Perhaps the illinois department of revenue (idor) may provide relief. Please call if you have any questions.

Chicagoland Il - Area Counties 2020- 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County

Delinquent tax sale december 7, 2021.

Illinois taxes due date 2021. Welcome to ford county, illinois : No personal checks or postmarks accepted. The due dates for both installments is october 15, 2021.

An (a) symbol means the state has an amazon fulfillment center. For example, if you were formed on july 15, 2020, your annual report is due july 1 2021. Monthly sales tax due on november 22, 2021.

The filing extension does not apply to estimated tax payments that are due on april 15, 2021. November 2021 sales tax due dates, in order of state. The state of illinois requires an illinois llc or partnership to file an annual report with the illinois secretary of state due before the first day of your business’ anniversary month a.

This process is expected to take several months. Mastercard credit or debit, discover, visa, or american express cards. 2020 real estate tax collection dates 2021.

First installment due date is july 2nd, 2021. Payments may also be made in person at the treasurer's office using a. September 2021 friday, october 15, 2021.

Tax year 2020 first installment due date: Monthly sales tax due on november 22, 2021. The due date for calendar year filers is may 17, 2021.

The due dates for the first three quarterly payments are april 15, june 15 and september 15. After december 17, only cashier checks, money orders or cash. Tuesday, march 2, 2021 (late payment interest waived through monday, may 3, 2021)

Payments may be mailed to the treasurer's office using a personal check or money order. My name is becky springer and it is my pleasure to serve as the dekalb county treasurer. Or visa debit card until friday.

Second installment due date is september 10th, 2021 Payment is due december 15 for s corporations and on january 15 of the following year for partnerships. For tax year 2020, the filing deadline for illinois income tax returns has been extended from april 15, 2021 to may 17, 2021.

The annual tax sale was held on feb. June 2021 thursday, july 15, 2021. Monthly sales tax due on november 22, 2021.

Personal or business checks are accepted until friday, september 24, 2021. Monthly sales tax due on november 30, 2021. The illinois department of revenue (idor) is providing tax filing and payment relief to individuals by automatically extending the illinois income tax filing due date for individuals for the 2020 tax year from april 15, 2021, to may 17, 2021.

Week of may 24, 2021. Individual taxpayers can postpone illinois income tax payments for the 2020 tax year due on. If you receive a federal extension of more than six months, you are automatically allowed that extension for illinois.

Real estate tax bills mailed earlier june and first due date of july 23, 2021 and second due date of september 23, 2021. These payments are still due on april 15 and can be based on either 100% of estimated or 90% of actual. The 2020 payable 2021 tax bills for ford county will be mailed may 28th, 2021.

I hold a bachelor's degree in economics from northern illinois university and previously worked in banking before being appointed dekalb county treasurer. Last day to pay current year mobile home & real estate taxes: Payment will be due within 60 days from the date of mailing, may 10, 2021.

Mobile home tax bills mailed earlier may and due date of august 12,2021. Illinois income tax filing deadline delayed. These payments are still due on april 15 and can be based on either 100% of estimated or 90% of.

Welcome to marion county, illinois. Friday, october 23, 2021 2021 tax sale: The illinois 2021 tax filing deadline has been extended until may 17, matching the irs federal tax filing extension announced wednesday.

A convenience fee of 2.35% will be added. All unpaid 2019 property taxes are now considered past due.

Eim2rjfixr-num

Order Your Favorite Desk Calendars 2017 Printing Online From United States Httpwwwnjprintandwebcomprodu Mini Desk Calendar Desk Calendars Diy Calendar

Property Taxes On Owner-occupied Housing By State Tax Foundation Infographic Map Map Social Science

Look Uppay Property Taxes

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling South African Revenue Service

Home Improvement Exemption Cook County Assessors Office

Secured Property Taxes Treasurer Tax Collector

Love Style Mix - Blog Diy Desk Calendar Creative Calendar Desk Calendar Inspiration

Property Tax - City Of Decatur Il

2

Property Tax Prorations - Case Escrow

Reminder - Individual Income Tax Quarterly Estimated Payment Due Date Is April 15

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2021 E-calendar Of Income Tax Return Filing Due Dates For Taxpayers In 2021 Tax Saving Investment Income Tax Return Income Tax

Pin On Itr Filing

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

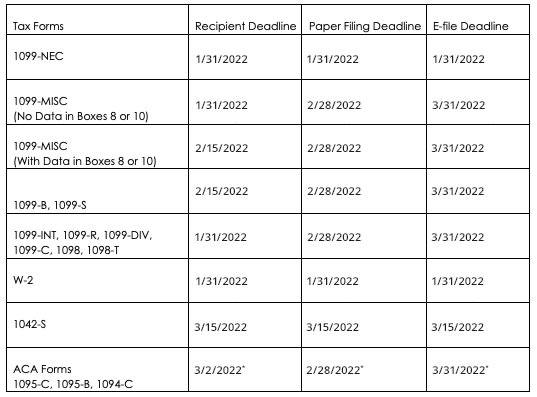

2021 Tax Returns Deadlines And New Developments For Employers

Cmp 08 Filing Due Date For January To March 2022 Ca Portal

First Installment Of 2021 Cook County Property Taxes Available Online Chicago Association Of Realtors