Democrats reportedly are contemplating a plan to repeal the 2017 cap on the state and native tax (salt) deduction for 2022 and 2023 solely. Prior to that, the average salt deduction in california exceeded $18,400.

Sanders Opposes Plan To Scrap Salt Cap Then Restore It - Roll Call

The more recent idea from senate majority leader chuck schumer is to completely lift the salt cap for the next five years and shift back to the $10,000 cap in 2026.

Salt tax cap repeal senate. According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. Biden did not propose a repeal of the $10,000 salt deduction cap, which limits the amount of state and local taxes that can be deducted before paying federal taxes, as part of his social spending. Bob mason, cpa august 24th, 2021 category:

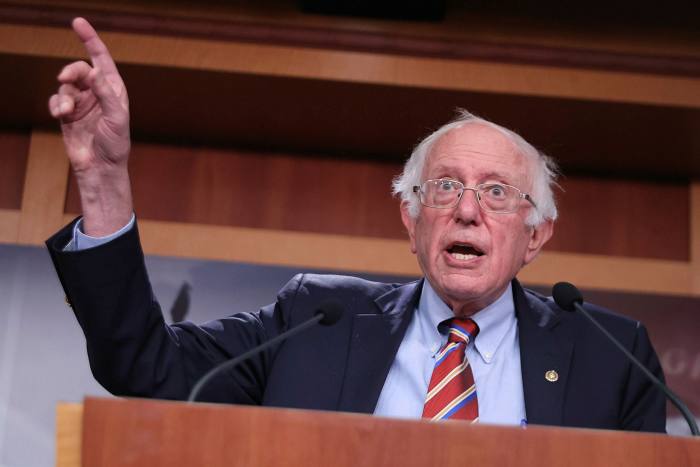

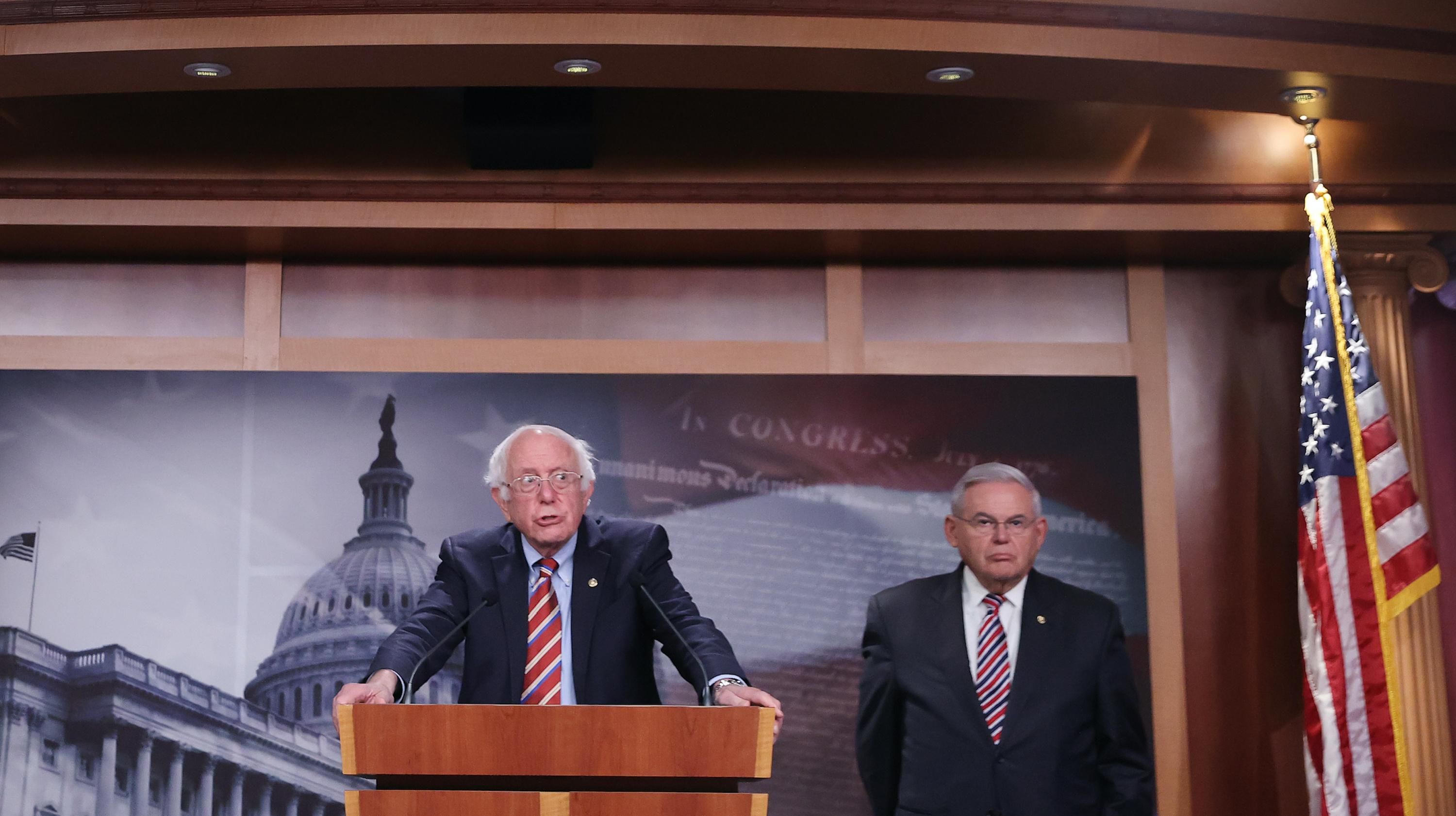

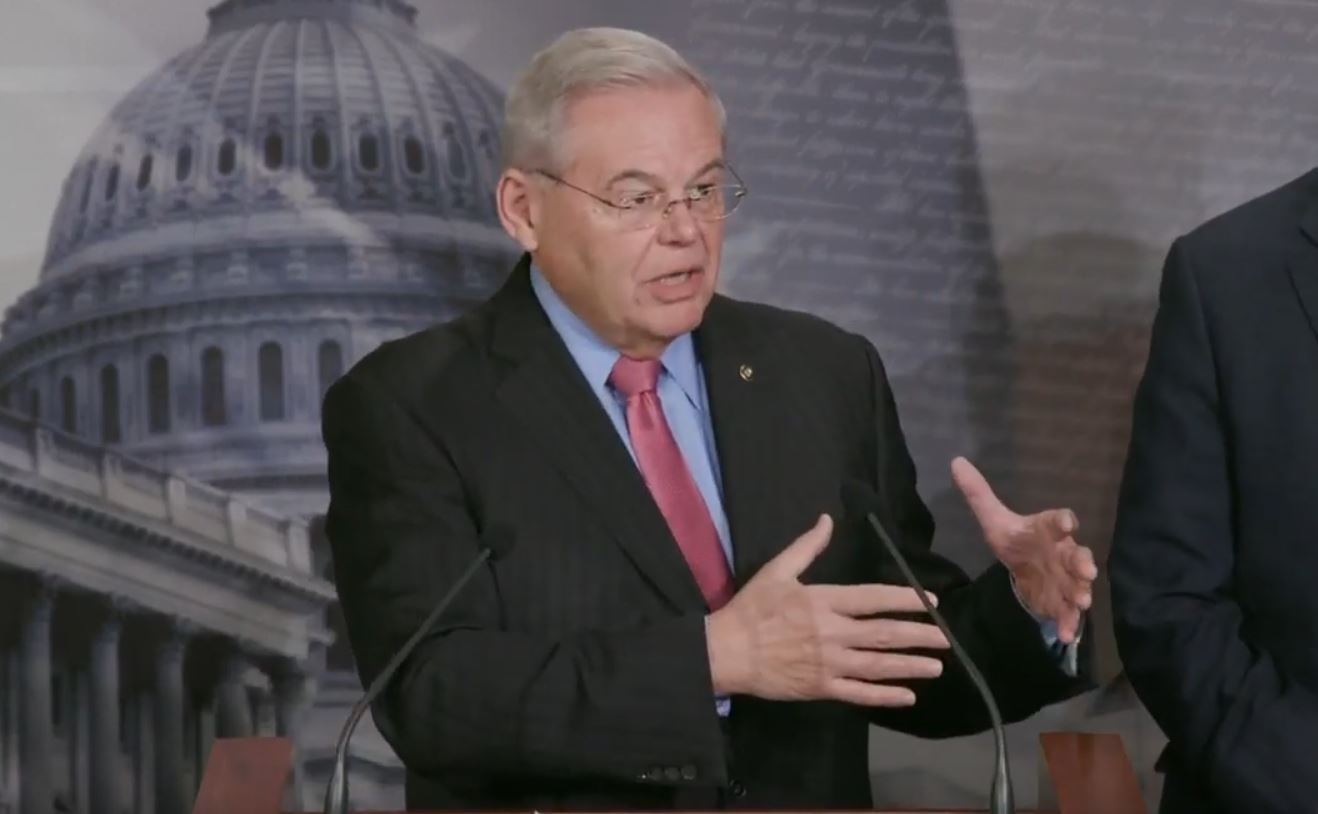

But trump and republicans placed a $10,000 cap on deductions for state and local taxes, called salt in government speak. Senator bob menendez pushes ahead on eliminating salt deduction caps nov 04 2021 2:57 pm new jersey senator bob menendez, a senior member of the senate finance committee that sets national tax policy, joined senator bernie sanders, chairman of the senate budget committee, to discuss their joint proposal to repeal the cap on state and local tax. Under the proposal circulating on capitol hill, the current $10,000 limit on salt deductions would be repealed for the 2021 through 2025 tax years, then reinstated from 2026 through 2030 in.

The law now goes back to the house for consideration, and one critical piece. Senators wednesday in warning against a move the organization says would overwhelmingly benefit wealthy americans. Nov 19, 2021 | taxes.

House speaker nancy pelosi is fighting to repeal the cap. The cap, imposed by the trump. The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes.

Senate considers repeal of the salt deduction cap. The senate approach would likely replace the salt measure in the house version of the bill that calls for lifting the cap to $80,000 from $10,000. House democrats pass spending package with $80,000 salt cap through 2030 published fri, nov 19 2021 11:00 am est updated fri,.

Senate approved a $3.5 trillion budget resolution that represents a significant goal for the biden administration. Senator bernie sanders said he is working on a proposal to set. Democratic senator bob menendez of new jersey said repealing the $10,000 cap on the federal deduction for state and local taxes for a few years could be a possibility as congress wrestles with.

This would be in place of the house plan to lift the cap to $80,000 through 2030 and reinstate it at $10,000 for 2031. We estimate repealing the salt cap for individuals earning up to $550,000 and for couples earning up to $1.1 million would cost about $250 billion over five years, with the largest benefits going to households with incomes near the $1.1 million per year threshold. A gaggle of blue state democrats has insisted on some salt repair as their worth for supporting biden’s construct again higher plan.

Salt Plan In Senate Would Fully Lift Cap Within Income Limits - Bnn Bloomberg

Democrats Salt Headache Hangs Over Budget Reconciliation Bill - Roll Call

Tax Giveaways To Millionaires Democrats Salt Plans Divide Party Financial Times

Chuck Schumer Salt Deduction-cap Repeal Tax Bailout For Rich Liberals National Review

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less

Senators Menendez And Sanders Show The Way Forward On The Salt Cap Itep

Salt Deduction Relief Included In Sanders Budget Proposal - Bloomberg

Property Tax Breaks Would Be Restored Under Senate Budget Bill Menendez Says - Njcom

Senators Offer Solution As Progressives Warn Salt Repeal Would Be Colossal Mistake

These Nj Democrats Have Their Own Demands For Their Partys Big Bill And Yes Its About Property Taxes

Paid Leave Immigration And Tax Changes Back In Biden Bill - Los Angeles Times

Senate Calls For Revamped Salt Tax Break Skip September State Estimated Tax Payment To Save Big

Major Unions Join The Call To Repeal Salt Cap - Axios

House Votes To End Cap On Salt Deductions But Senate Likely Wont

Democrats Prepare Plan To Pass Salt Cap Relief Tax Break For Wealthy

Pin On Coin Mama

Senator Bob Menendez Pushes Ahead On Eliminating Salt Deduction Caps The Lakewood Scoop

Salt Deduction In Democrats Spending Plan Provides Little Middle-class Help Analysis Shows Fox Business

Ni1uk_yimeat-m