The kaufman county assessor's office can help you with many of your property tax related issues, including: The tax office, its officers, agents, employees and representatives shall not be liable for the information posted on the tax office website in connection with any actions losses, damages, claims or liability in any way related to use of, distribution of or reliance upon such information.

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Change of address on motor vehicle records.

Kaufman county tax assessor. Box 339 kaufman, texas 75142 The kaufman county tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in kaufman county. Find 11 listings related to county tax assessors office in kaufman on yp.com.

Taxnetusa offers solutions to companies that need delinquent property tax data in one or more counties, including kaufman county, tx, and want the data in a standard form. Delinquent tax data products must be purchased over the phone. The county is also responsible for road and bridge maintenance in unincorporated areas, maintaining public records, collecting property taxes, issuing vehicle registrations and.

May i pay my taxes by phone in kaufman county, tx? Find results quickly by selecting the owner, address, id or advanced search tabs above. Links to a description of business and other.

Try using the advanced search above and add more info to narrow the field. Registration renewals (license plates and registration stickers) vehicle title transfers. Find 21 listings related to kaufman county tax office in terrell on yp.com.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in kaufman county. Having trouble searching by address? Kaufman county tax assessor, august 18, 2021.

The kaufman county property appraiser is responsible for determining the taxable value of each piece of real estate, which the tax assessor will use to determine the owed property tax. Kaufman cad strives for excellence in the provision of quality appraisals with sensitivity to the cost of operations and also the interaction with property owners. Kaufman county tax assessor 100 n.

2018 utility report 2017 utility report. Kaufman county tax office p.o. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in kaufman county.

The directory portal provides updated information of the local tax assessor and tax office for the reference of kaufman taxpayers: The texas tax code establishes the framework by which local governments levy and collect property taxes. See reviews, photos, directions, phone numbers and more for kaufman county tax office locations in.

At the prompt, enter jurisdiction code 6382. Try a more simple search like just the street name. “improving and maintaining the accuracy and uniformity of appraisals of all property in kaufman county”.

Kaufman county is responsible for judicial (civil and criminal justice, adult and juvenile probation), human services, law enforcement and jail services. Up to $7,500 off assessed value. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property.

It is the duty and responsibility of the kaufman tax assessor office to provide transparent information to the public regarding tax processes and appraisals. Use just the first or last name alone. 2018 utility report 2017 utility report.

See reviews, photos, directions, phone numbers and more for county tax assessors office locations in kaufman, tx. The kaufman county tax assessor is the local official who is responsible for assessing the taxable value of all properties within kaufman county, and may establish the amount of tax due on that property based on the fair market value appraisal. 273,349,891 the reported totals above are based on data from the certified tax roll provided by the kaufman county appraisal district and other

Having trouble searching by name? Kaufman county tax assessor, august 18, 2021. Kaufman county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in kaufman county, texas.

Kaufman county collects, on average, 2% of a property's assessed fair market value as property tax. The texas tax code establishes the framework by which local governments levy and collect property taxes.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XMIFG7GE7D6TUDEFWUWHPVMEHQ.jpg)

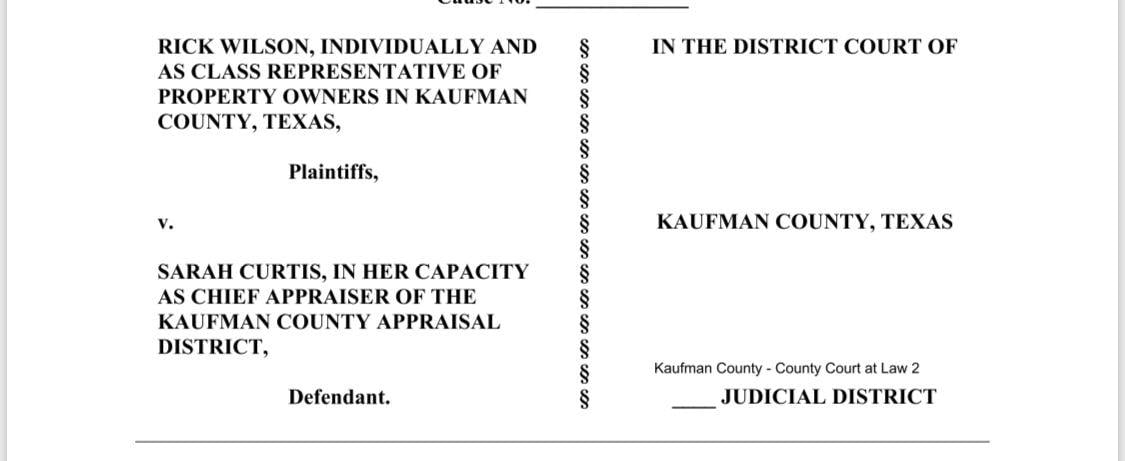

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

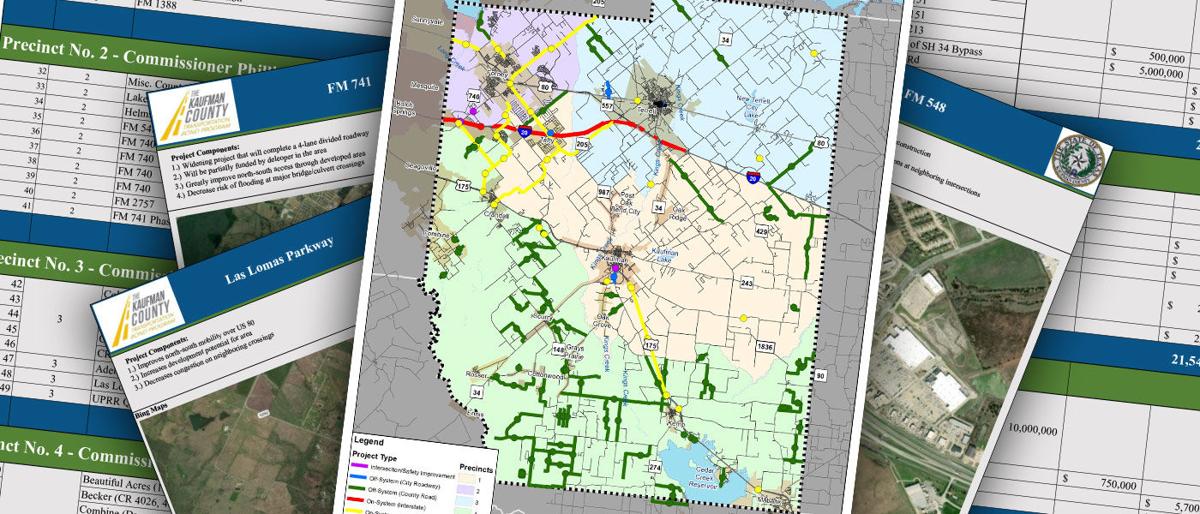

Facilities Kaufman County Transportation

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

2

2

Board Terminates Kaufman County Chief Appraiser Local News Inforneycom

400 E Grove St Kaufman Tx 75142 Mls 14511132 Redfin

2

Kaufman Cad Property Search

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Kaufman Central Appraisal District Facebook

Kaufman County Appraisal District - How To Protest Property Taxes

Kaufman County Releases Details On Proposed 1041 Million Transportation And 50 Million Facilities Bonds Local News Inforneycom

Assessor Elbert County Co

Kaufman County Texas Fha Va And Usda Loan Information

Contact Kaufman Cad Official Site

Forney Mayor Files Suit Against County Appraisal District Business Inforneycom

County Government Kaufman County

Truth In Taxation Kaufman County