Sales or use tax [tenn. As reported by carsdirect, tennessee state sales tax is 7 percent of a vehicle's total purchase price.

Used Cars Under 15000 For Sale In Memphis Tn Autonation Honda Covington Pike

The memphis's tax rate may change depending of the type of purchase.

Vehicle sales tax in memphis tn. How 2021 sales taxes are calculated in memphis. If you are trading in a vehicle, the trade in allowance would be deducted from the purchase price and that's what you pay sales tax on. Tennessee collects a 7% state sales tax rate.

The december 2020 total local sales tax rate was also 9.250%. • total vehicle sales price = $25,300 • $25,300 x 7% (state general rate) = $1,771 • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if county clerk has received the payment from dealer. Tn auto sales tax calculator.

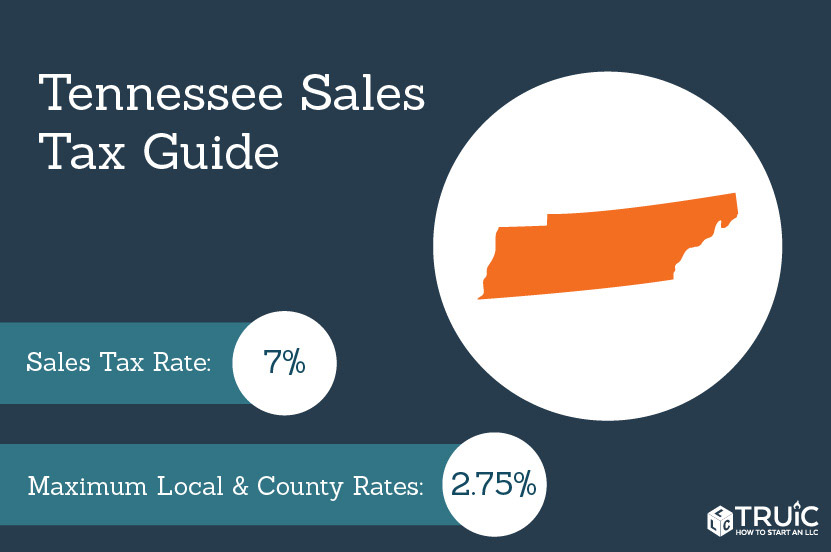

The tennessee sales tax rate is currently %. This page covers the most important aspects of tennessee's sales tax with respects to vehicle purchases. The following information is for williamson county, tn, usa with a county sales tax rate of 2.75%.

The following information is for williamson county, tn, usa with a county sales tax rate of 2.75%. The combined rate used in this calculator (9.75%) is the result of the tennessee state rate (7%), the 38134's county rate (2.25%), the memphis tax rate (0.5%). What is the memphis area retail sales tax rate?, memphis, 3 replies classic car inspector or mechnic with classic car experience, memphis, 5 replies sales tax cheaper in tn, ms, or ar?, memphis, 3 replies tennessee sales tax, memphis, 15 replies visiting memphis for the first time/high sales tax, memphis, 8 replies

Every 2021 combined rates mentioned above are the results of tennessee state rate (7%), the county rate (2.25%), the memphis tax rate (0% to 0.5%). Other counties in tn may have a higher or lower county tax rate (applied to the first $1600). The county sales tax rate is %.

For vehicles that are being rented or leased, see see taxation of leases and rentals. Tennessee car buyers pay local sales tax ranging from 1.5 to 2.75 percent on the first $1,600 plus state sales tax of 7 percent on the entire purchase price. The memphis, tennessee sales tax rate of 9.75% applies to the following 50 zip codes:

7% state and 2.25% local. See the state tax list pdf for rates in your city/county. County administration building 160 n main street memphis, tn 38103 phone:

The minimum combined 2021 sales tax rate for memphis, tennessee is. For example, if you buy a car for $20,000, then you'll pay $1400 in state sales tax. The minimum combined 2021 sales tax rate for memphis, tennessee is.

The highest the combined city/county rate can be is 2.75%. Title fees should be excluded from the sales or use tax base when Motor vehicle or boat, is subject to the sales or use tax.

This tax is generally applied to the retail sales of any business, organization, or person This is the total of state, county and city sales tax rates. The memphis sales tax rate is %.

37501, 37544, 38101, 38103, 38104, 38105, 38106, 38107, 38108, 38109, 38111, 38112, 38113, 38114, 38115, 38116, 38117, 38118, 38119, 38120, 38122, 38124, 38126, 38127, 38128, 38130, 38131, 38132, 38134, 38136, 38137, 38141, 38152, 38157, 38161, 38166, 38167, 38168, 38173, 38174,. If sales tax value is greater than $1600 but less than $3200 your single article tax is 2.75% after $1600 if sales tax value is more than $3200 your single article tax is $44.00 disclaimer: As reported by carsdirect, tennessee state sales tax is 7 percent of a vehicle's total purchase price.

Car sales tax in memphis tn sales tax on automobile transfers. Depending on the zipcode, the sales tax rate of memphis may vary from 7% to 9.75%. 732 s congress blvd rm 102.

The shelby county trustee does not offer tax lien certificates or make over the counter sales. The 38134, memphis, tennessee, general sales tax rate is 9.75%. The current total local sales tax rate in memphis, tn is 9.750%.

You won't pay sales tax in ga. It boils down to 9.25%. There is no special rate for memphis.

The sales tax calculator is for informational purposes only, please see your motor vehicle clerk to confirm exact sales tax amount. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes.

Yeadlyuoaq7tvm

Used Cars Under 10000 For Sale In Memphis Tn Autonation Ford Memphis

Used Acura In Memphis Tn For Sale

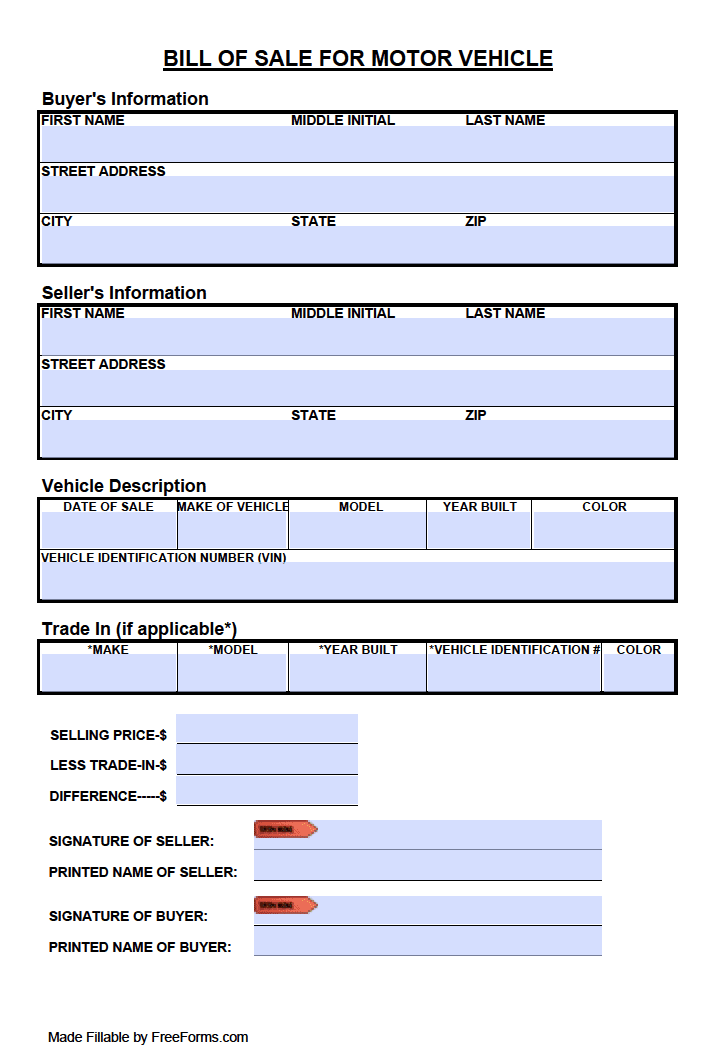

Free Tennessee Bill Of Sale Forms - Pdf Word

Ford Bronco Sport For Sale In Memphis Tn Autonation Ford Memphis

Used Crossovers In Memphis Tn For Sale

Sales Tax On Cars And Vehicles In Tennessee

Used Acura For Sale In Memphis Tn - Cargurus

Used Maserati For Sale In Memphis Tn - Cargurus

Tennessee Car Sales Tax Everything You Need To Know

L6sma5aisb7rdm

Used Land Rover For Sale In Memphis Tn - Cargurus

Used Tesla For Sale In Memphis Tn Carvana

Used Infiniti For Sale In Memphis Tn - Cargurus

Auto Universe Cars For Sale - Memphis Tn - Cargurus

Tennessee Sales Tax And Other Fees - Motor Vehicle - County Clerk - Knox County Tennessee Government

Tennessee Sales Tax - Small Business Guide Truic

New Subaru Cars For Sale In Memphis Tn Jim Keras Subaru

Free Tennessee Motor Vehicle Dmv Bill Of Sale Form Pdf