The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

South Dakota Sales Tax - Small Business Guide Truic

South dakota is another popular state for purchasing and registering rvs.

South dakota motor vehicle sales tax rate. Purchasers in south dakota are charged a 4% excise tax, which is much lower than most states, and south dakota has low registration fees as well. Additionally, if you want to avoid surprise maintenance costs after buying a used car, you should think about ordering a vehicle. Lease payment (includes all capitalized costs but does not include:

In addition to taxes, car purchases in south dakota may be subject to other fees like registration, title, and plate fees. The south dakota dmv registration fees you'll owe. State sales tax and any local taxes that may apply.

The states with the highest car sales tax rates are: 2021 south dakota state sales tax. $300 maximum tax does not apply and the lease is subject to the sales and use tax at a rate of 6% plus the applicable local sales tax rate.

4% the following taxes may apply in. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. Our dataset includes all local sales tax jurisdictions in south dakota at state, county, city, and district levels.

The cost of a vehicle inspection/emissions test. Dealers are required to collect the state sales tax and any applicable municipal sales tax, municipal gross receipts tax, and tourism tax on any vehicle, product, or service they sell that is subject to sales tax in south dakota. Mobile / manufactured homes are subject to the 4% initial registration fee.

The tax data is broken down by zip code, and. The amount of the municipal tax varies from city to city. You can find these fees further down on the page.

South dakota on which south dakota sales tax was not paid. Exact tax amount may vary for different items. They are subject to a four percent motor vehicle tax on the purchase price.

Sale or purchase of a motor vehicle which is subject to the motor vehicle excise tax. The 6.5% sales tax rate in mitchell consists of 4.5% south dakota state sales tax and 2% mitchell tax. The state also has no state income tax and a low sales tax (4.5%) and it’s easy to establish residency in the state.

Motor vehicles are not subject to state and local sales taxes. Counties and cities can charge an additional local sales tax of up. The cost of your car insurance policy.

South dakota collects a 4% state sales tax rate on the purchase of all vehicles. Motor vehicles registered in the state of south dakota are subject to the 4% motor vehicle excise tax. Title fee, registration fees, excise tax, federal excise tax, insurance, or refundable security deposits on lease) [number of months _____ x $_____ per month] 2.

Unfortunately, if you live close to a state with a lower or no car sales tax, such as if you live near delaware, you cannot buy a car in that state to avoid sales tax. There is no applicable county tax or special tax. The lease is subject to the tax even if the motor vehicle is subsequently taken out of state

There is no applicable county tax or special tax. Most cities and towns in south dakota have a local sales tax in addition to the state tax.

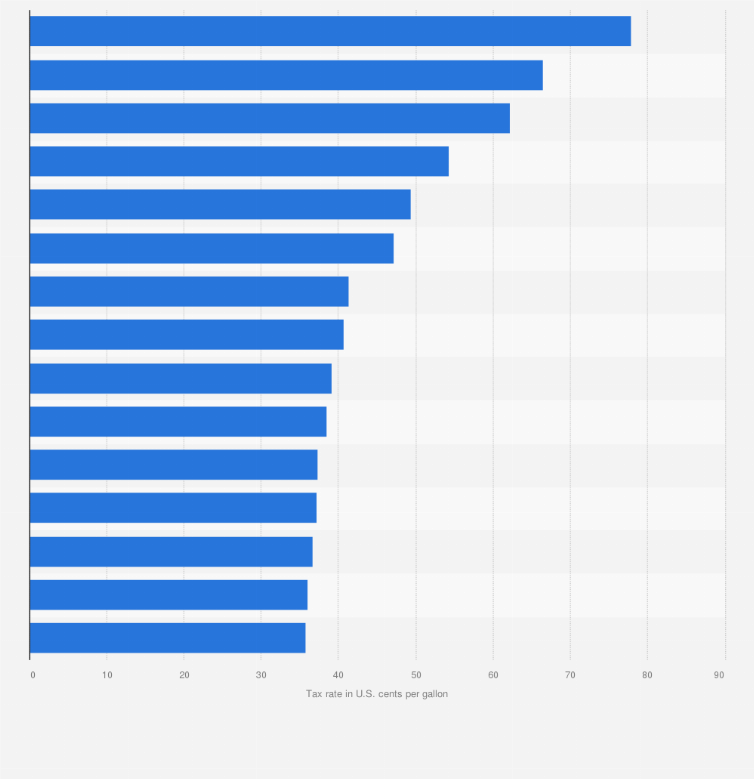

Us States With Highest Gas Tax 2021 Statista

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Whats The Car Sales Tax In Each State Find The Best Car Price

Yamaha Motorcycles For Sale - Motorcycles On Autotrader In 2021 Motorcycles For Sale Sports Bikes Motorcycles Yamaha

Sales Taxes In The United States - Wikiwand

Individual Faqs South Dakota Department Of Revenue

File And Pay Your Sturgis Rally Sales Tax Online South Dakota Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

2

Sales Tax On Cars And Vehicles In South Dakota

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Mka7r8ijnvvd2m

Sales Use Tax South Dakota Department Of Revenue

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Pin Op Infographics

Sales Use Tax South Dakota Department Of Revenue

Dmv Fees By State Usa Manual Car Registration Calculator