Recipients of gifts or bequests received during the current tax year from foreign persons), the 2017 version of which asks the following questions: Prefill and prior year info saves you time, then your etax accountant handles the rest.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

It is the tax form filed by a u.s.

Foreign gift tax return. Finish your 2021 tax returns with confidence it's done right. In order for the foreign gift to be from a foreign person, the person giving the gift must be foreign. Prefill and prior year info saves you time, then your etax accountant handles the rest.

Part, then gifts whether received from india or abroad will be charged to tax. Foreign gift tax & the irs: You would therefore file it separately from your form 1040 tax return.

In form3520, should file as individual, but not as joint form 3520? Form 709 (gift tax returns) for transfer of assets to fund a foreign trust. Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million.

Finish your 2021 tax returns with confidence it's done right. Foreign gifts are reported on form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts). Person upon receiving a gift or bequest from abroad.

Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. The thresholds referenced above derive from part iv of form 3520 (u.s. Important practice tip if you receive a gift from taiwan for example of $600,000 and your dad needed 12 of their friends to each facilitate the transfer of $50,000 due to currency restrictions, this is still reportable.

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or. All information must be in english. Certain transactions with foreign trusts.

Person upon receiving a gift or bequest from abroad. Person receives a gift from a foreign person. The answer i reached is that you do need to file form 3520, to report the receipt of the foreign gift(s) in excess of $100,000;

But the fact that some of the money received was intended for graduate school tuition has no impact on the filing form 3520. The rules are different when the u.s. Person gives a gift that exceeds the annual exclusion amount, they typically must file a form 709, unless an exception or exclusion applies.

Form 3520 is the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. About form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. I file joint tax return.

Annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to www.irs.gov/form3520 for instructions and the latest information. The gift tax return exists to keep u.s. In addition, if the gift generates income either in the u.s.

It is the tax form filed by a u.s. The value of the gifts received from foreign corporations or foreign partnerships exceeds $16,649 as of the tax year 2020 (the value adjusted annually for inflation) form 3520 is considered an informational return rather than a tax return because foreign gifts are generally not subject to income tax. This is a really good question, and i did some tax research on it it for you.

Once the aggregate value of gifts received during the year exceeds rs. Person must r eport the gift on form 3520. Persons with respect to certain foreign corporations, form 8621, information return by a shareholder of a passive.

And i received foreign gift $110,000 in my own account. Person receives a gift from a foreign person that meets the threshold for filing, the u.s. Or abroad, the recipient may have significantly more reporting tax filing requirements.

50,000 then all gifts are charged to tax sum of money received without consideration by an individual or huf is chargeable to A penalty of up to 25 percent of the total amount received as a foreign gift or foreign bequest (inheritance) a penalty of 35 percent of the total amount contributed to a foreign trust Ta 2021/2 concerns arrangements where australian resident taxpayers fail to declare foreign income in their tax returns and then conceal the character of the funds upon repatriation to australia, by disguising the funds received as a purported ‘gift’ or ‘loan’ from a related overseas entity.

Show all amounts in u.s. If you are a u.s. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679.

In addition, gifts from foreign corporations or partnerships are subject to a lower. For the same reason, if you receive more than $100,000 in gifts from a foreign person in a year, you’d then also have to file form 3520. Owner, form 5471, information return of u.s.

Form 3520 is an information return, not a tax return, because foreign gifts are not subject to income tax. Irs form 3520 is required if you receive more than $100,000 from a nonresident alien or a foreign estate.

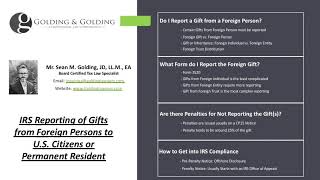

Gifts From Foreign Persons New Irs Requirements 2021

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

311106 Estate And Gift Tax Returns Internal Revenue Service

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

6 Surprising Facts Found In Presidential Tax Returns Through History - History

Receiving A Foreign Gift You May Need To Tell The Irs - The Wolf Group

How To Fill Out A Fafsa Without A Tax Return Hr Block

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation-skipping Transfer Tax Return Definition

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Foreign Gift Tax - Ultimate Insider Info You Need To Know

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Irs 1040 Milk Chocolate 8oz Deluxe Bars Case Of 4 Totally Chocolate Chocolate Milk Custom Chocolate Chocolate

311106 Estate And Gift Tax Returns Internal Revenue Service

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

311106 Estate And Gift Tax Returns Internal Revenue Service

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

Gifts From Foreign Persons New Irs Requirements 2021

Foreign Gift Tax - Ultimate Insider Info You Need To Know

311106 Estate And Gift Tax Returns Internal Revenue Service