Meaning estates under $11.58 million—possibly a lot less than $11.58 million—could be subject to these taxes. No estate tax or inheritance tax.

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Arizona Real Estate

Wisconsin does not levy an inheritance tax or an estate tax.

Inheritance tax wisconsin rates. Washington has the highest estate tax at 20%, applied to the portion of an estate's value greater than $11,193,000. The occasion was the 1898 report of the wisconsin state tax commission (commission), 3 a state agency that. The average effective rate is 1.95%.

Eight states and the district of columbia are next with a top rate of 16 percent. Income tax rates in wisconsin range from 4.00% to 7.65%. The top estate tax rate is 16 percent (exemption threshold:

Your unified lifetime gift and estate tax exemption in 2017 was $5.49 million and is now the same as the federal estate tax exemption of $11,580,000 per individual (and $23,160,000 for married couples). As provided under egtraa, all of the rates except those at the top remain the same as they were under prior law. The property tax rates are among some of the highest in the country at around 2%.

The internal revenue service (irs) requires estates to exceed $11.4 million to file a federal estate tax return and pay estate tax. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million. Individual belongings are taxed at different rates determined by what they are and the situation.

Rich states, poor states ranks wisconsin 40th in the nation in all three categories. Wisconsin has no gift tax. Though wisconsin has no inheritance tax, you may owe if you inherit property in another state.

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15% and 19%. [2] but subject to “nys cliff” for taxable estates exceeding 105% of exemption amount. However, if you are inheriting property from another state, that state may have an estate tax that applies.

Ad an inheritance tax expert will answer you now! Likewise, the top tax rate is 40%. The tax rate on the estate of an individual who passes away this year with an estate valued over the $11.58 million exemption is also a flat 40%.

[1] however, gifts made within 3 years of death are pulled back into estate to calculate nys estate tax. Download brief history of the inheritance tax rates in wisconsin books now! But really, any property you own is subject to capital gains tax if you sell it for more than the original purchase price.

The maximum credit is $1,168. Brief history of the inheritance tax rates in wisconsin written by anonim, published by anonim which was released on 01 december 2021. Available in pdf, epub, mobi format.

Inheritance tax rates depend on. However, like every other state, wisconsin has its own inheritance laws, including what happens if the decedent dies without a valid will. There is no wisconsin inheritance tax for decedents dying on or after january 1, 1992.

The top marginal rate was 46% for 2006, and is 45% for 2007 through 2009. However, the top graduated tax rate was reduced to 50% for 2002, with annual decreases of 1% thereafter through 2007. The top estate tax rate is 20 percent (exemption threshold:

Homeowners with total household incomes of less than $24,680 who own and occupy their homes are eligible for a property tax credit. Ad an inheritance tax expert will answer you now! There are signs that the federal exemption for estate taxes may be lowered in 2021.

Wisconsin does not have a state inheritance or estate tax. We’ll discuss what wisconsin has to say about that situation, along with details about the probate process and how to successfully create a valid will. Wisconsin also has a sales tax between 5% to 6%, and counties can leverage an additional 1% to 2% on top of that.

You will also likely have. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. No estate tax or inheritance tax.

Wisconsin has neither an estate nor an inheritance tax. Policy issues influencing the inheritance tax some of the major public policy issues related to the inheritance tax emerged soon after sanderson. California, florida, virginia and wisconsin do not have estate, gift or inheritance tax.

For full functionality of this site it is necessary to enable javascript. Wisconsin has among the highest property tax rates in the nation. $2.193 million) washington dc (district of columbia):

Here are the instructions how to enable javascript in your web browser. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. The graduated tax rates ranged from 18% to 55%.

Your capital gains tax rate can range from 0%, 15%, or 20%, depending on your income and tax status. Income tax rates average from 4% to 8%. Let’s say your aunt bought a house in 1970 for $70,000.

There are both federal estate taxes and state estate taxes. While wisconsin gets top marks for having a right to work law and not having a state inheritance tax, the state gets less than stellar marks for top marginal tax rates, the progressive nature of the personal income tax, and the high cost of workers’ compensation.

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Property Tax Inheritance Exclusion

A Windfall For Wealthy Heirs - Center For American Progress

Inheritance Tax What Is An Inheritance Tax Taxedu

State Estate And Inheritance Taxes Itep

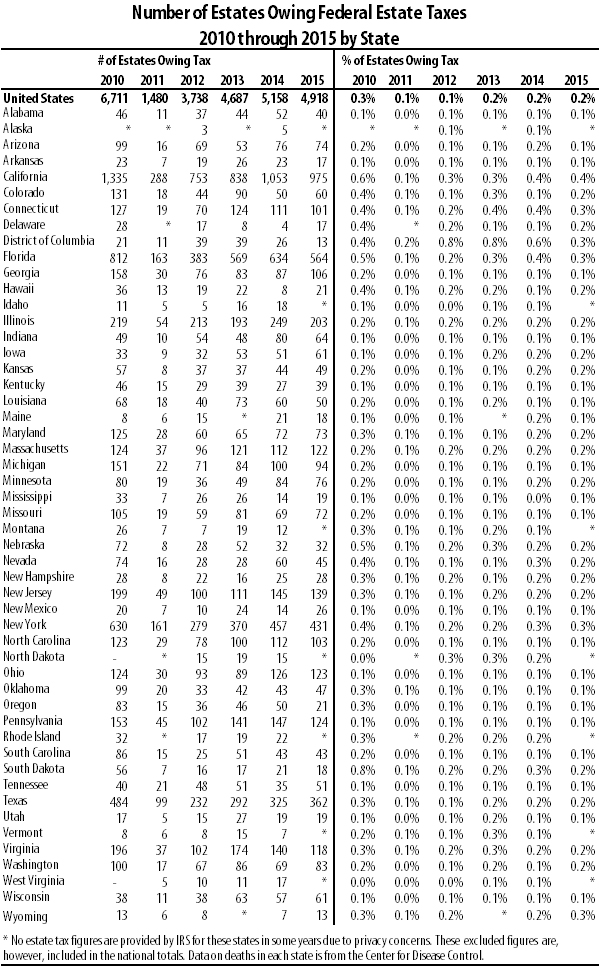

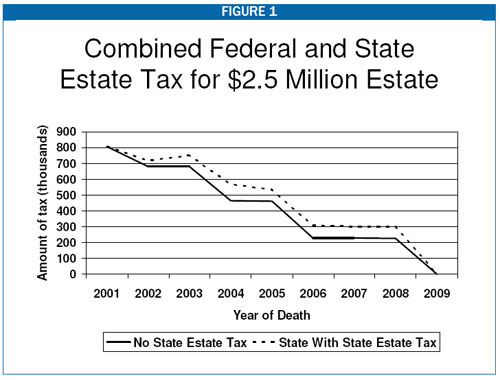

Assessing The Impact Of State Estate Taxes Revised 121906

States With An Inheritance Tax Recently Updated For 2020

States With An Inheritance Tax Recently Updated For 2020

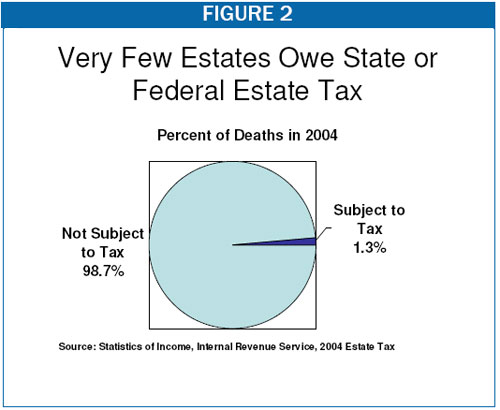

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

2

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

What Is Inheritance Tax

Recent Changes To Estate Tax Law Whats New For 2019

Recent Changes To Estate Tax Law Whats New For 2019

Assessing The Impact Of State Estate Taxes Revised 121906

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep