A variety of property tax exemptions are available in jefferson parish county, and these may be deducted from the assessed value to give the property's taxable value. Jefferson parish officials and svn gilmore.

Xtxn54cvfe0zym

The average effective property tax rate in east baton rouge parish is 0.61%, which is over half the national average.

Jefferson parish property tax 2020. Reporting entity and its servies. Profile o f the parish o f jefferson reportin g entit y and its services. A variety of property tax exemptions are available in jefferson parish county, and these may be deducted from the assessed value to give the property's taxable value.

In order to redeem, the former owner must pay jefferson parish 12% per annum 5% on the amount the winning bidder paid to purchase the property at the jefferson parish tax deeds (hybrid). Search our database of jefferson parish county property auctions for free! Join the jefferson parish louisiana tax sale discussion.

Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax.louisiana is ranked 1929th of the 3143 counties in the united states, in order. 30 rows the louisiana constitution requires residential properties and land to be assessed at. Adjudicated property auction to be held online on sat.

Property taxes for 2020 become due upon receipt of the tax notice. The total number of parcels, both commercial and residential, is 185,245. Yearly median tax in jefferson parish.

This rate is based on a median home value of $180,500 and a median annual tax payment of $940. Assessor jefferson parish assessor 200 derbigny st., suite 1100, gretna,. Please be advised the 2021 preliminary roll has been uploaded to the jefferson parish assessor website.

Suite 1200 gretna, la 70053: The millage is expected to generate about $29. Current tax represents the amount the present.

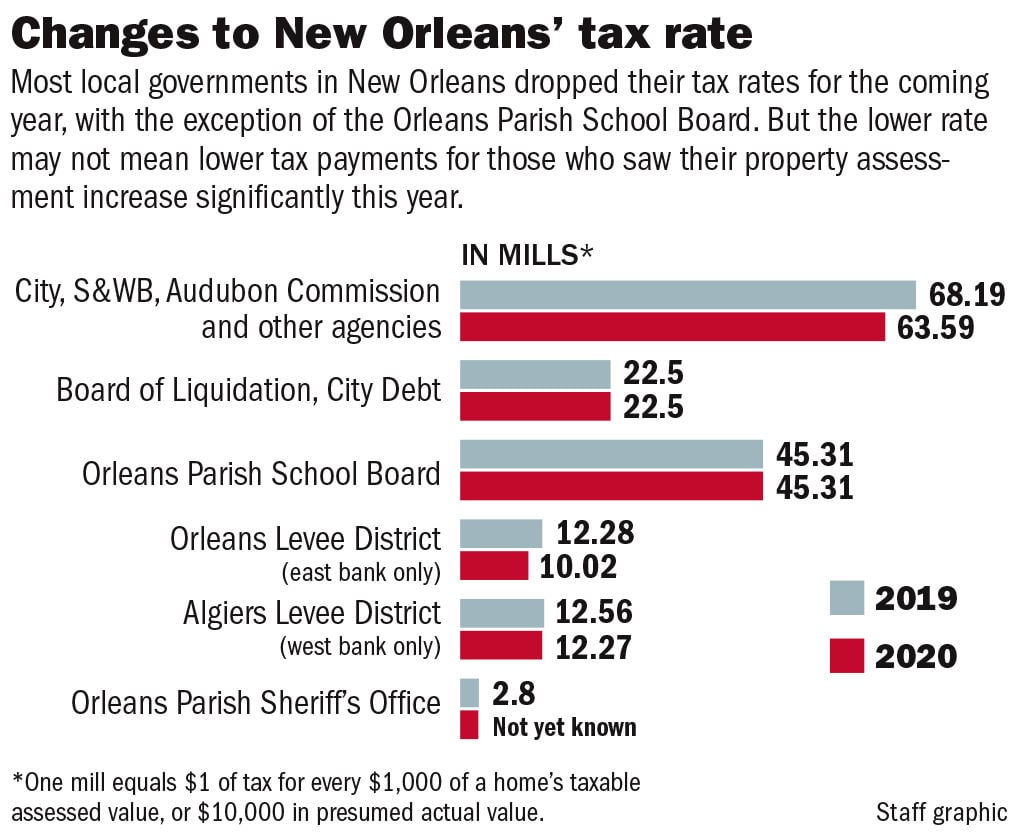

Total property taxes owed in jefferson for 2020 are $435.1 million, up 0.5% from $432.7 million in 2019. Louisiana is ranked 1929th of the 3143 counties in the united. If it is a commercial or industrial building, then the assessed rate is 15% of their fair market value instead of 10%.

