supported.

2

If you are already familiar with our system, you may disable tooltips.

Maricopa county tax lien map. You can record your lien at the county office of the recorder. Welcome to maricopa county, the 4th populous county in the nation with over 13,000 employees working together to continually improve residents quality of air, environment, public health, human services, animal shelters, roads, planning & development, elections, courts, parks, and more. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale.

How does a tax lien sale work? Please note that creating presentations is not supported in internet explorer versions 6, 7. The tax lien sale of unpaid 2019 real property taxes will be held on and will close on tuesday, february 8, 2022.

As of november 30, maricopa county, az shows 18,451 tax liens. Other counties such as pima county and. A number will be assigned to each bidder for use when purchasing tax liens through the treasurer’s office and the online tax lien sale.

How does a tax lien sale work? The initial step is for the irs or local tax agency to decide that a person truly owes back taxes, and that it is worth the effort to impose a lien. What does the newspaper ad contain?

Tax liens in maricopa county, az buy tax liens and tax lien certificates in maricopa county, az, with help from foreclosure.com. As of november 28, pinal county, az shows 8,095 tax liens. Bidding is online only and will begin when the list is published and close on february 5, 2019.

View various years of aerial imagery for maricopa county. View which parcels have overdue property taxes and unsold liens. Due to potential complications concerning questions of law and notice, you may want to consult with an attorney.

Directing the maricopa county arizona treasurer to execute and deliver to the purchaser of the maricopa county arizona tax lien certificate in whose favor the judgment is entered, including the state, a deed conveying the property described in the maricopa county arizona tax lien certificate (sec. The maricopa county treasurer’s office is to provide billing, collection, investment, and disbursement of public monies to special taxing districts, the county, and school districts for the taxpayers of maricopa county, so the taxpayer can be confident in the accuracy and accountability of their tax dollars. How does someone acquire a tax lien?

Find a parcel number using the assessor's website. What is a tax lien, also known as, a certificate of purchase? Interested in a tax lien in maricopa county, az?

Then, the taxpayer is sent a letter with a notice and demand, which informs the taxpayer. The process of imposing a tax lien on property in maricopa county, arizona is typically fairly simple. The next delinquent property tax lien auction for maricopa county will be on february 5, 2019 for the 2017 tax year.

Disable tooltips just for this page. Liens are publicly recorded in the county where the property is located. The maricopa county treasurer’s office (mcto) makes every reasonable effort to maintain accurate data for the map as a service to the community.

When are property taxes in arizona due? Maricopa county superior court's modified operations website the arizona tax department was established in september 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition, assessment or collection of a tax. Then, the taxpayer is sent a letter with a notice and demand, which informs the taxpayer.

Forcible or because the maricopa county judgment records for no value of supervisors. • gila county recorder’s office. Maricopa county treasurer's home page.

24 rows sale year tax year parcels advertised $ value not auctioned (1) liens sold $ value. If you can't find what you're looking for, please try the county assessor's page. You can type in your name, business name, situs address, parcel/account number and vin to find the information you're looking for.

The place, date and time of the tax lien sale. • apache county recorder’s office. Interested in a tax lien in pinal county, az?

If you do not have access to a computer, the treasurer’s office will provide public access computers by appointment at. The treasurer’s tax lien auction web site will be available tbd for both research and registration.

Liens And Research

Liens And Research

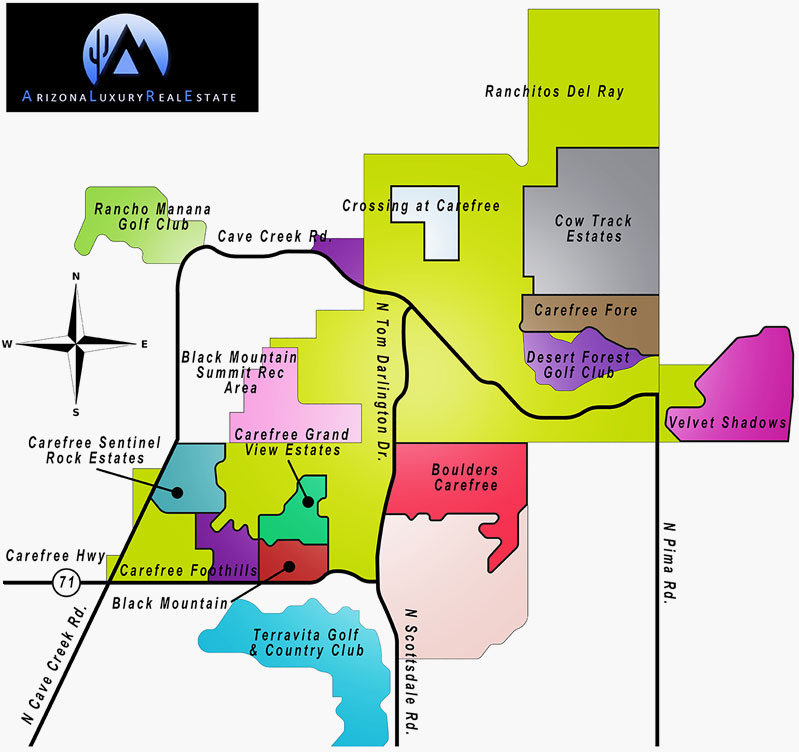

Homes For Sale In Carefree Rentals Arizona Luxury Real Estate

Goodyear Az Land For Sale Real Estate Realtorcom

Goodyear Az Land For Sale Real Estate Realtorcom

Goodyear Az Land For Sale Real Estate Realtorcom

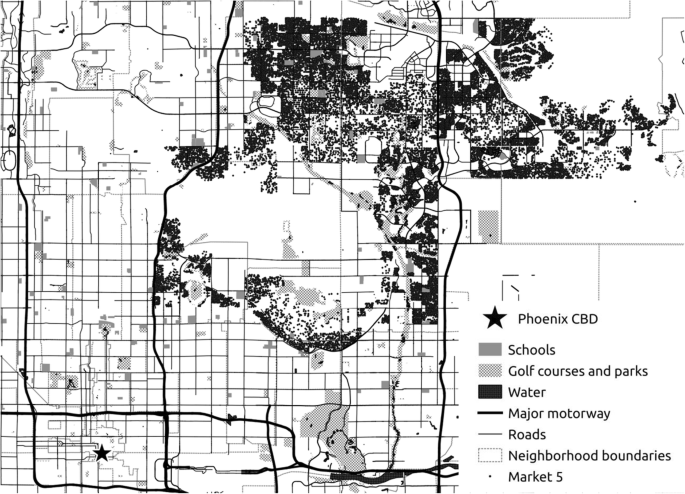

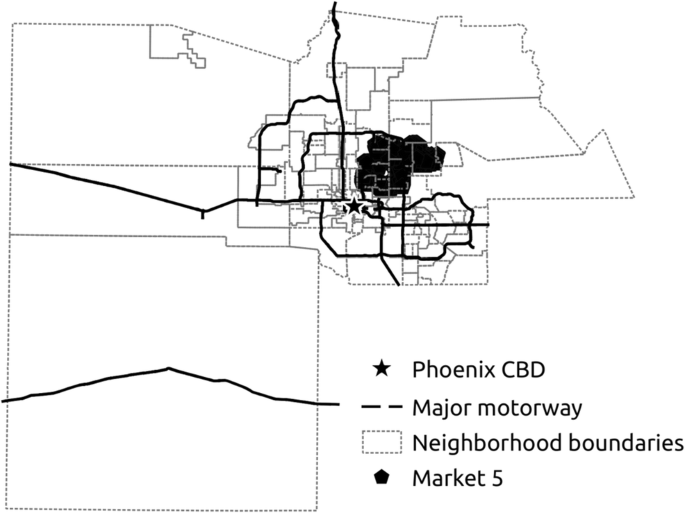

Are Estimates Of Rapid Growth In Urban Land Values An Artifact Of The Land Residual Model Springerlink

Are Estimates Of Rapid Growth In Urban Land Values An Artifact Of The Land Residual Model Springerlink

Maricopa County Assessors Office

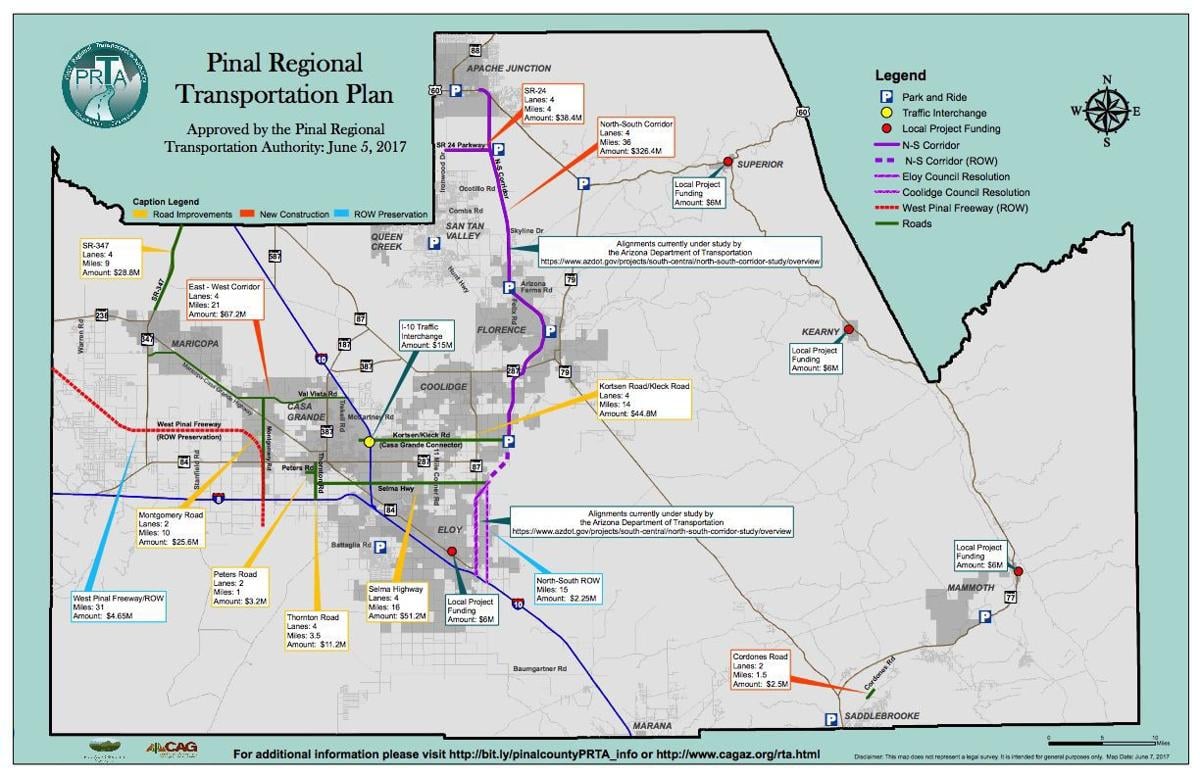

Pinal Road Excise Tax On Ballot In November Area News Pinalcentralcom

2

Seligman Az Land For Sale Real Estate Realtorcom

Wemar Surprise Luke Afb Map Task Force At Surprise City Council Sept 17 2019 - Government Affairs

Maricopa County Assessors Office

Interactive Parcel Maps Maricopa County Az

2

Liens And Research

Nice Chandler Metro Map Zip Code Map Metro Map Map

Wellton Az Land For Sale Real Estate Realtorcom