27 with the enactment of a.b. This cap remains unchanged for your 2020 and 2021 taxes.

California Democrats Have Chance To Restore Salt Deductions - Los Angeles Times

Commentary for tax years beginning in 2018 through 2025, the tcja amended irc sec.

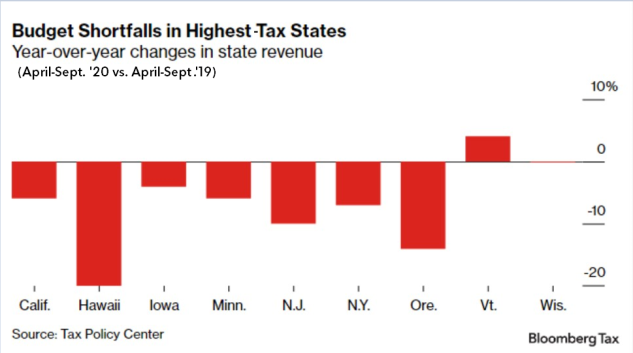

Salt tax deduction california. The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes. For tax years beginning on or after jan. The itep plan tpc analyzed would allow an.

House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes, known as salt. How households would be affected by three changes in the salt tax deduction. 1, 2022, the tax is due on or before the original due date of the entity’s return, without regard to extensions.

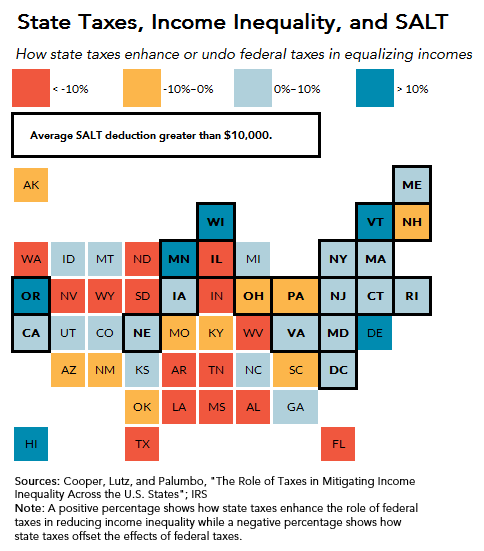

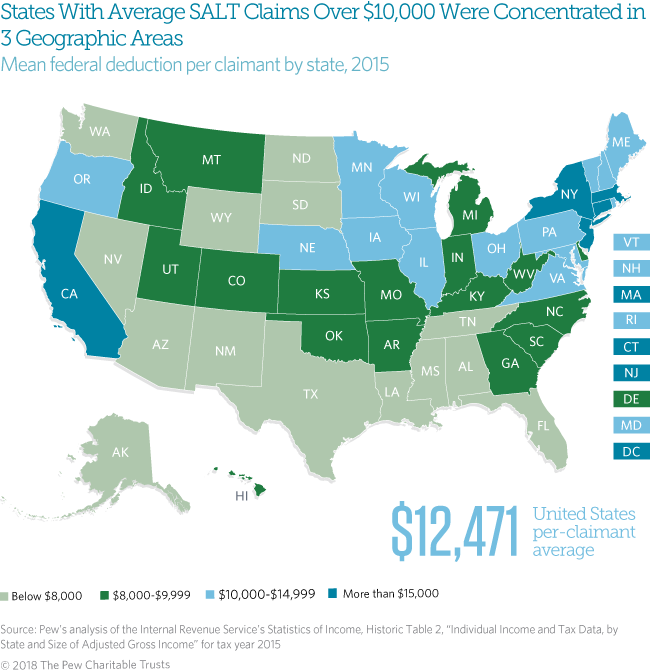

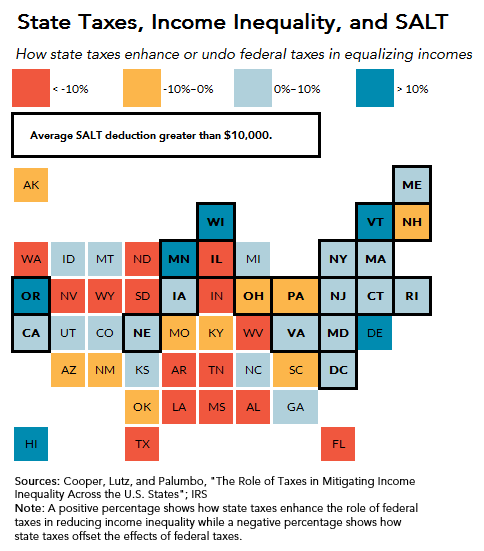

This limit applies to single filers, joint filers, and heads of household. California sb104 seeks to circumvent the salt cap deduction by. We speak of the $10,000 cap on the state and local tax deduction, or salt, designed to drain revenues from the likes of california, new york, new jersey and massachusetts.

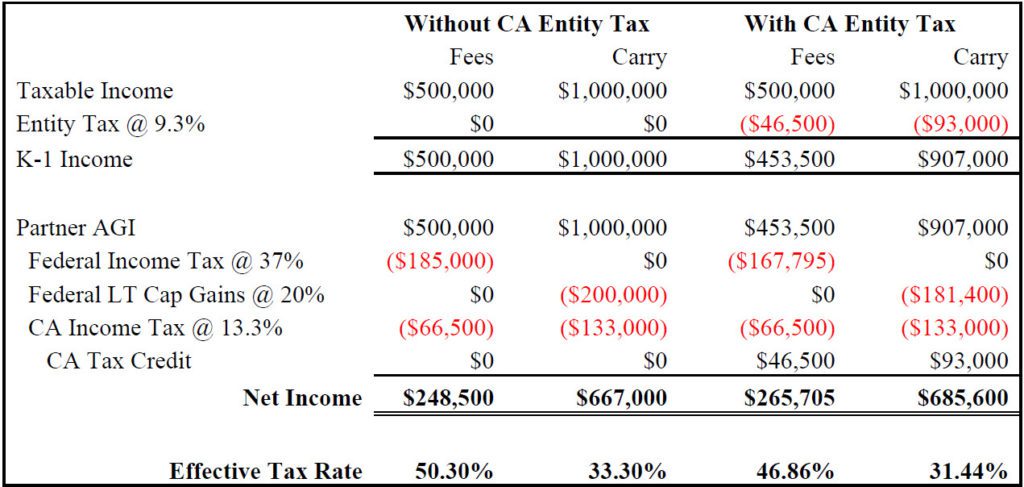

This tax will apply for california residents on their entire distributive share, and for nonresidents, their california source amount. The deduction has a cap of $5,000 if your filing status is married filing separately. 164 to limit the deductibility of state taxes to $10,000 for individuals, but imposed no similar limitation on business entities.

Adding the $10,000 cap increases the payment of an average california taxpayer who previously took the full salt deduction by about $4,000, according to a statement against the changes by several. 1, 2022 and ending before jan. California governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the deduction for state and local taxes paid for individuals that was established by the tax cuts and jobs act of 2017 (tcja).

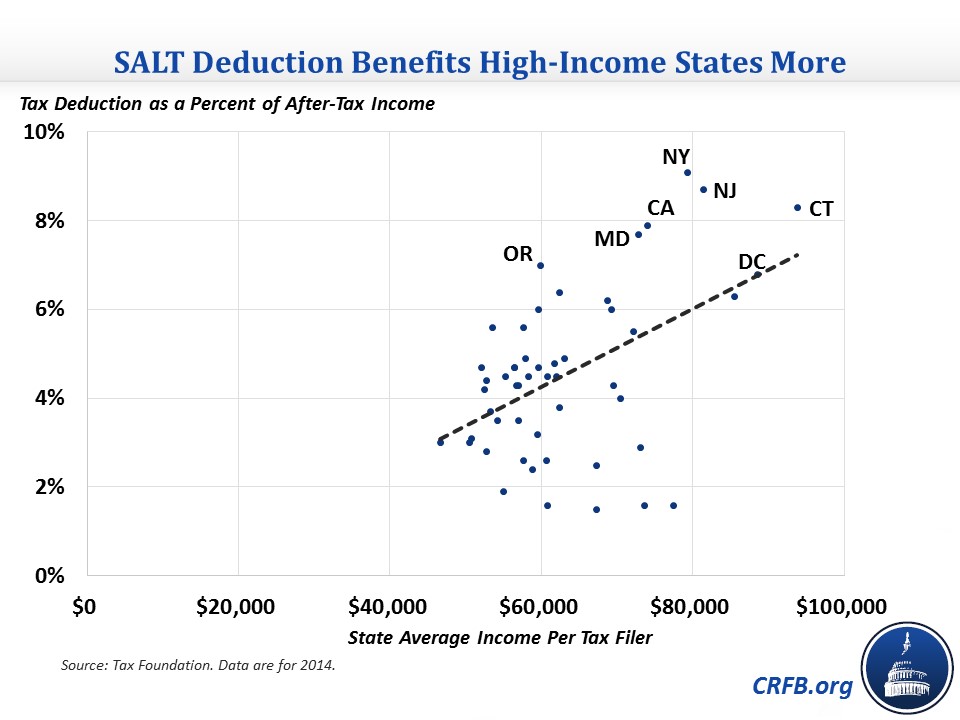

Among them is pelosi's 12th congressional district where the average salt paid by households claiming a deduction is $62,769—well under the. For tax years beginning on or after jan. According to the nonpartisan tax policy center, the top 20% of taxpayers may receive more than 96% of the benefit of a salt cap repeal and the top 1% would see about 54% of the benefit.

California has joined the ranks of states who have developed a way to circumvent the $10,000 federal deduction limitation state and local taxes (known as salt) limitation with the enactment of a.b.150 recently signed by governor gavin newsom. “that households so high on the income spectrum can expect a net tax cut from the build back better act is entirely due to the increase in the salt deduction cap from $10,000 to $80,000,” the. House speaker nancy pelosi is fighting to repeal the cap.

While congress has stalled on passing legislation that would eliminate, in whole or in part, the current limit on an individual taxpayer's ability to take the itemized deduction for state and local taxes, california has taken a dramatic step toward allowing many of its residents to mitigate the effects. The bbba would raise the salt deduction limitation from $10,000 per year to $80,000 per year from 2021 through 2030, lower it to $10,000 in 2031, and then eliminate it altogether. 150 on july 16, 2021.

Taxpayers in california would receive $12.5 billion of the $55.9 billion national tax reduction, or 22.3 percent. This is due to the state’s: 1, 2021, and ending before jan.

On july 16 th, the governor signed ab 150, a budget trailer bill containing language outlining california’s pte tax guidelines that. As of 2019, the maximum salt deduction is $10,000.

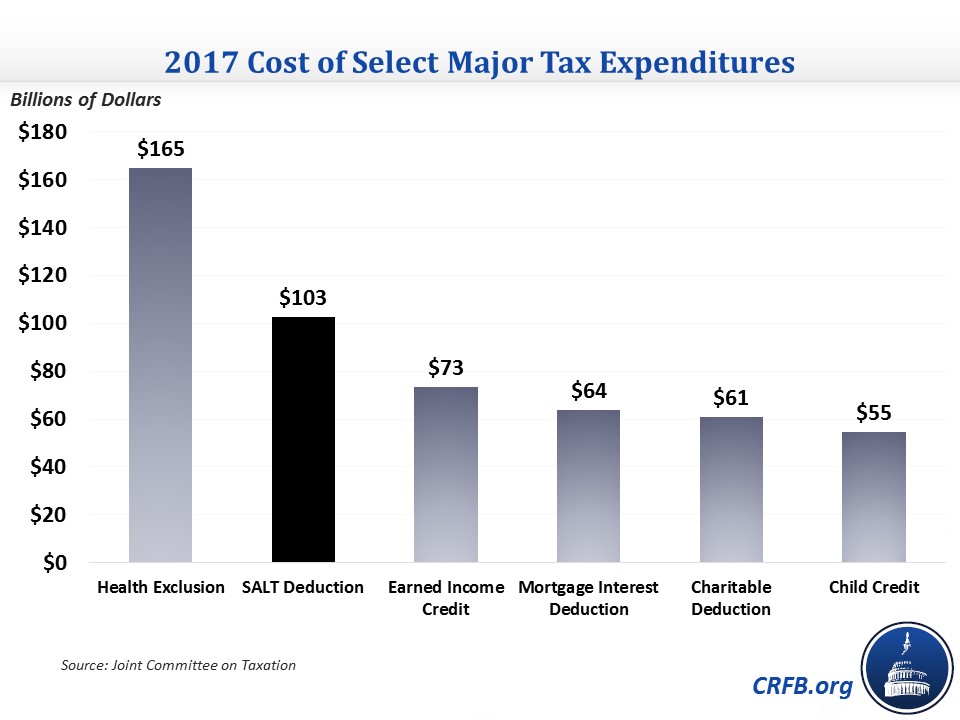

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

California Lawmakers Governor Float Salt Cap Workaround Plans

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained - Vox

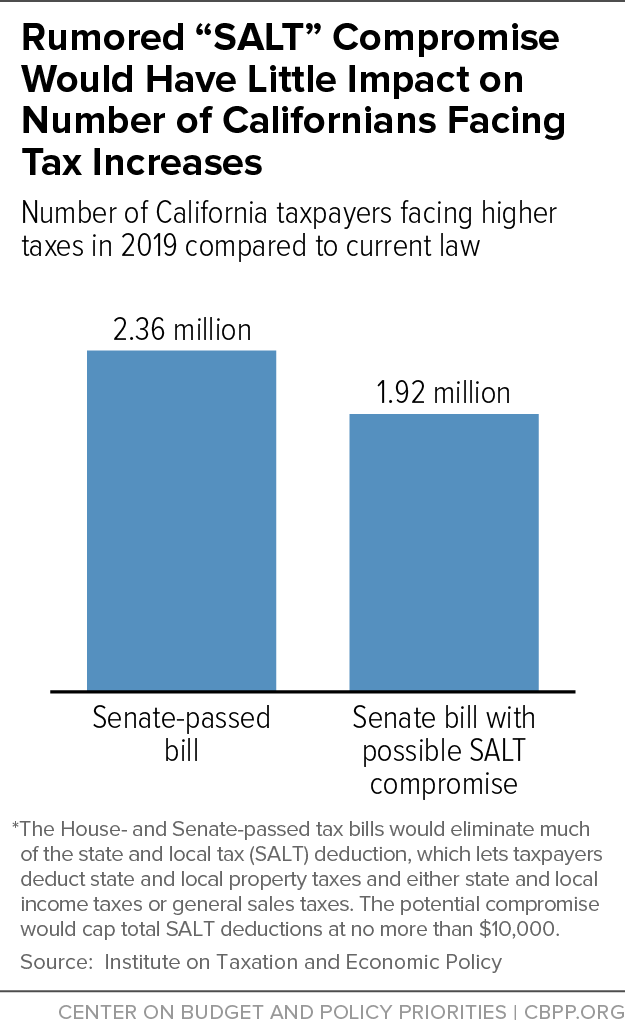

Update California House Members Appear To Be Settling For Bad Salt Compromise Center On Budget And Policy Priorities

Client Alert Gov Newsom Signs Ab 150 - Salt Workaround - Shartsis Friese Llp

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Schumer Pushes For Elimination Of Salt Deduction Cap

State And Local Tax Deductions Implications For Reform - Aaf

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Congress And The Salt Deduction - The Cpa Journal

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

We Dont Know If The Salt Cap Is Driving Away Residents Of High-tax States Tax Policy Center

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Salt Cap Workarounds Will They Work Accounting Today

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained - Vox