Jefferson parish louisiana property taxes 2021. In february of 2019, jedco board of commissioners and the jefferson parish council adopted the final document as the official master plan of churchill park to serve as a guide to the effective development of the site so that it is done in a manner that both utilizes the land in the most efficient way and also supports the goals and target industries of jefferson edge 2020. And local property taxes and water rates in our parish are among the lowest in the nation.

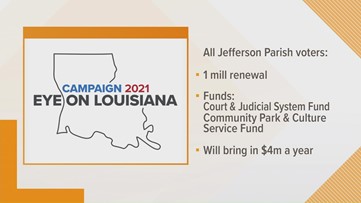

The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. The louisiana constitution requires residential properties and land to be assessed at 10% of their fair market value, by which the tax millage rate is applied. On december 11, 2021, voters in jefferson parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for jefferson parish residents.

Once the preliminary roll has been approved by the louisiana tax commission, the 2020 assessments will be updated on the website. Current tax represents the amount the present owner pays, including exemptions and special fees. (just now) jefferson parish real estate transfers august 2020.search jefferson parish property tax and assessment records by parcel number, owner name, address, or property description;

The preliminary roll is subject to change. $755 5 hours ago the median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. Jefferson parish government building 200 derbigny st.

Find and bid on residential real estate in jefferson parish county, la. Below you will find a collection of the latest user questions and comments relating to the sale of tax lien certificates and tax. Driven by ares act funds received by the parish in 2020 of $34,670.

Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax. *payments are processed immediately but may not be reflected for up to 5 business days. Located in southeast louisiana adjacent to the city of new orleans, jefferson parish has a property tax rate of 0.52%.

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

2

Parish Presidents Proclamations

Xtxn54cvfe0zym

Heres Whats On The Ballot Saturday In Your Parish Wwltvcom

Online Property Tax System

Jefferson Parish Public Flood Portal Geoportal

Millages

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nolacom

Pin On Etcetera

Zdlhzuwu28yd1m

Xtxn54cvfe0zym

Fees Jefferson Parish Clerk Of Court

Jefferson Parish Jeffparishgov Twitter

Xtxn54cvfe0zym

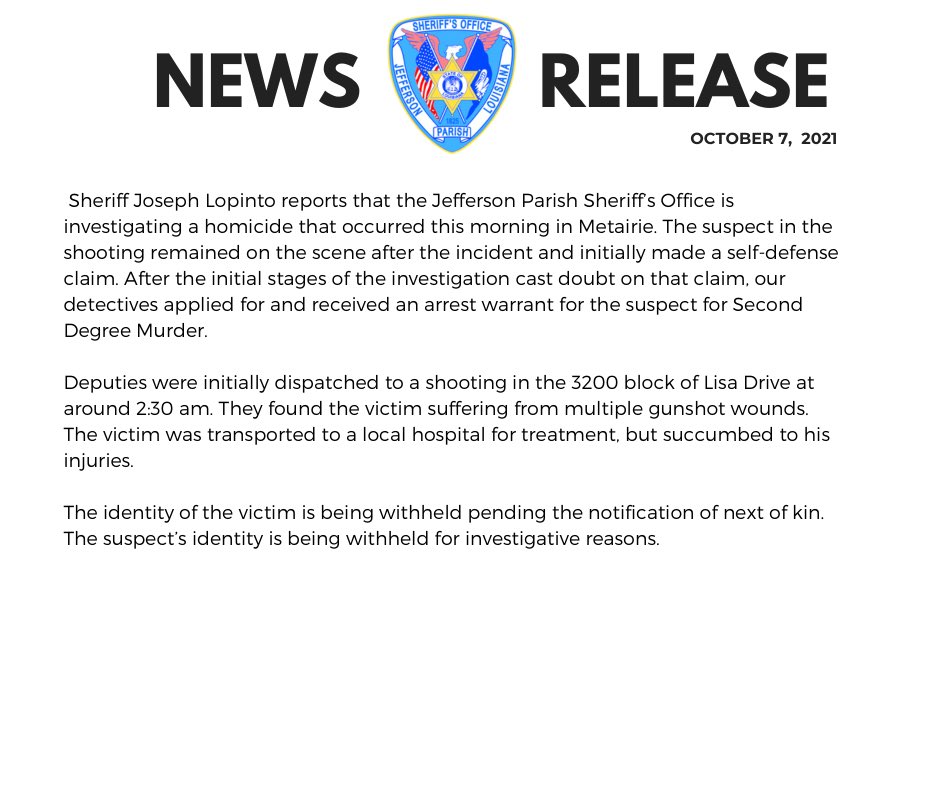

Jp Sheriffs Office Jeffparishso Twitter

Xtxn54cvfe0zym

Payments Jefferson Parish Sheriff La - Official Website

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills