Kern county property tax appeal kern county calculates the property tax due based on the fair market value of the home or property in question, as determined by the kern county property tax assessor. Here you will find answers to frequently asked questions and the most.

2-1-1 Kern County United Way Of Kern County

The first installment of kern county property tax bills will become delinquent if not paid by 5 p.m., friday, dec.10.

Kern county property tax due. ( kget) — the kern county treasurer and tax collector (kcttc) is reminding kern residents that the first installment of property tax is due next week. The first installment is due on 1st november with a payment deadline on 10th december. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the kern county tax appraiser's office.

The median property tax on a $217,100.00 house is $1,606.54 in california. Find kern county, california assessor, assessment, auditor's, and appraiser's offices, revenue commissions, gis, and tax equalization departments. In order to avoid a 10% late penalty, property tax payments must be submitted or postmarked on or before that time.

Last day to file a late exemption for homeowners and veterans: A 10% penalty is added as of 5:00 p.m. Lien date for the assessment of property on the assessment roll:

10 or it will become delinquent. Kern county assessor 7050 lake isabella boulevard lake isabella, ca. (kget) — the kern county treasurer and tax collector (kcttc) is reminding kern residents that the first installment of property tax is due next week.

Property tax bills were filed for all property owner on jan 1, 2021, according to the agency. Property tax payment due on by dec. Last day to pay first installment of regular property taxes (secured bill) without penalty:

The kern county treasurer and tax collector is warning people not to be late otherwise a. The county agency is urging residents to make sure they pay the first installment of their property tax by 5 p.m. First installment of real property taxes due dec.

The first round of property taxes is due by 5 p.m. Secured tax bills are paid in two installments: 10 or it will become delinquent.

Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. The median property tax on a $217,100.00 house is $1,736.80 in kern county. The county agency is urging residents to make sure they pay the first installment of their property tax by 5 p.m.

List of kern county assessor offices. Last day to file property tax exemptions Jordan kaufman, kern county treasurer and tax collector, reminded the public monday that the first installment of kern county property taxes will become delinquent if not paid by 5 p.m.

Kern county assessor 400 north china lake boulevard ridgecrest, ca. (* if a delinquent date falls on a weekend or holiday, the delinquent date is the next business day.) february 1:

Campaign Toolkit United Way Of Kern County

2

Kern County Grant Deed Form - Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Supervisorial District 3 Map Kern County Ca

International Per Diem Rates 2020 Httpsinternationalperdiemrates2020freetaxfreecom Tax Refund Freetax Irs Irs Kern County County Thank You For Dinner

Jordan Kaufman Kern County Treasurer-tax Collector - Home Facebook

Kern County Treasurer And Tax Collector

Pin By Bbb Serving Central California On Bbb Accredited Businesses Tulare County Del Valle Tulare

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Bankrupt Crc Owes Kern 26 Million In Back Taxes News Bakersfieldcom

Kern County Clerk

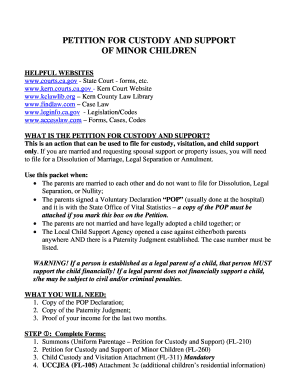

Kern County Court Forms - Fill Online Printable Fillable Blank Pdffiller

Housing Authority Of The County Of Kern Creating Brighter Futuresone Home One Family At A Time

Home - Water Association Of Kern County

2

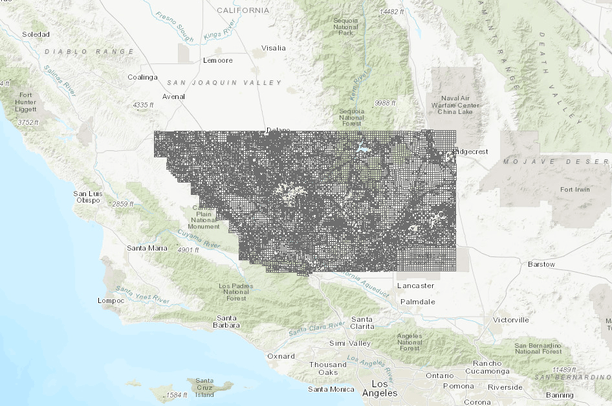

Parcels 2019 Kern County Data Basin

Kern County Property Deeds - Mo5mlcom