Then, the capital gains tax gets calculated only on the net capital gain (gains minus losses). Less any discount you are entitled to on your gains.

Capital Gains Tax In Kentucky What You Need To Know

The tax is based on the profit you made — the price you sold it for minus the price you paid — and how long you held onto the asset.

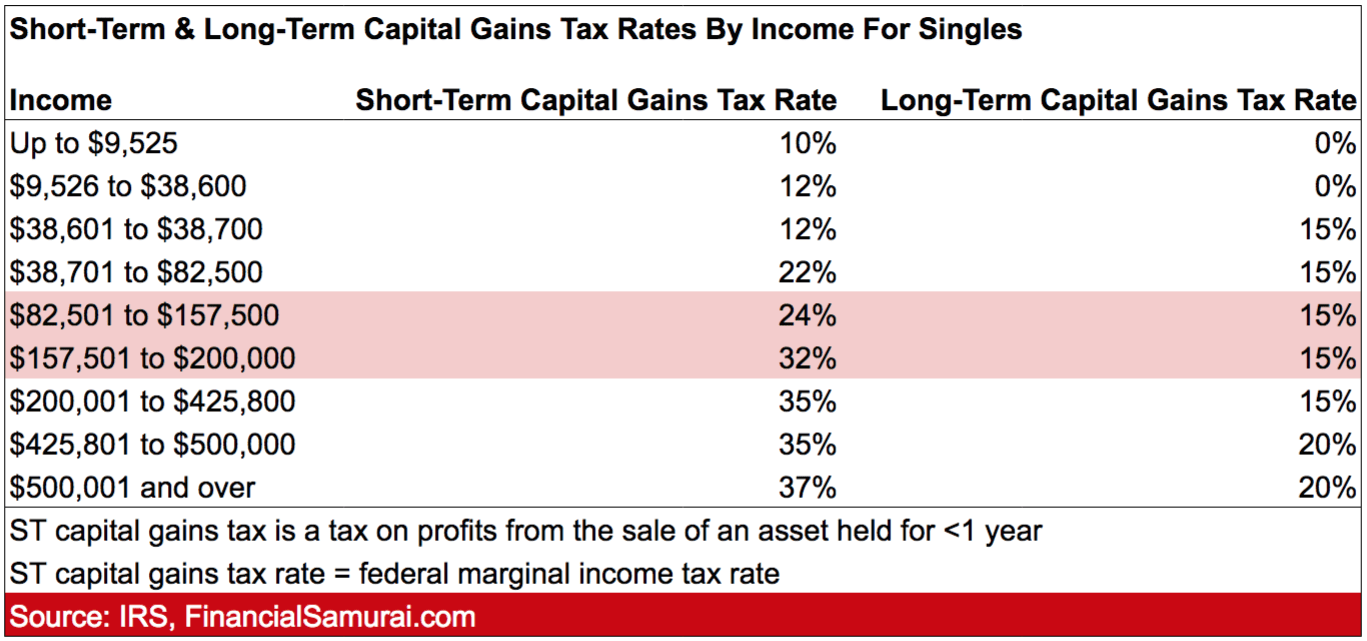

How is capital gains tax calculated in florida. Capital gains are treated differently based on how much time transpired between the investor’s purchase and sale of the asset. 10%, 12%, 22%, 24%, 32%, 35% and 37%. Capital gains are taxed differently when selling your primary residence or an investment asset held for less than one year.

2021 capital gains tax calculator. However, when a mutual fund sells shares of its holdings during the year, mutual fund investors could be charged capital gains. Capital gains taxes apply to the sale of stocks, real estate, mutual funds and other capital assets.

Calculating capital gains on your florida home sale in real estate, capital gains are based not on what you paid for the home, but on its adjusted cost basis. 10, 12, 22, 24, 32, 35, or 37 percent. How is capital gains tax calculated in florida.

Firpta withholding (15% of gross sale price of property) long term and short term gain. Income over $40,400 single/$80,800 married: Depending on your income level, your capital gain will be taxed federally at either 0%, 15% or 20%.

Capital gains taxes are determined by tax bracket and location. Your primary residence can help you to reduce the capital gains tax that you will be subject to. How long you own a rental property and your taxable income will determine your capital gains tax rate.

