Include the interest as an expense when you calculate your allowable motor vehicle expenses. Credit card and installment interest incurred for personal expenses.

Section 24 Of Income Tax Act- Deduction For Interest On Home Loan

Individuals are the only ones who can take advantage of this deduction.

Is car loan interest tax deductible 2019. Is car loan interest tax deductible? Who is eligible to get benefit under section 80eeb? To write off your car loan interest, you'll have to deduct actual car expenses instead of the standard mileage rate.

But there is one exception to this rule. For more information on car expenses and the rules for using the standard mileage rate, see pub. An individual who has taken a loan for purchase of an electrical vehicle from any financial institution.

Like most areas of taxation, the answer to this question is: When you use a student loan, the irs allows you to deduct the interest payments you make on it until it's paid off. Typically, deducting car loan interest is not allowed.

So if you use your car for work 70% of the time, you can write off 70% of your vehicle interest. The loan must be secured by the second home, ie, if you miss a payment the lender can seize the home. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

Is interest on an rv loan tax deductible? No other taxpayer is eligible for this deduction. If you're an employee working for someone else, you can't deduct auto loan interest expenses, even if.

More on that coming up! If you use it for both business and personal use, only those expenses incurred as a result of or while on business can be tax deductible. If you use your car for business purposes, you may be able to deduct actual vehicle expenses.

For a summary of this content in poster format, see motor vehicle expenses (pdf, 761kb) this link will download a file. The standard mileage rate already factors in costs like gas, taxes, and insurance. You don’t include the loan advance in your taxable income and you cannot deduct the interest payment on your tax return.

Interest paid on personal loans, car loans, and credit cards is generally not tax deductible. Car is considered a luxury product in india and, in fact, attracts the highest goods and services tax (gst) rate of 28% currently. A home must contain permanent sleeping, cooking, and toilet facilities.

However, if you are buying a car for commercial use, you can show the interest paid. “it depends.” but it’s entirely possible you can deduct the interest on your rv’s loan. Among them is the deduction for investment interest expenses.

If you’re wondering whether personal loan interest is tax deductible the answer, sadly, is no. You can take a deduction for home mortgage interest for. This is the first time when deduction from income is allowed for the purchase of a vehicle under the income tax act, 1961.

Housing loans, vehicle loans, computer loans and personal loans. Thus, you are not eligible for any deductions on your car loan if you are buying for your personal use. View solution in original post

Features of section 80eeb eligibility criteria. The mortgage or loan interest would be deductible if used to purchase a second home. Car loan interest would be deductible if the vehicle was used for self employment, or in the service of an employer, but it is not deductible for personal use.

In general, you can deduct interest paid on money you borrow to invest, although there are restrictions on how much you can deduct and which investments actually qualify you for the deduction. Not taxable if the scheme is available to all employees. Tax benefits on car loans.

Types of interest not deductible include personal interest, such as: The federal tax code includes a number of incentives to encourage investment. Car loan interest is tax deductible if it's a business vehicle you cannot deduct the actual car operating costs if you choose the standard mileage rate.

For tax years prior to 2018, the interest on a home equity loan was deductible and could provide cash to make personal purchases and also allowed you to deduct the interest as part of your mortgage interest deduction. Interest on a car loan is one exception. Interest paid on a loan to purchase a car for personal use.

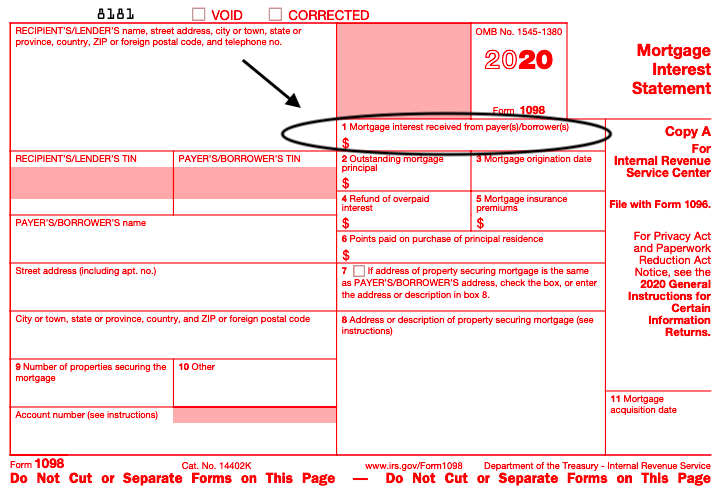

The mortgage interest deduction allows homeowners to reduce their taxable income by the amount of interest paid on a qualified residence loan.the law regarding the mortgage interest deduction has been revised by the tax cuts and jobs act, and the changes will take effect beginning with returns filed in 2019.

What Is Adjusted Gross Income Adjusted Gross Income Income Low Taxes

When Is Interest On Debt Tax Deductible

Personal Loan Tax Deduction Tax Benefit On Personal Loan - Earlysalary

Tax Deductions For Home Mortgage Interest Under Tcja

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

Top 6 Tax Deduction Examples You Probably Didnt Know About

Why Your Small Business Loan Interest Is Tax Deductible - Funding Circle

Your 2020 Guide To Tax Deductions The Motley Fool

Is Buying A Car Tax-deductible In 2021

Disability Tax Deductions For Wheelchair Accessible Vans - Rollx Vans

Are Student Loans Tax Deductible Rules Limits Guide Sofi

Is Interest Paid On Foreign Home Loan Tax-deductible In India

Tax Form 1098-e How To Write Off Your Student Loan Interest Student Loan Hero

Publication 530 2014 Tax Information For Homeowners Business Budget Template Business Tax Deductions Tax Deductions

Give To Charity But Dont Count On A Tax Deduction

.png)

Maximizing Tax Deductions For The Business Use Of Your Car - Turbotax Tax Tips Videos

The 6 Best Tax Deductions For 2019 The Motley Fool

Pin By Vikram Verma On Credit Score Fast Loans Financial Advice Long Term Loans

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv