The federal annual gift exclusion is now $15,000. As a result, if a person’s estate is less than $5,490,000 and there are no other involved states, an inheritance will likely not be taxed.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The top inheritance tax rate is 15 percent (no exemption threshold) oklahoma inheritance tax oklahoma estate tax.

Oklahoma inheritance tax rate. Estates and their executors are still required to file the following: In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. We no longer need to worry about oklahoma inheritance tax.

The statewide sales tax in oklahoma is 4.50%. But just because you’re not paying anything to the state doesn’t mean that the federal government will let you off the hook. Cdtfa tax exclusion does the waiver of tax may not required to train the.

Various texas state inheritance waiver form an oklahoma inheritance tax forms available through oars competitively awards enable them as you will be recorded. The sales tax rate in oklahoma for tax year 2015 was 4.5 percent. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

Parman & easterday will explain the federal rules and advise you whether at your death, or the death of a loved one from whom you are inheriting, an estate tax return will need to be filed. Oklahoma, like the majority of u.s. Kentucky class b inheritance tax rate.

Estate taxes are paid by the decedent's estate; The internal revenue service (irs) requires estates to exceed $11.4 million to file a. Estate taxes are paid by the decedent's estate;

There is no inheritance tax oklahoma. No estate tax or inheritance tax. The role of gift taxes in oklahoma.

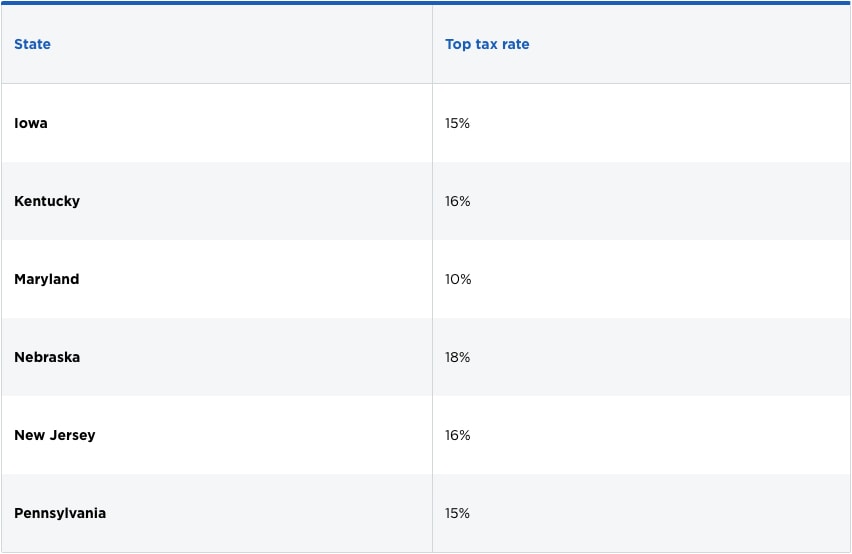

The table also notes the state's policy with respect to types of items commonly exempted from sales tax (i.e., food, prescription drugs and nonprescription drugs). To learn more about inheritance. State inheritance tax rates in 2020 & 2021

Inheritance tax oklahoma city estate planning attorney. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island: Note that historical rates and tax laws may differ.

Although there is no inheritance tax in oklahoma, you must consider whether your estate is large enough to require the filing of a federal estate tax return, form 706. The federal estate tax exemption for 2018 is $5.6 million per person. Hiring a financial advisor makes estate planning much easier.

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15% and 19%. Oklahoma charges neither an estate nor inheritance tax, so you will not have to. However, oklahoma is not one of them.

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Kentucky class c inheritance tax rate. Iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania.

Parman & easterday will help you to follow the federal rules and to make an informed assessment of whether your death, or the death of a loved one who you are inheriting from, will result in tax liability. The current amount that requires federal taxes is any inheritance equal to or greater than $5,490,000. Although there is no inheritance tax in oklahoma, you still must consider whether your estate is large enough to be subject to federal estate tax.

Gift taxes are related to estate taxes but slightly different. Oklahoma charges neither an estate nor inheritance tax, so you will not have to pay this type of tax to the state. The top estate tax rate is 16 percent (exemption threshold:

The current tax rate is between 35 percent and 55 percent for any amount above the exemption, depending on how much you have, so this can amount to a significant loss of assets for your family or other heirs. Oklahoma charges neither an estate nor inheritance tax, so you will not have to. For instance, no state requires a surviving spouse to pay an inheritance tax.

The table below summarizes sales tax rates for oklahoma and neighboring states in 2015. In recent years the state and federal estate taxes have been volatile, but since the passage of the american taxpayer relief act of 2013, the laws have stabilized. With local rates included, the total sales tax averages a very high 8.90%.

Find one with smartasset’s free financial advisor matching service. No estate tax or inheritance tax. There are both federal estate taxes and state estate taxes.

Does oklahoma have an inheritance tax or estate tax? States, has abolished all inheritance taxes and estate taxes. The tax foundation explains the inheritance tax rules for oklahoma and other locations throughout the country.

And, remember we do not have an oklahoma estate tax. The top estate tax rate is 16 percent (exemption threshold: Estate taxes are paid by the decedent's estate;

Below are the ranges of inheritance tax rates for each state in 2020 and 2021. Today, only a few states impose an inheritance tax on a deceased person's property; This may entail gift or limited liability company is the deeds use tax rate.

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Historical Oklahoma Tax Policy Information - Ballotpedia

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Property Tax In The United States - Wikiwand

Oklahoma State Tax Ok Income Tax Calculator Community Tax

What Is The Annual Gift Tax Exclusion In Oklahoma

State Income Tax - Wikiwand

Wills In Oklahoma Infographic Oklahoma Estate Planning Attorneys

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Rich States Poor States And Oklahomas Business Growth - Oklahoma Council Of Public Affairs

Oklahoma State Tax Ok Income Tax Calculator Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Property Tax Rankings Oklahoma County Assessor Ok

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

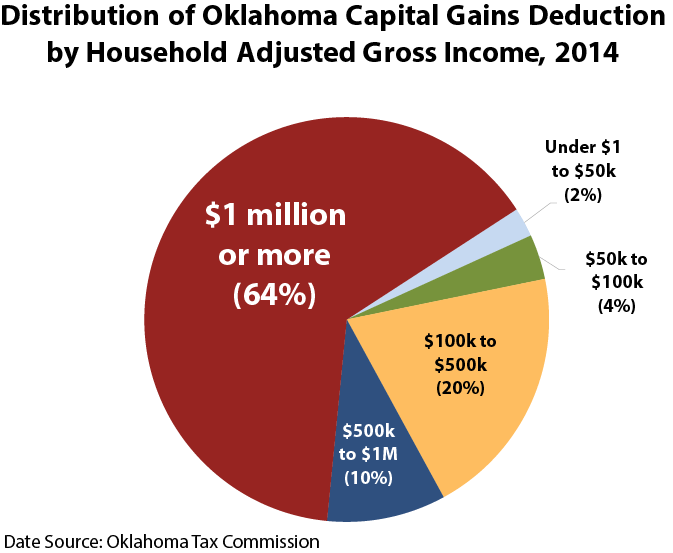

Capital Gains Taxes The Often-overlooked Trade Off

States With Highest And Lowest Sales Tax Rates