How 2021 sales taxes are calculated in new hampshire. The meals and rentals (m&r) tax was enacted in 1967 at a rate of 5%.

Eqkdqb7mjbevtm

“to ensure a smooth transition to the new tax rate, we are.

Nh food tax rate. There are, however, several specific taxes levied on particular services or products. New hampshire cities and/or municipalities don't have a city sales tax. Years ending on or after december 31, 2025, nh i&d rate is 3%.

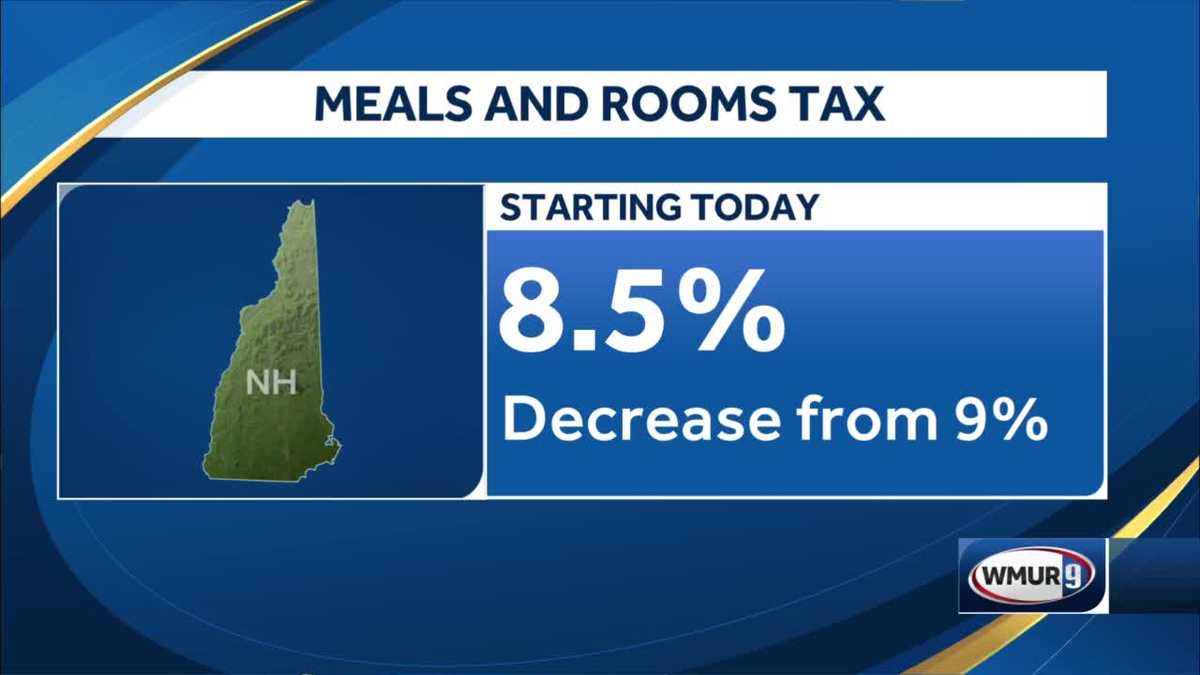

Years ending before december 31, 2023, nh i&d rate is 5%. The state meals and rooms tax is dropping from 9% to 8.5%. New hampshire department of revenue administration (nhdra) is reminding operators and the public that starting october 1, 2021, the state’s meals and rooms (rentals) tax ratewill decrease by 0.5%, from 9% to 8.5%.

Concord — the new hampshire department of revenue administration (nhdra) sets tax rates for the cities and towns in new hampshire beginning in october of each year. The tax is assessed upon patrons of hotels and restaurants, on certain rentals, and upon meals costing $.36 or more. Exact tax amount may vary for different items.

2021 new hampshire state sales tax. Manchester’s tax rate for fiscal year 2022 has been set at $17.68 per $1,000, down $6.98 — or 28.30% — from the previous year’s $24.66 per $1,000, according to city New hampshire's meals and rooms tax is a 8.5% tax on room rentals and prepared meals.

Every 2021 combined rates mentioned above are the results of new hampshire state rate (0%). Advertisement it's a change that was proposed by gov. Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%.

Designed for mobile and desktop clients. This comes on the heels of local property reappraisals many new hampshire cities and towns have undertaken and which assessors are required by law to perform every five years. There are, however, several specific taxes levied on particular services or products.

New hampshire's meals and rooms tax is a 9% tax on room rentals and prepared meals. While new hampshire lacks a sales tax and personal income tax, it does have some of the highest property taxes in the country. (this is the connecticut state sales tax rate plus and additional 1% sales tax.)

2021 2020 2019 2018 2017 2016. A 9% tax is also assessed on motor vehicle rentals. New hampshire levies special taxes on electricity use ($0.00055 per kilowatt hour), communications services (7%), hotel rooms (9%) and restaurant meals (9%).

The 2021 tax rate for londonderry is $18.38 per 1,000. • this budget helps small businesses by. • this budget helps consumers by reducing the meals and rooms tax from 9% to 8.5%, its lowest level in over a decade.

This set annually in october by the department of revenue. Nh meals and rooms tax decreasing by 0.5% starting friday. The new hampshire department of revenue administration has approved the city’s 2021 tax rate for fiscal year 2022 of $15.03 per $1,000 of valuation.

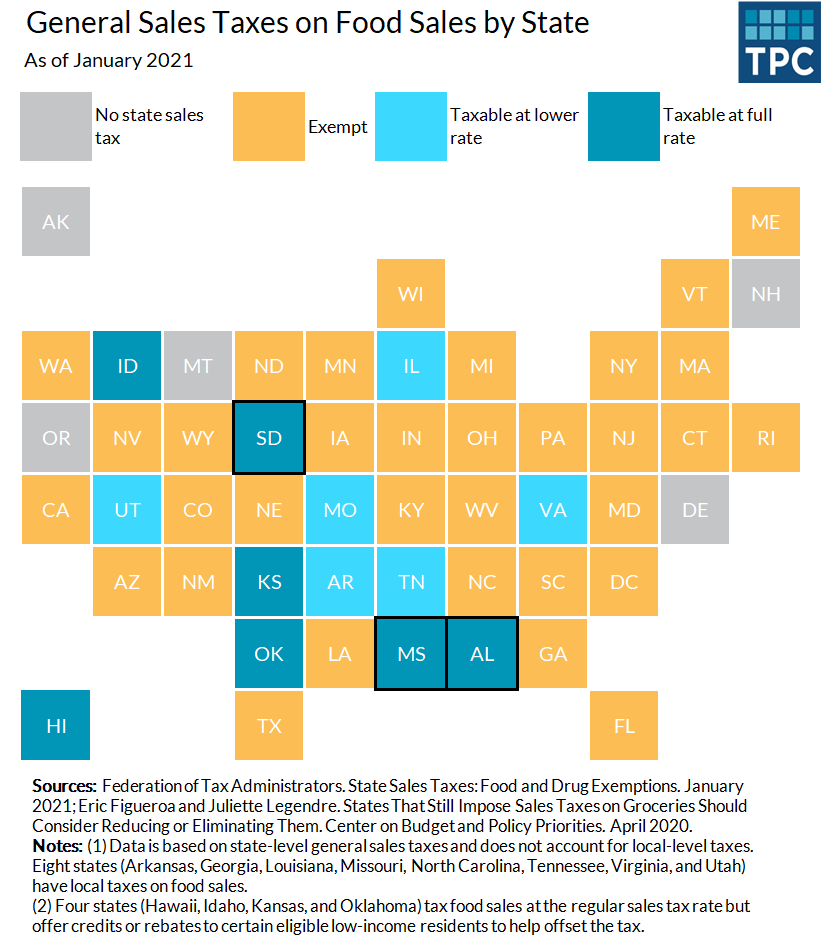

Chris sununu in this year's budget package, which passed state government in. New hampshire is one of the few states with no statewide sales tax. General hospitals and special hospitals for rehabilitation required to be licensed under rsa 151 that provide inpatient and outpatient hospital services, but not including government facilities.

$21.31 $28.48 $26.96 $27.23 $26.01 $25.10 n/a revaluation year (values increased) 78.6% 83.8% 88.2% 91.1% 96.6% revaluation year (values increased) 2015. You only have to file a new hampshire income tax return if you have earned over $2,400 annually ($4,800 for joint filers) in taxable dividend and interest income. The 2020 real estate tax rate for the town of stratham, nh is $18.95 per $1,000 of your property's assessed value.

New hampshire's individual tax rates apply to interest and dividend income only. There is no county sale tax for new hampshire. Income tax is not levied on wages.

For the taxable period ending june 30, 2016, the tax rate is reduced to 5.45% and for the taxable period ending june 30, 2017 and forward, the tax rate is reduced to 5.4%. On average, homeowners in new hampshire pay 2.05% of their home’s. What is the meals and rooms (rentals) tax?

Starting october 1, the tax rate for the meals and rooms (rentals) tax will decrease from 9% to 8.5%. The state general sales tax rate of new hampshire is 0%. A 9% tax is assessed upon patrons of hotels (or any facility with sleeping accommodations), and restaurants, on rooms and meals costing $.36 or more.

Chapter 144, laws of 2009, increased the rate from 8% to the current rate of 9% and added campsites to the definition of hotel. New hampshire is one of the few states with no statewide sales tax. The new hampshire state sales tax rate is 0%, and the average nh sales tax after local surtaxes is 0%.

Years ending on or after december 31, 2024, nh i&d rate is 4%. Exact tax amount may vary for different items. Additional exemptions exist for seniors or disabled individuals:

New Hampshire Sales Tax - Taxjar

New Hampshire Sales Tax Rate - 2021

7 States Without Income Tax - Mintlife Blog

Pin On Picture

New Hampshire - Sales Tax Handbook 2021

New Hampshire Sales Tax Rate - 2021

Historical New Hampshire Tax Policy Information - Ballotpedia

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

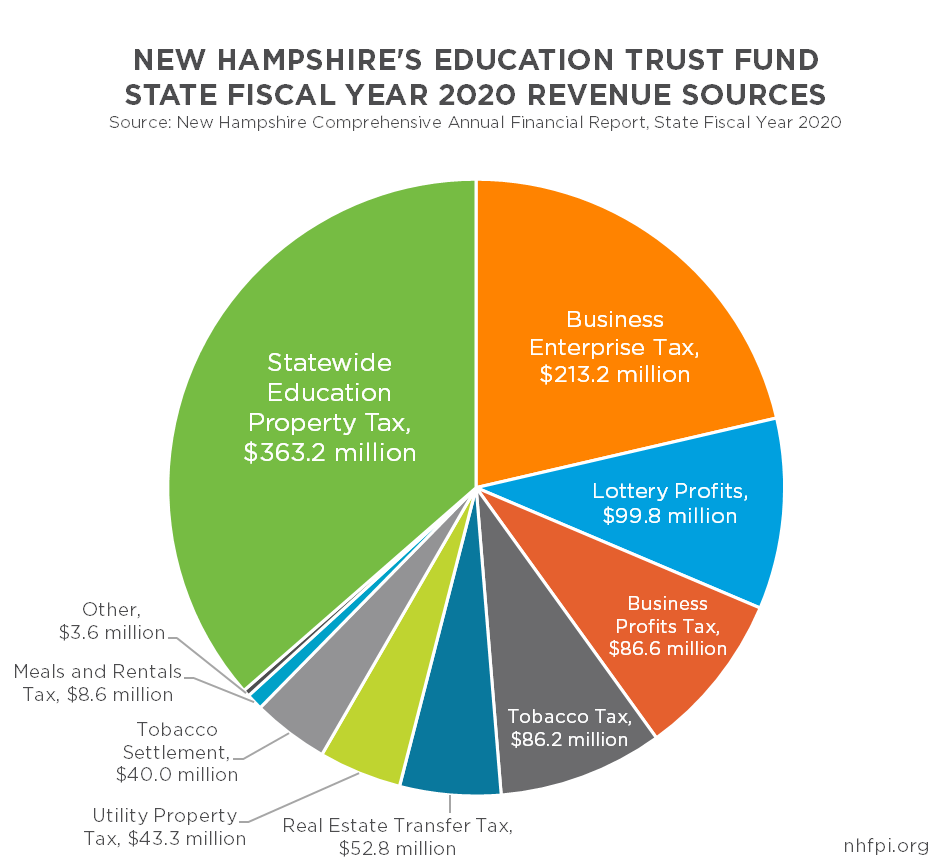

The State Budget For Fiscal Years 2022 And 2023 - New Hampshire Fiscal Policy Institute

New Hampshire Sales Tax Rate - 2021

Cut To Meals And Rooms Tax Takes Effect - Nh Business Review

New Hampshire Sales Tax Rate - 2021

States With Highest And Lowest Sales Tax Rates

New Hampshire Meals And Rooms Tax Rate Cut Begins

State Sales Tax On Groceries Ff 09202021 Tax Policy Center

Understanding New Hampshire Taxes - Free State Project

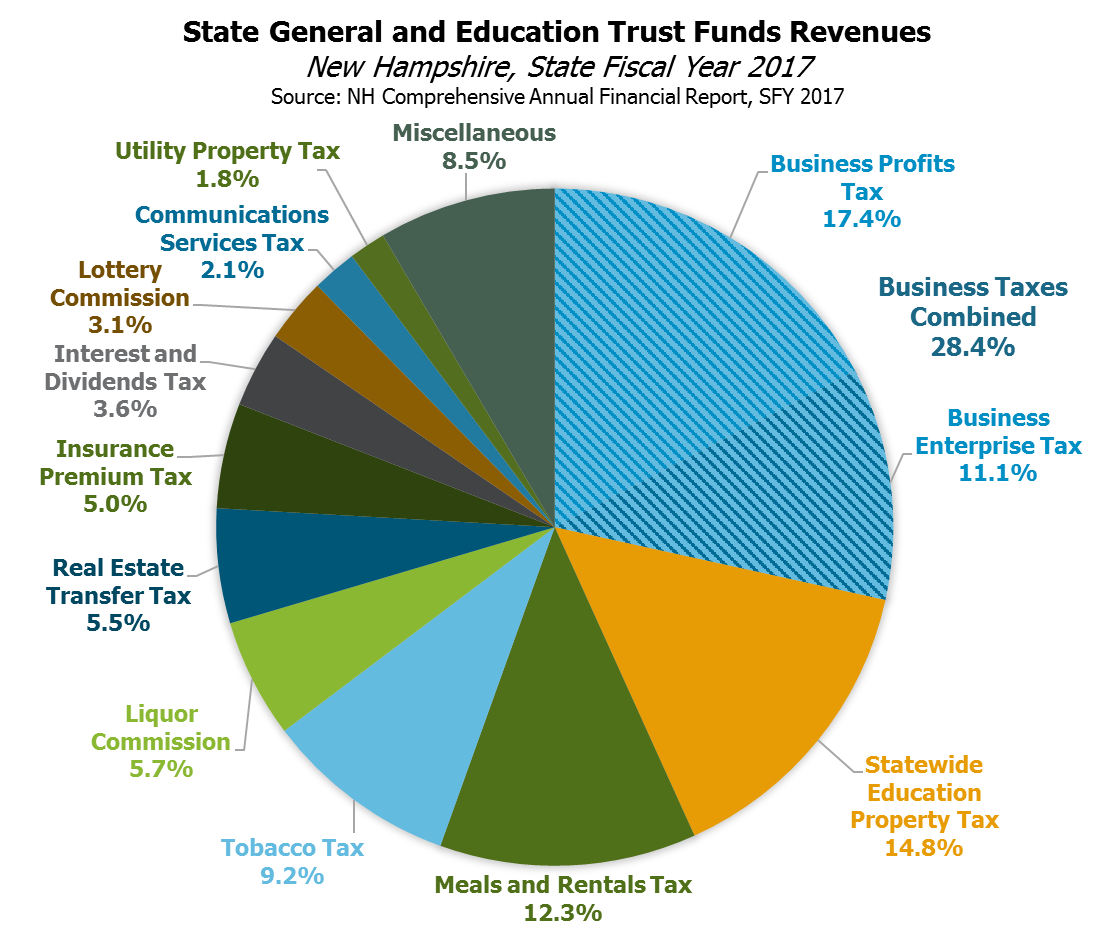

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Is New Hampshire Really As Anti-tax As Its Cracked Up To Be Stateimpact New Hampshire

States With The Highest And Lowest Property Taxes Property Tax High Low States