S corps create tremendous savings because they reduce the biggest expense many llc owners face: In new york city, for example, the general corporation tax is imposed on all corporations at a rate of 8.85%.

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp

As ceo and founder of carl’s sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you’re entitled to 50% of—or $100,000.

S corp tax calculator nyc. This is known as the new york city unincorporated business tax (“ubt”). Your annual federal business tax return is due march 15th instead of april 15th. For taxpayers in the state of new york, there’s new york city, and then there’s everywhere else.

This tax calculator shows these values at the top of. This calculation is only valid if your business income is $132,000. New york state voluntary contributions.

Also i was told to pay using one check but the instructions later say to pay using 3 checks. From the authors of limited liability companies for dummies. New york city service businesses summary

S corp vs llc tax savings calculator. However, one major difference from c corporations is that the new york city s corporation tax rate is a flat 8.85%—as opposed to a range of 6.5% to 8.85%. Use our detailed calculator to determine how much you could save.

Now, if $50 of those $75 in expenses was related to meals and. Our calculator will estimate whether electing s corp will result in a tax win for your business. This calculator helps you estimate your potential savings.

Annual cost of administering a payroll. New york state corporate income tax 2021. Payments due april 15, june 15, september 15, 2021, and january 18, 2022.

8.05 cents per gallon of regular gasoline, 8.00 cents per gallon of diesel. New york city is an economic hub and part of the engine that makes the global economy work. Electing s corp status allows llc owners to be taxed as employees of the business.

If your business is incorporated in new york state or does business or participates in certain other activities in new york state, you may have to file an annual new york state corporation tax return to pay a. I'm relatively new to the tax world and just started my business. The s corporation tax calculator below lets you choose how much to withdraw from your business each year, and how much of it you will take as salary (with the rest being taken as a distribution.) it will then show you how much money you can save in taxes.

How s corps create savings. The nyc s corp tax provides a wide array of tax benefits for prospective owners of small businesses. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.there are a total of twenty three states with higher marginal corporate income tax rates then new york.

As a sole proprietor self employment taxes paid as a sole proprietor. New york has a flat corporate income tax rate of 7.100% of gross income. The s corp tax calculator.

Nyc does not recognize federal or new york state s corporation elections, and so s corporations are subject to the general corporation tax. For partnerships, new york city has a flat tax rate on net income of 4%. This page and calculator are not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

Our small business tax calculator has a separate line item for meals and entertainment because the irs only allows companies to deduct 50% of those expenses. For example, if you have a business that earns $200 in revenue and has $75 in expenses, then your taxable income is $125. With multiple colleges and universities throughout new york, many college students graduate and stay in new york city to start small businesses.

If your company is taxed at a. Information on this page relates to a tax year that began on or after january 1, 2020, and before january 1, 2021.

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

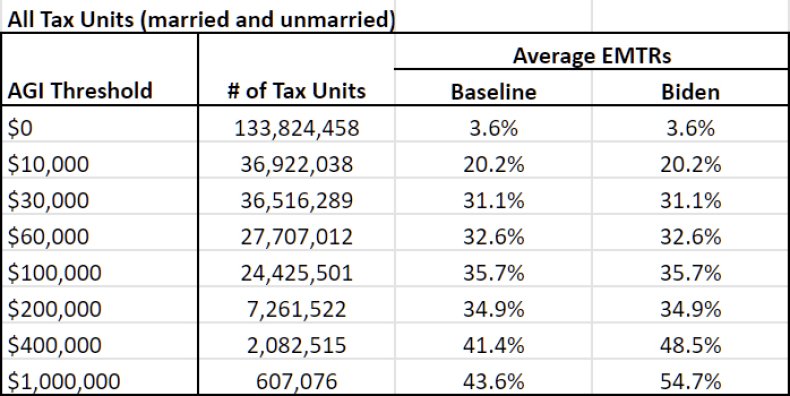

Joe Biden Tax Calculatorhow Democrat Candidates Plan Will Affect You

Paycheck Calculator - Take Home Pay Calculator

Bidens Tax Plan Calculator See How Your Taxes Might Change Forbes Advisor

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Investing Preferred Stock

Tax Calculator - Estimate Your Income Tax For 2021 And 2022 - Free

Paycheck Calculator - Take Home Pay Calculator

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

![]()

1040 Income Tax Calculator Free Tax Return Estimator

Nyc Mansion Tax Of 1 To 39 2021 Overview And Faq Hauseit

Calculating Federal Taxes And Take Home Pay Video Khan Academy

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp

Co-op Apartment Flip Tax Calculator Hauseit Nyc

Llc Tax Calculator - Definitive Small Business Tax Estimator

Exclusive S-corp Tax Calculator - Newway Accounting

Quarterly Tax Calculator - Calculate Estimated Taxes

Mortgage Calculator Mortgage Calculator Smartassetcom Free Online Mortgage Calculator Tools C Mort Mortgage Payoff Pay Off Mortgage Early Online Mortgage

Wyoming Income Tax Calculator - Smartasset

Free Tax Estimate Excel Spreadsheet For 201920202021 Download