Our experienced staff of licensed appraisers and tax experts handles each client’s case efficiently and. Empire tax reductions offers expert tax relief and tax grievance services in suffolk county, ny.

Heller Consultants Tax Grievance - Home Facebook

At lighthouse tax grievance, corp.

Suffolk county tax grievance services. Our proprietary valuation algorithm ensures that your case is presented to the local assessor with the best possible information so we earn you the largest reduction you are entitled to. Begining march 13, 2020, there will be only limited access to the services of the suffolk county real property tax service agency until further notice. Suffolk county property tax grievance deadline.

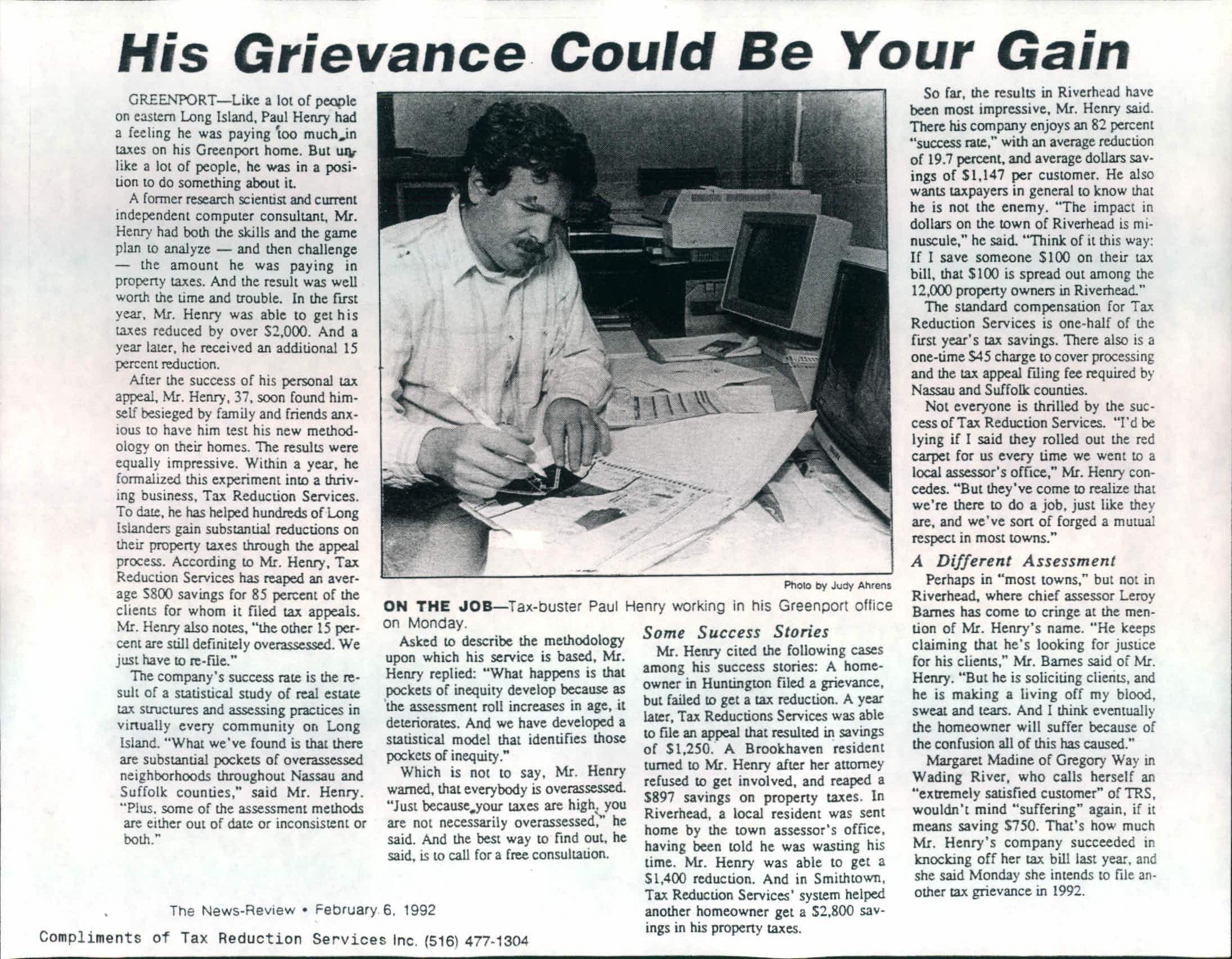

(trs) reduces real estate taxes for residential and commercial property owners who live in nassau and suffolk counties and has saved long island property owners over a billion dollars in real estate taxes since 1990. Is recognized as fair and honest. Get help filing your tax grievance.

You can find on our website a contact form that you can fill out if you wish to have us as your agent. Documents may be mailed to the agency at 300 center drive, riverhead, new york 11901 or they may be delivered to the county center at the same address and left for processing. Grievance day deadline may 17, 2022 hurry, there's only 164 days to go!!

1) hire a tax grievance company and pay them at least 50% of your tax savings. Suffolk county tax reduction application. We are one of the leaders in property tax challenges on long island.

If a taxpayer is unhappy with an assessment, the. You will receive confirmation from the county at our meeting that your taxes have been grieved. File your tax grievance petition with your local bar (board of assessment review) by the filing deadline step 2:

The tax year for each of the towns in suffolk county runs from december 1st to the following november 30th. Our clients benefit directly from the close working relationships we have established with the assessing units throughout the years. The process of filing for a tax grievance in suffolk county:

We will explain everything involved and not charge you a penny until we secure you a lower tax rate. The assessor(s) of each town prepares a tentative assessment roll for that tax year which is available for public review on or about the preceding april 1st based upon the value of the property on the preceding july 1st. Serving suffolk county homeowners for over 30 years!!

Our main objective is to minimize our client’s property tax assessment with personalized service. All island tax grievance specializes in representing homeowners in suffolk county. W e believe that homeowners & commercial property owners should pay no more than their fair share of real estate taxes.

Not only can the grievance process can be long and complicated but if you try to do it yourself you will not have the same access to data as our advanced computer system. In bohemia, ny, our team offers assistance to our clients in suffolk county. (filing dates vary for village assessments within suffolk county.) only the property owner or someone the owner has authorized may file a property tax.

There is absolutely no charge if we do not get you a property tax reduction. Mark left his management team to run the business when he moved to florida in 2000. The process of property tax grievance is a strategic and lengthy process.

To submit your application, feel free to call our team today. Call now to set up a consultation. Talk to an expert now nassau county:

Heller & consultants tax grievance specializes in grieving property taxes on long island for both suffolk and nassau counties, saving homeowners thousands. If you want to learn more about our. Our team of tax reduction experts has years of experience in this field, and are ready to provide accurate assessments and analysis of our customers’ properties, and work together with them to come up with a viable yearly tax plan that ensures they pay only their “fair share”.

We have won over 84,935 reductions on long island!! We research your case, file all required paperwork, and, if necessary, represent you in court. If you are in suffolk or nassau county in long island and need assistance in appealing your property’s value and getting a better rate on your property taxes, give us a call in nassau county:

Reliance property tax grievance services. Once you sign up with us, we will prepare all the forms required to file a grievance on your behalf. At the cobra consulting group, we provide consulting for select services on a concierge basis so you can meet your business requirements efficiently without having to retain multiple service providers.

Our clients have saved over $1 billion dollars on their property taxes!! That’s why we are the only firm that can say we hold the single largest tax reductions in both nassau and suffolk counties of over $75,000 a year. In recent years we have received record tax reductions for our clients, a sample of which can be found by visiting the “our reductions” page, totaling a.

You must grieve every year. At all island tax grievance, we specialize in property tax grievance services for suffolk county homeowners. The assessment grievance filing period for all suffolk county towns begins on may 1, 2018 and ends on may 15, 2018, the third tuesday in may.

We have grown to be one of the largest tax grievance services in suffolk county with reductions averaging $1,000.

Mark Lewis Tax Grievance Service Inc - Home Facebook

Nassaus Property-tax Grievance System Is Out Of Control Newsday

Heller Consultants Tax Grievance - Home Facebook

How To Know If You Are Eligible For A Tax Grievance In Suffolk County 2018- Part 1 - Property Tax Grievance Heller Consultants Tax Grievance

Tax Reduction Services - Trs - Property Tax Grievance

Heller Consultants Tax Grievance - Home Facebook

Heller Consultants Tax Grievance - Home Facebook

Suffolk County Tax Grievance Process Learn More About The Tax Grievance Process - Ptrc

Mark Lewis Tax Grievance Service Inc - Home Facebook

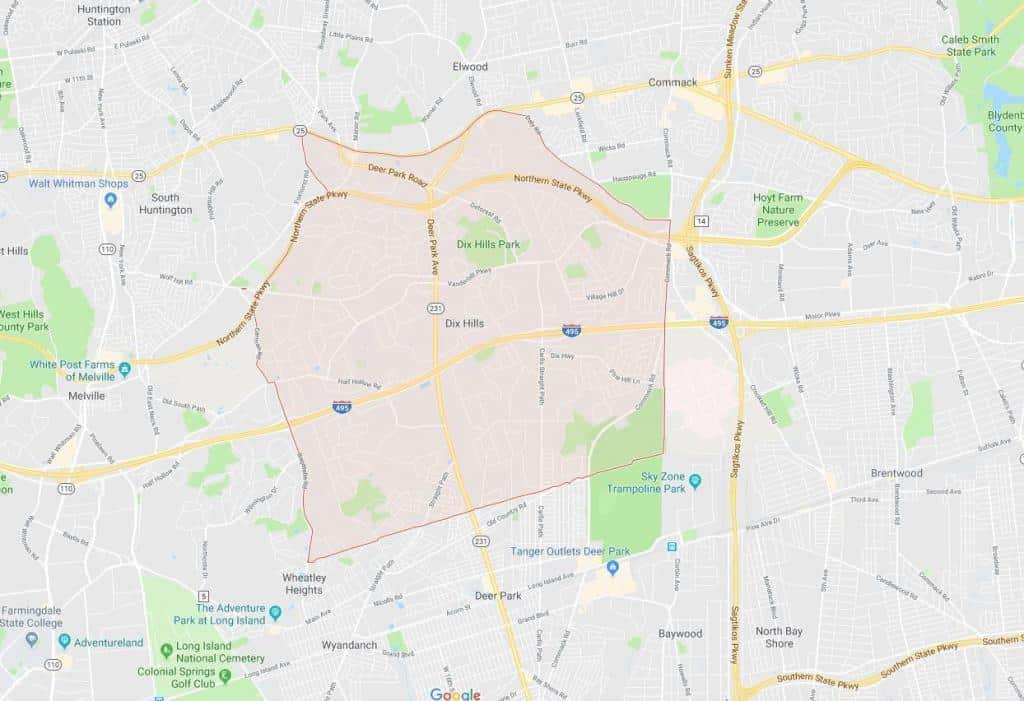

Dix Hills Property Tax Grievance - Tax Grievance Company

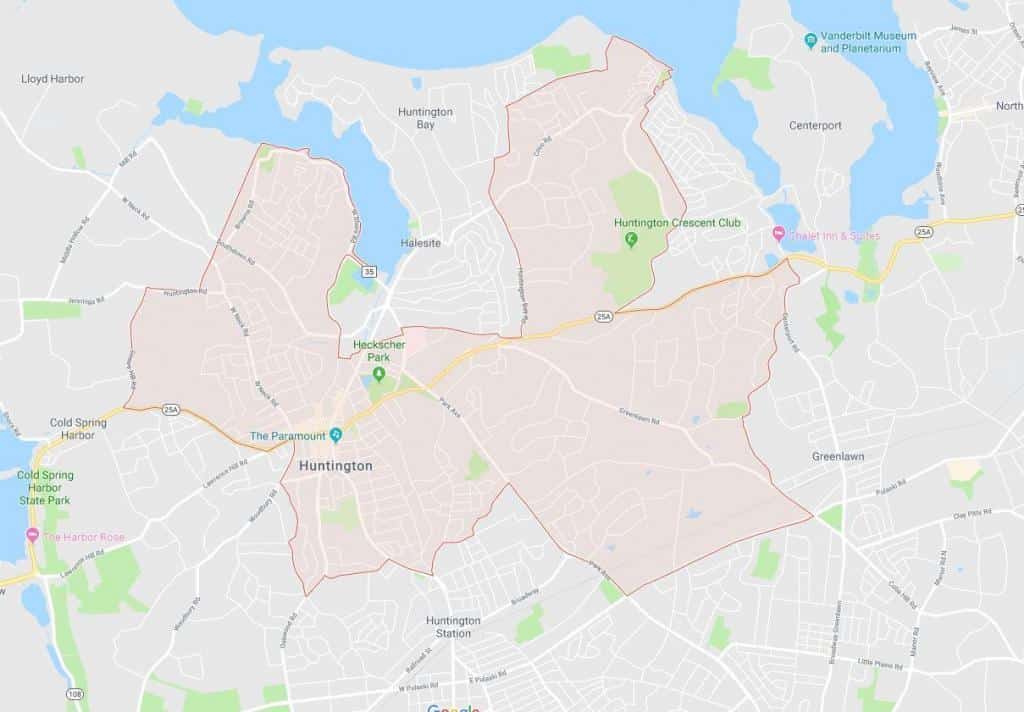

Huntington Tax Grievance - Property Tax Grievance Services

Learn The Key Differences Between The Nassau County Suffolk County Tax Grievance Processes

Tax Reduction Services - Trs - Property Tax Grievance

Trs In The News - Tax Reduction Services

Mark Lewis Tax Grievance Service Inc - Home Facebook

Tax Reduction Services - Trs - Property Tax Grievance

The Tax Grievance Process And How It Works - Property Tax Grievance Heller Consultants Tax Grievance

Everything You Need To Know About Tax Grievance On Long Island

Guide To Reduce Property Taxes In Suffolk County - Final Notice - Property Tax Grievance Heller Consultants Tax Grievance