Regular gambling withholding for certain games. Any sweepstakes, lottery, or wagering pool (this can include payments made to.

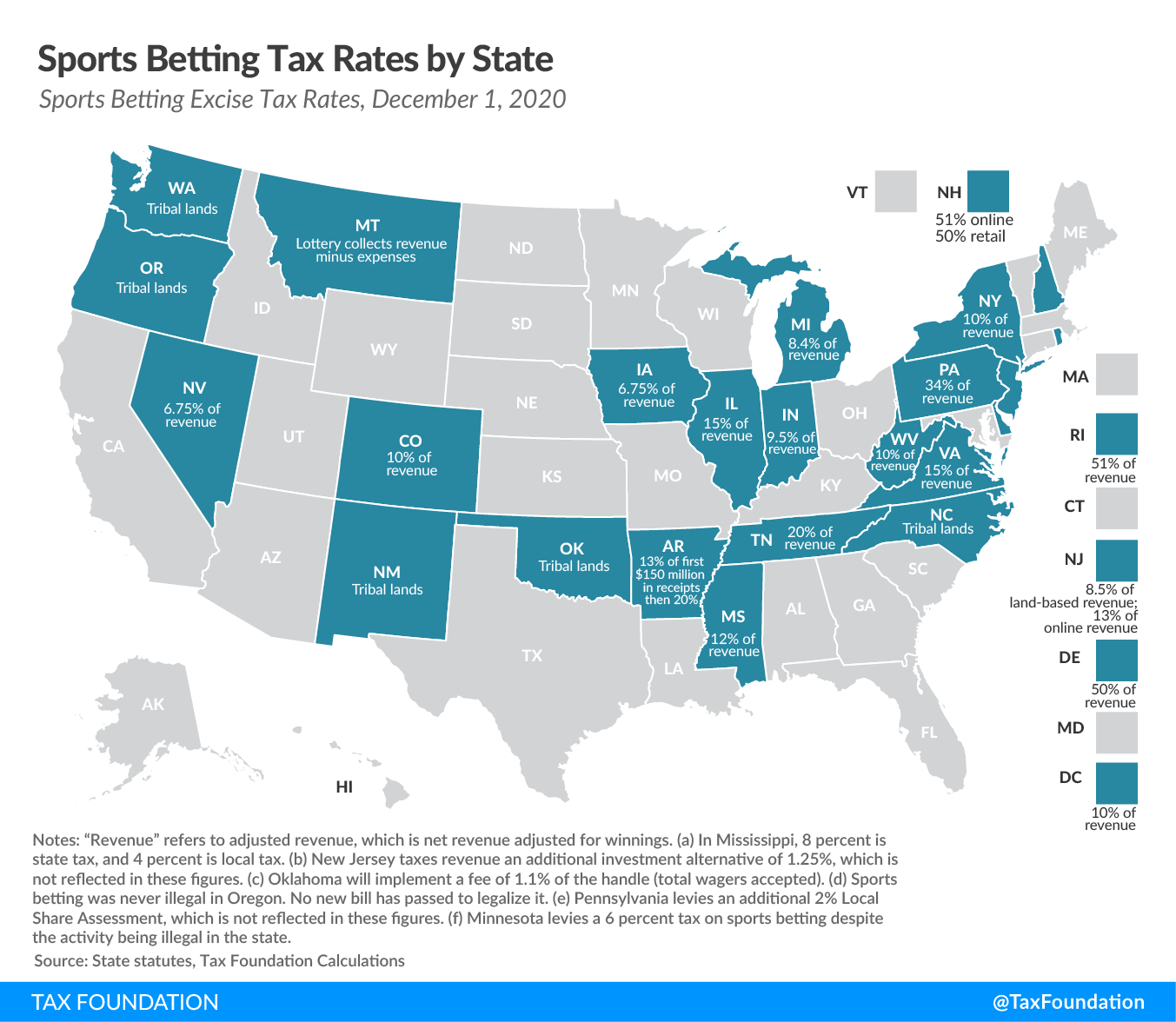

Super Bowl Sports Betting And State Tax Revenue Tax Foundation

Any other bet if the proceeds are equal to or greater than 300 times the wager amount.

Ri tax rate on gambling winnings. Your gambling winnings are generally subject to a flat 24% tax. · $13,000 and the winner is filing single;*. Gambling winnings are subject to 24% federal tax, which is automatically withheld on winnings that exceed a specific threshold (see next section for exact amounts).

The effective tax rate is the actual percentage you pay after taking the standard deduction and other possible deductions. · $12,000 and the winner is filing separately; However, for the following sources listed below, gambling winnings over $5,000 will be subject to income tax withholding:

Any lottery, sweepstakes, or betting pool. The tax rate deductible from your winnings is still the same irrespective of the amount you win. Gambling income includes (but is not limited to) winnings from;

(a) regular gambling withholding at 24% (31.58% for certain noncash payments) and (b) backup withholding which is also at 24%. The brackets are as follows. This percentage is already significant.

Prior to that act, these winnings and prizes were exempt under title 42, chapter 61, section 17. How much will the irs tax my gambling winnings? That’s a cumulative amount for the entire year, so even if you win $1,000 on five or more separate occasions during the year, you still need to report your winnings.

While regulating casino gambling, the ri authorities made all winnings subject to a payable income tax rate of up to 5.99% (in addition to the federal levy of 24%). Rhode island has an oddly high gambling winnings state tax of 51% on all gambling winnings revenue this is part of a ‘revenue sharing model’ rhode island have with delaware, where revenue is shared between state, casinos, and operators Again, uncle sam wants 24% of your winnings.

If you win a substantial amount of money in any legally operated game of chance, the payer of your winnings will deduct 24% of the total for taxes and will give. When gambling winnings are combined with your annual income, it could move you into a higher tax bracket, so it’s important to be aware of gambling income before starting tax preparation. As with some other states, the rhode island betting tax rate varies depending on a person’s overall income over the year.

You must pay federal taxes on wins no matter what—even if you live in a state with no gambling taxes. In canada, austria, australia, great britain, france, finland, germany, ireland, turkey and belarus, the wins are paid out in full with no tax on gambling winnings. Fair market value of prizes (like cars and trips) the general rules.

Gambling winnings are typically subject to a flat 24% tax. If a payment is already subject to regular gambling withholding, it isn't subject to backup withholding. There are two types of withholding on gambling winnings:

So it doesn’t matter if you earn $2,000 or $400,000 because betting taxes are not progressive. However, public law 1989, chapter 126, article 21, removed the exemption of lottery winnings from the personal income tax law. A winner must file a connecticut income tax return and report his or her gambling winnings if the winner’s gross income for the 2011 taxable year exceeds:

You are required to report 100% of gambling winnings as taxable income on your 1040. In some cases, the tax ( 25% ) is already deducted by the casino before you are paid your winning. Tax rate on gambling winnings of conflicting information, the information described in the terms and conditions for royal tax rate on gambling winnings panda promotions and bonuses shall prevail over any descriptions provided in royal tax rate on gambling winnings panda’s promotions and.

It's important to consider all of your az gambling winnings when preparing your taxes because those winnings, when added to your annual income, could move you into a higher tax bracket. You may be required to withhold 24% of gambling winnings for It becomes even more noteworthy in a state like california, where you could pay up to a 37.3% total tax (24 + 13.3).

The state tax rate in new jersey is 3%, which is the rate your gambling winnings are taxed. Usa tax on gambling winnings First off—what counts as gambling in the eyes of the irs?

Federal tax rates range from 10% to 37%, and gambling winnings can bump a person into a higher tax bracket. However, for the activities listed below, winnings over $5,000 will be subject to income tax withholding: Marginal tax rate is the bracket your income falls into.

Virginia’s state tax rates range from 2% to 5.75%. How gambling winnings are taxed. Effective for tax years after 2017, the federal withholding rate for gambling winnings of $5,000 or more is 24%.

But it doesn’t take much — an annual income of more than $17,000 — for the highest percentage to kick in. Income up to $65,250 is taxed at 3.75%. These winnings must also be reported as income on your federal tax return, where your rate depends on your income level and whether you’re filing as an individual or jointly with a spouse.

The state income tax rate in arizona ranges. The twin river casino opened first on july 7, 1947 as lincoln downs.

How Much Tax Casinos Pay - E-play Africa

Irs - Even If Youre A Casual Gambler Remember That Gambling Winnings Are Fully Taxable And You Must Report The Income On Your Tax Return Gambling Income Includes Winnings From Lotteries Raffles

Taxes On Gambling Winnings Comparing The Situation In The Rf And Europe Russian Gaming Week

Tpcs Sports Gambling Tip Sheet Tax Policy Center

The Ultimate Guide To Gambling Tax Rates Around The World

Gambling Winnings Tax Hr Block

Sports Betting Might Come To A State Near You Tax Foundation

How To Pay Taxes On Sports Betting Winnings Bookiescom

How Much Tax Casinos Pay - Top 10 Highest Lowest Countries

Gambling Winnings Losses Taxes Do I Have To Pay Taxes - Tax Professionals Member Article By Flynn Financial Group Inc

How Much Tax Casinos Pay - Top 10 Highest Lowest Countries

Rhode Island Gambling Age Legal Ri Sportsbook Casino Age

What Percentage Of Lottery Winnings Would Be Withheld In Your State

The 73 Billion In Voluntary Taxes Up 9 Consumers Pay Eagerly And With Great Excitement Wolf Street

Filing Out Of State W-2g Form Hr Block

Free Gambling Winnings Tax Calculator All 50 Us States

Tax Reform Law Deals Pro Gamblers A Losing Hand - Journal Of Accountancy

Sports Betting Tax Treatment Sports Betting Operators Tax Foundation

Gambling Winnings Are Taxable Income On Your Tax Return