When including the net investment income tax, the top federal rate on capital gains would be 43.4 percent. Capital gains tax rates on most assets held for.

Capital Gains Tax 101

A summary can be found here and the full text here.

When will capital gains tax rate increase. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. The effective date for this increase would be september 13, 2021. Add in the 3.8% surtax on net investment income and the total tax rate on long term capital gains and qualified dividends would be 28.8%.

If passed, this new rate would apply to transactions that occur after september 13,. Lily batchelder and david kamin , using jct projections , estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in $290 billion between 2021. While the proposed increase is not as severe as originally feared, the top capital gains tax would see an increase from 20% to 25%.

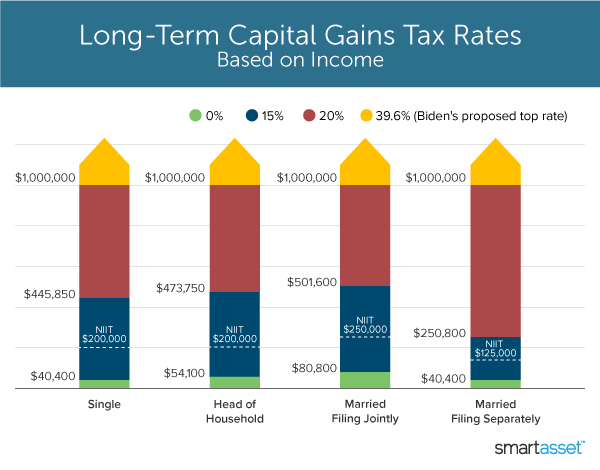

Thus, even older taxpayers, including some retirees, may have some or all or part of their capital gains taxed at the 0% rate. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Biden’s “plan” is to raise taxes, and not just by upping tax rates, but also by changing how and when taxes are collected.

Capital gains tax will be raised to 28.8 percent, according to house democrats. Still another would make the change to capital gains tax retroactive, with a start date of april 2021. You’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year, depending on your annual taxable income (for more on how to calculate your long.

One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. Still another would make the change to capital gains tax retroactive, with a start date of april 2021.1,2. Capital gains tax rate 2022.

When would the new capital gains rate go into effect? The proposal would increase the maximum stated capital gain rate from 20% to 25%. Understanding capital gains and the biden tax plan.

At this point, many ideas are being considered as. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28.

This may be why the white house is seeking an april 2021 effective date for the retroactive capital gains tax increase, as president biden announced the proposal on april 28, 2021, although it was not widely publicized at the time and investors are still becoming aware of. The house ways and means committee released their tax proposal on september 13, 2021. The new democratic party (ndp), in particular, pledges to increase the capital gains rate to 75%.

Currently, the capital gains rate is 20% for single taxpayers with income over $441,451 and for taxpayers who are married filing jointly with income over $496,601. The table also shows the / % inclusion eligible For 2021, this rate is available to single filers with taxable income under $40,400 or $80,800 for joint filers.

Biden’s plan would raise the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million. Candidates and their political parties are proposing several changes to the current tax schemes. To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate for transactions occurring after september 13, 2021.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under The C Capital Gains Tax Capital Gain Paying Taxes

Rethinking How We Score Capital Gains Tax Reform Bfi

Whats In Bidens Capital Gains Tax Plan - Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The States With The Highest Capital Gains Tax Rates The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Pin By Investopedia Blog On Finance Terms Capital Gain What Is Capital Capital Gains Tax

Pin On Abstract 3d Wallpaper

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times