The glenwood springs sales tax rate is %. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent), new york (4.52 percent), and oklahoma (4.45 percent).

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

With local taxes, the total sales tax rate is between 2.900% and 11.200%.

Colorado springs sales tax rate 2021. The extension will focus on improving road conditions near neighborhoods. The colorado springs, colorado sales tax is 2.90% , the same as the colorado state sales tax. 431 rows 2021 list of colorado local sales tax rates.

The colorado sales tax rate is currently %. Starting in 2021, the 2c sales tax rate will decrease from 0.62% to 0.57% throughout the extension. This is the total of state, county and city sales tax rates.

How 2021 sales taxes are calculated in colorado springs the colorado springs, colorado , general sales tax rate is 2.9%. Surging colorado springs sales tax revenue showed no sign of slowing in the new year as online sales and a hot housing market continued to fuel strong gains in. The local sales tax rate in colorado springs, colorado is 8.2% as of november 2021.

While colorado law allows municipalities to collect a local option sales tax of up to 4.2%, colorado springs does not currently collect a local sales tax. The income tax rate will drop to 4.5% in 2021, down from 4.55%, and individual taxpayers will get an additional sales tax refund payment, on. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

Colorado has state sales tax of 2.9% , and. No states saw ranking changes of more than one place since july. Colorado taxpayers will get a break on their income taxes and a refund payment because the state’s cap on government growth and spending under the taxpayer’s bill of rights was exceeded last fiscal year.

The colorado springs sales tax rate is %. Local tax rates in colorado range from 0% to 8.3%, making the sales tax range in colorado 2.9% to 11.2%. This exception applies only to businesses with less than $100,000 in retail sales.

The minimum combined 2021 sales tax rate for colorado springs, colorado is. Please note that the department will need to verify that you The county sales tax rate is %.

On july 12, 2021, the city of colorado springs sales tax office will be transitioning to a new online licensing and tax filing system, powered by munirevs. He has shown just how well the city is doing by approving raises and bonuses to city employees. Even though the city is financially sitting pretty, suthers still presented his 2022 budget to the public that’s 16.26% ($56 million) higher than 2021.

The colorado sales tax rate is currently %. 2021 local sales tax rates. 101 rows how 2021 sales taxes are calculated for zip code 80910 the 80910, colorado springs ,.

Depending on the zipcode, the sales tax rate of. This system will greatly improve our business’s experience by allowing businesses to file and pay taxes at any time via an internet connected device, view their account history on demand, and delegate access to tax professionals, for filing on their behalf. The minimum combined 2021 sales tax rate for glenwood springs, colorado is.

Find your colorado combined state and local tax rate. Let’s take a look at the biggest expense within city government: Colorado sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

Effective january 1, 2021, the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions occurring on or after that date. Also, if your internal point of sale system supports it, the gis information can be accessed through an application programming interface (api).this api can automatically reference current tax information directly from the cdor. Colorado (co) sales tax rates by city the state sales tax rate in colorado is 2.900%.

The county sales tax rate is %. The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%. Method to calculate colorado springs sales tax in 2021.

Beginning february 1, 2022, all retailers will be required to apply the destination sourcing rules. The base state sales tax rate in colorado is 2.9%. This is the total of state, county and city sales tax rates.

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

File Sales Tax Online Department Of Revenue - Taxation

How To Calculate Cannabis Taxes At Your Dispensary

Colorado Sales Tax - Taxjar

Colorado Sales Tax Rates By City County 2021

25 Teacher Tax Deductions Youre Missing In 2021 Teacher Tax Deductions Diy Taxes Tax Deductions

Sales Tax Information Colorado Springs

How To Make Tax Season Less Stressful 5 Ways To Prepare Year-round For Tax Time In 2021 Business Tax Tax Prep Filing Taxes

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Pin On Realtor Associations Ethics Fiduciary

File Sales Tax Online Department Of Revenue - Taxation

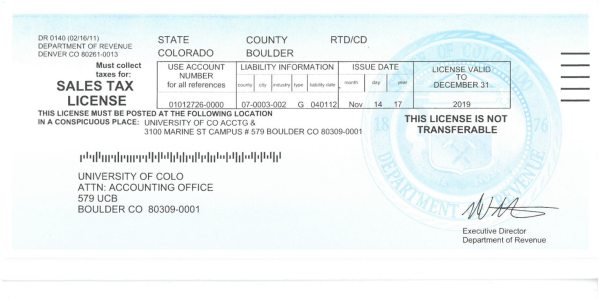

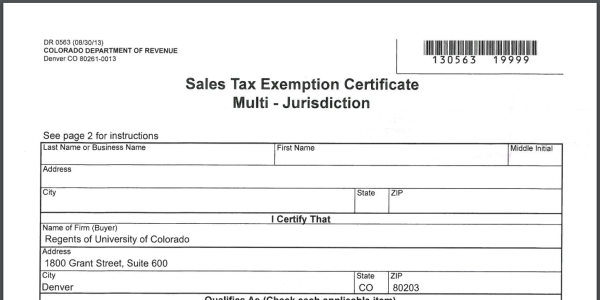

Sales Tax Campus Controllers Office University Of Colorado Boulder

The Best Place To Retire Isnt Florida Best Places To Retire Retirement Locations Retirement

Sales Tax Campus Controllers Office University Of Colorado Boulder

Pin On Fort Lewis

File Sales Tax Online Department Of Revenue - Taxation

Sales Tax Information Colorado Springs