Extended deadline with mississippi tax extension: The state tax filing and payment deadline has been moved to may 17, 2021.

State Tax Lien Registry Dor

There is a convenience fee for this service which is paid directly to the company.

Deadline to pay mississippi state taxes. The payment deadline to avoid penalties and interest on 2019 personal, c orporate and fiduciary income tax returns is april 15, 2021. For all affected taxpayers, the due date for making 2019 state income tax payments due from april 20, 2020 to. Mississippi code at lexis publishing

The federal tax filing postponement only applies to individual federal income tax returns and payments for the 2020 tax filing year. Mississippi has one of the lowest median property tax rates in the united states, with only three states collecting a lower median property tax than mississippi. Failure to file the required return will subject you to the penalty provisions under the mississippi tax laws.

A return is required regardless of your payment method. This automated service is available 24 hours, 7 days a week. 2022 estimated 3rd quarter tax payment due:

Earlier, the due of filing the tds was may 31. The due date for filing a ms tax return and submitting ms payments is april 18, 2022. There is an additional convenience fee to pay through the ms.gov portal.

The median property tax in mississippi is $508.00 per year for a home worth the median value of $98,000.00. The state tax filing and payment deadline has been moved to may 17, 2021. Individual income tax filing and payment deadlines are july 15 or later in all other states.

At the end of your call you will be given a confirmation number. Ms individual income tax returns are due by april 15 — or by the 15 th day of the 4 th month following the end of the taxable year (for fiscal year filers). Counties in mississippi collect an average of 0.52% of a property's assesed fair market value as property tax per year.

In march, the state moved the deadline to file and pay 2019 individual income tax to may 15, 2020. 2020 hurricane ida filing extension. The 2021 mississippi state income tax return forms for tax year 2021 (jan.

Qualified individuals can apply for ltss benefits beginning january 2025. The state tax filing and payment deadline has been moved to may 17, 2021. Taxpayer access point (tap) online access to your tax account is available through tap.

Individual taxpayers will automatically avoid interest and penalties on the taxes paid by may 17. For all affected taxpayers, the due date for filing 2019 state income tax returns due from april 20, 2020 to june 20, 2020 is postponed to july 20, 2020. 2021 estimated 4th quarter tax payment due:

You can make electronic payments for all tax types in tap, even if you file a paper return. How to make a credit card payment Mississippi has announced that the tax filing deadline for individual returns is may 17th.

If signed by the governor, hb 1323 will go into effect july 25. Mississippi pass through entity tax extension. This relief does not apply to estimated quarterly payments that are due on april 15, 2021.

An instructional video is available on tap. First quarter 2020 mississippi estimated tax. The state tax filing and payment deadline has been moved to may 17, 2021.

In idaho, the deadline for income tax filing and payment has been bumped two months, from april 15 to june 15, while mississippi extended filing and payment deadlines one month, to may 15th. See the tap section for more information. Withholding returns are due the 15th day of the month following the period.

2022 estimated 1st quarter tax payment due: Read more about quarterly estimated taxes here (if due date of submission of return of income is november 30, 2021).

If a due date falls on a saturday, sunday, or legal holiday, the due date becomes the next business day. Mississippi will follow the federal extended due date of november 1, 2021 to file certain income tax returns for victims of hurricane ida. Save this as proof of payment for your records.

All other income tax returns p. The central board of direct taxes (cbdt) has extended the deadlines to file income tax returns for the financial year 2021. What are the due dates for estimated tax payments?

The mississippi department of revenue has extended the state's filing deadline for 2020 individual income tax returns from april 15 to may 17. 1 to march 31) federal taxes has been extended as well. 2022 estimated 2nd quarter tax payment due:

You now have until july 15 to make that payment. The payment deadline for taxpay ers who Find irs or federal tax return deadline details.

Mississippi moves tax filing deadline to may 15. Employees begin paying the tax january 1, 2022.

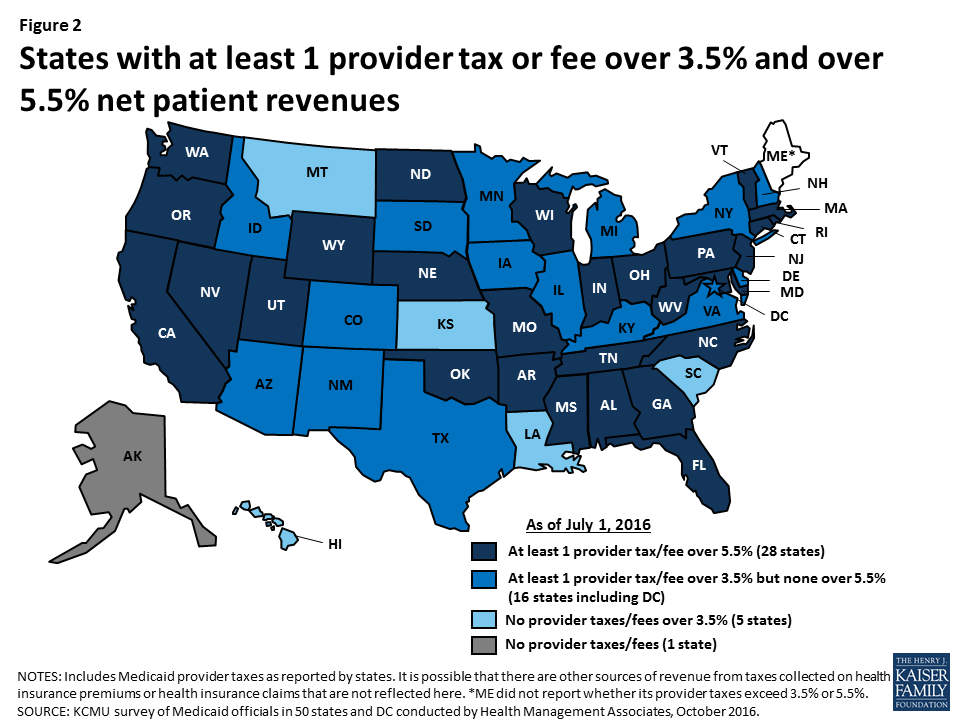

States And Medicaid Provider Taxes Or Fees Kff

Mississippi Follows Irs Lead Extends Deadline For Filing Taxes The Sun-sentinel

Mississippi State Tax Payment Plan Details

Pin On Coronavirus Columbus Ohio And Usa

Tax Filing 2021 Which States Have Extended Their Deadline - Ascom

Mississippi State Tax Software Preparation And E-file On Freetaxusa

Property Tax Comparison By State For Cross-state Businesses

2020 Tax Deadline Extension What You Need To Know Taxact

Stimulus Checks Last Day For Direct Deposit Payment Before The Irs Mails Your 1400 Irs Deposit Filing Taxes

Mississippi Sales Tax - Small Business Guide Truic

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Federal Tax Filing Deadline Being Extended To May 17 Mississippi State Filing Deadline Likely Staying At April 15 Mississippi Politics And News - Yall Politics

The Chugh Firm Usa Financial Statements Auditing And Assurance Services Read More Httpwwwchughco Certified Public Accountant Medical Irs Taxes

Coroners Report Template Professional Order Birth Certificate Ms Pleasant Order Mississippi Birth Certificate Template Birth Certificate Certificate Templates

Mississippi State Tax Refund - Ms State Tax Brackets Taxact Blog

Prepare Your 2021 2022 Mississippi State Taxes Online Now

2020 Tax Deadline Extension What You Need To Know Taxact

Mississippi Tax Forms And Instructions For 2020 Form 80-105

Mississippi State Tax Hr Block