States due to state and local capital gains taxes, leading to a combined average rate of over 48 percent. 2021 capital gains tax calculator. It all depends on your tax bracket.

Click here to embed this calculator on your site. When your capital loss exceeds your capital gains for the year, then the difference is carried forward to future tax years and applied against future capital gains. Individuals with lower regular or investment income may be subject to lower capital gain tax rates than the estimates generated by this tool.

Get unlimited capital gain and loss questions answered This means you pay tax on only half the net capital gain on that asset. You pay tax on your net capital gains.

Florida’s capital gains tax rate depends upon your specific situation and defaults to federal rules. The amount you pay in federal capital gains taxes is based on the size of your gains, your federal income tax bracket and how long you have held on to the asset in question. Capital gains are the profits realized from the sale of capital assets such as stocks, bonds, and property.

Capital gains tax is calculated using your profits and income to determine your taxable income, which is then. Defer capital gains tax by using 1031 exchange. Obtaining the amount requires you to make adjustments including acquisition and improvements costs.

Ncome up to $40,400 single/$80,800 married: The capital gain tax is triggered only when an asset is sold, not while the asset is held by an investor. There is a capital gains tax (cgt) discount of 50% for australian individuals who own an asset for 12 months or more.

To figure out the size of your capital gains, you need to know your basis. You can maximize this advantage by frequently moving homes. Take advantage of primary residence exclusion.

Assets subject to capital gains tax include stocks , real estate, cryptocurrency, and businesses. The amount that can be excluded stands at $250,000 for an individual and $500,000 for a married couple. Basis is the amount you paid for an asset.

The capital gains tax is calculated on the profit made from the sale of real estate. How is capital gains tax calculated? How is capital gains tax calculated in florida.

The capital gains tax is calculated on the profit made from the sale of real estate. 52 rows the capital gains tax calculator is designed to provide you an estimate on the cap. Capital gains tax is payable on the net gain from the sale of property.

Individuals and families must pay the following capital gains taxes. The gain is calculated by taking the sale price less the purchase price and all related costs incurred in the purchase and sale of the. Rates are one of the following percentages:

When selling your primary home, you can make up to $250,000 in profit or double that if you are married, and you won’t. Assets subject to capital gains tax include stocks , real estate, cryptocurrency, and businesses. The capital gains tax is a tax on money earned from investments rather than from wages or salary, which are generally subject to income tax.

How is capital gains tax calculated in florida. Ad a tax expert will answer you now!

Capital Gains Tax

Capital Gains Tax Calculator 2021 Casaplorer

Us Short Term Capital Gains Tax - Capital Gains Tax Rate 2021

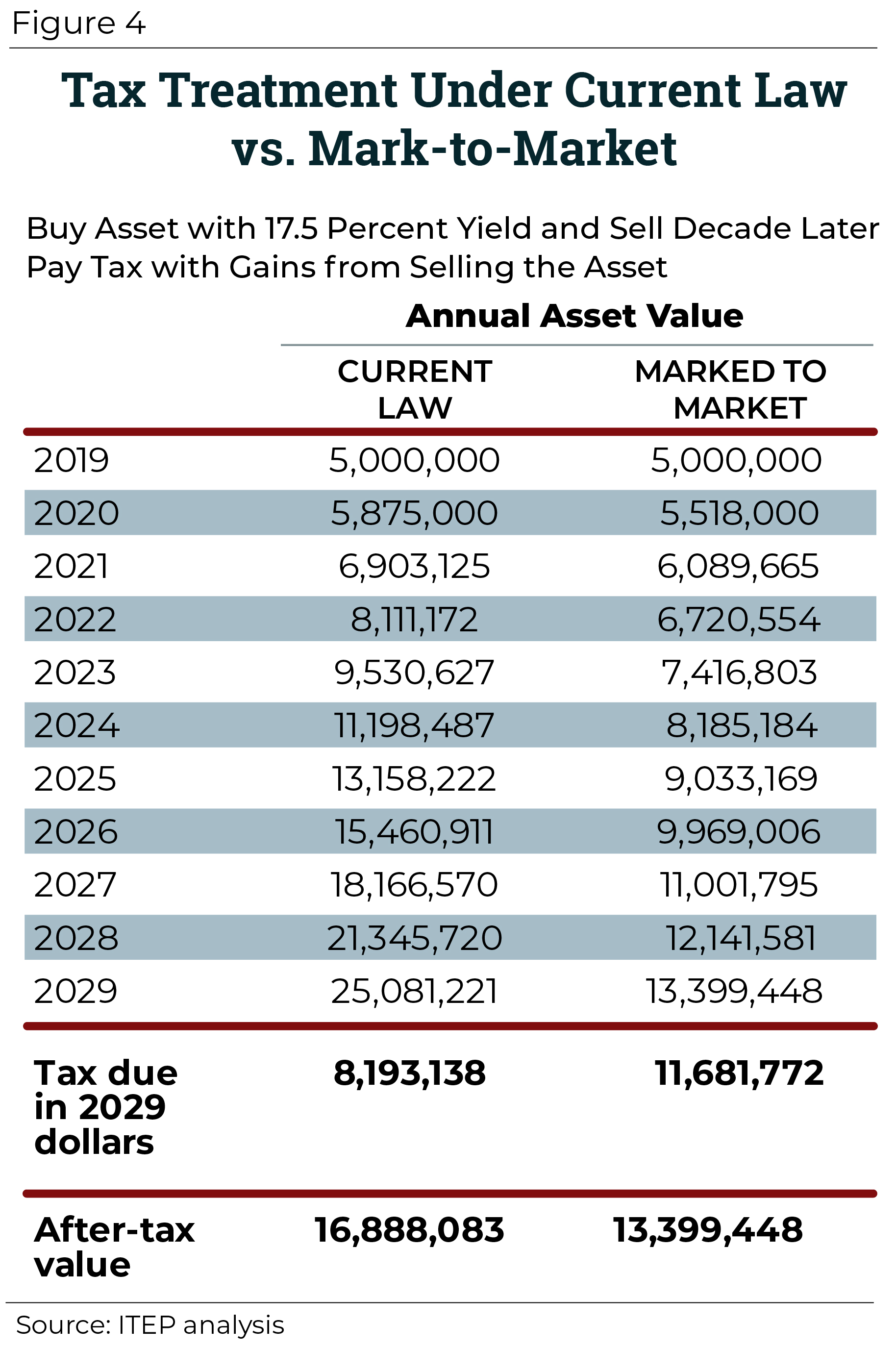

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

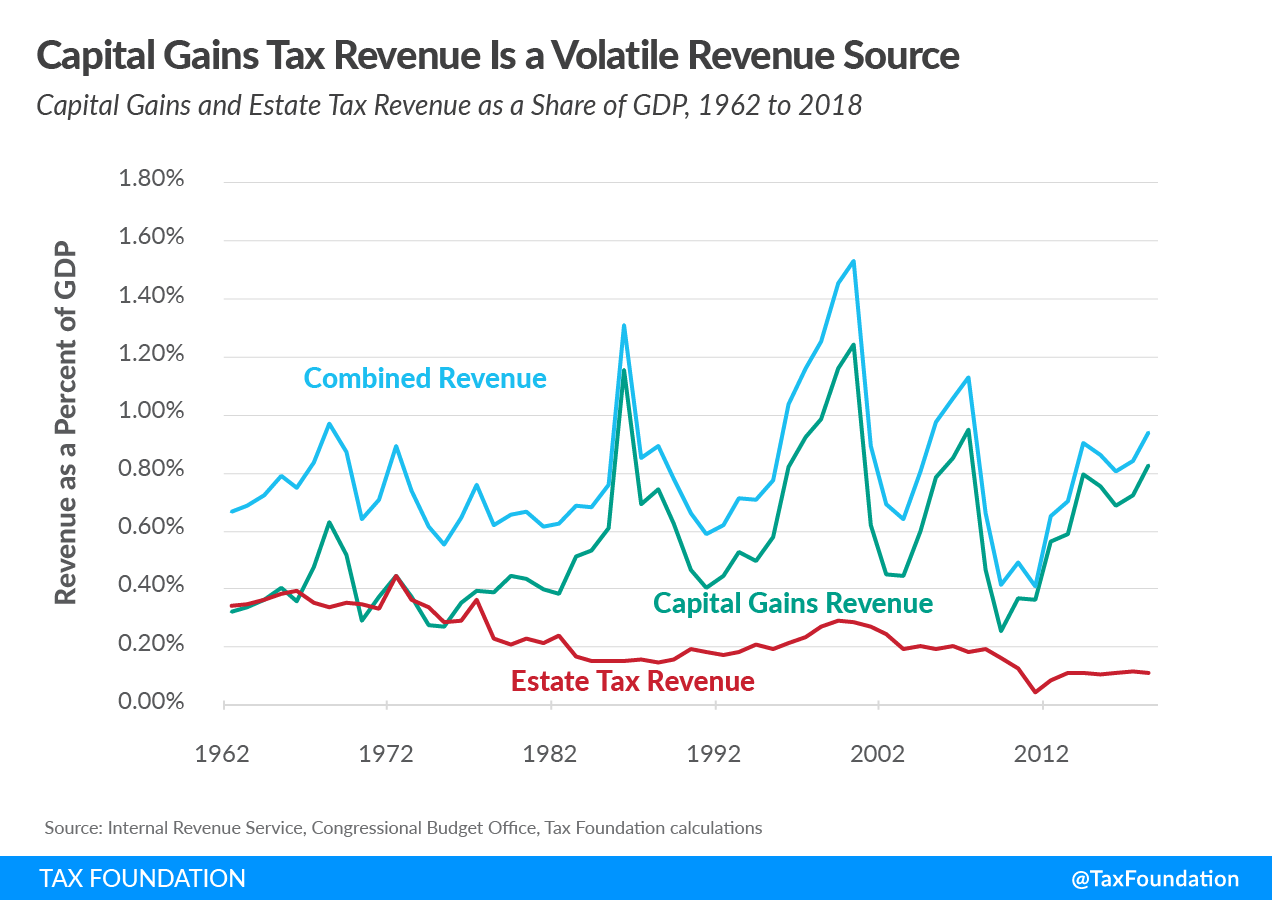

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The States With The Highest Capital Gains Tax Rates The Motley Fool

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How High Are Capital Gains Taxes In Your State Tax Foundation

Income Types Not Subject To Social Security Tax Earn More Efficiently

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains On Selling Property In Orlando Fl

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

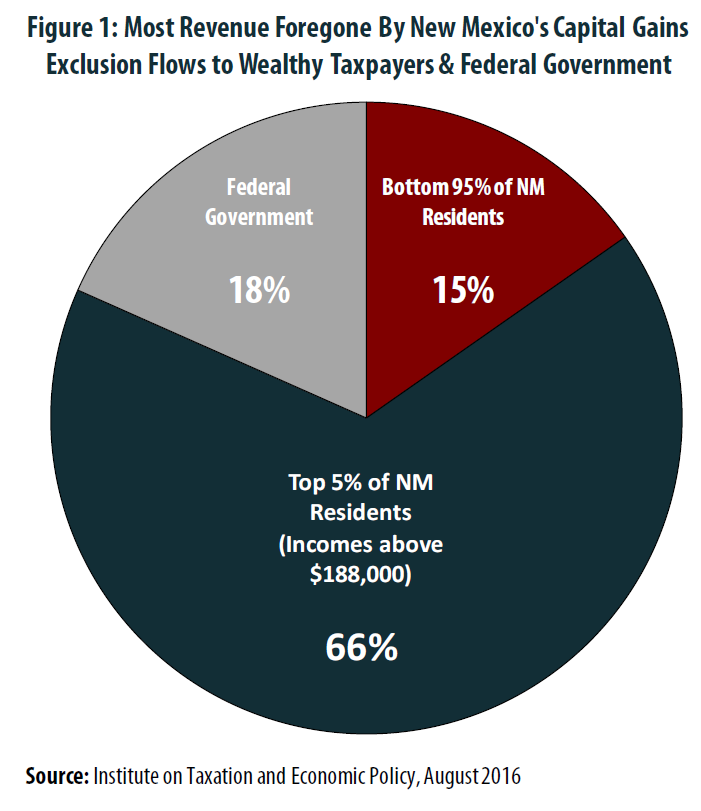

The Folly Of State Capital Gains Tax Cuts Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube