Groceries and prescription drugs are exempt from the colorado sales tax. City of lakewood accommodations tax :

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

State of colorado sales tax:

Lakewood co sales tax rate. State income taxes, just like federal taxes, are due on april 15th. The colorado state sales tax rate is 2.9%, and the average co sales tax after local surtaxes is 7.44%. The us average is 7.3%.

Businesses located in the centerra fee districts sales tax rate is 1.75% and is in addition to the district fees. The estimated 2021 sales tax rate for 80228 is. The december 2020 total local sales tax rate was 9.900%.

The minimum combined 2021 sales tax rate for lakewood, colorado is. The st3 sales and use tax rate of 0.50% is effective april 1, 2017, bringing the total sales and use tax rate for sound transit to 1.40%. The current total local sales tax rate in lakewood, wa is 10.000%.

The city portion (3%) must be remitted directly to the city of lakewood. This is the total of state, county and city sales tax rates. 90711, 90712, 90713, 90714 and 90715.

The city of loveland’s sales tax rate is 3.0%, combined with larimer counties 0.80% sales tax rate and the state of colorado’s 2.9% sales tax rate, the overall total is 6.70%. There is no applicable county tax. Future job growth over the next ten years is predicted to be 44.1%, which is higher than the us average of 33.5%.

The current total local sales tax rate in lakewood, co is 7.500%. Location tax rates and filing codes. This downloadable spreadsheet combines the information in the dr 1002 sales and use tax rates document and information in the dr 0800 local jurisdiction codes for sales tax filing in one lookup tool.

Taxes for auto dealers get a little trickier because we collect taxes based on a couple of different factors. There are approximately 66,978 people living in. Create your own online store and start selling today.

, wa sales tax rate. Try it now & grow your business! Businesses located in belmar or the marston park and belleview shores districts have different sales tax rates.

The lakewood, california sales tax rate of 10.25% applies to the following five zip codes: The breakdown of the 10.0% sales tax rate is as follows: You can print a 8.81% sales tax table here.

Code local rate state rate combined sales tax (1) lewis (cont.) mossyrock. The tax rate for most of lakewood is 7.5%. 2.09% lower than the maximum sales tax in co.

The lakewood sales tax rate is %. Look up the current sales and use tax rate by address Any business in these jurisdictions would be expected to collect sales tax on items they sell in the area.

Lakewood collects a 4.6% local sales tax, the maximum local sales tax allowed under colorado law lakewood has a higher sales tax than 64.2% of colorado's other cities and counties lakewood colorado sales tax exemptions For those who file sales taxes. Exact tax amount may vary for different items.

Create your own online store and start selling today. California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. 2021 colorado state sales tax.

The colorado sales tax rate is currently %. City of lakewood sales tax: Code local rate state rate combined sales tax (1) a aberdeen.

Lakewood has seen the job market increase by 2.8% over the last year. This rate is a combination of the colorado sales tax rate of 2.9%, denver county sales tax rate of 0.5%, the lakewood sales tax rate of 3%, and a special rate of 1.1%. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage.

The 2018 united states supreme court decision in south dakota v. The 8.81% sales tax rate in denver consists of 2.9% colorado state sales tax, 4.81% denver tax and 1.1% special tax. The city of lakewood receives 1% of the 10.0% sales tax rate.

The current total local sales tax rate in lakewood, co is 7.500%. Lakewood in colorado has a tax rate of 7.5% for 2022, this includes the colorado sales tax rate of 2.9% and local sales tax rates in lakewood totaling 4.6%. Location sales/use tax county/city loc.

, co sales tax rate. For example, if you owned a retail store selling books at the lakewood address you would charge 7.5% tax on each sale. The county sales tax rate is %.

Try it now & grow your business! For tax rates in other cities, see colorado sales taxes by city and county. Colorado’s state income tax is a flat 4.63% regardless of your taxable revenue.

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Clevelandakron Area - Clevelandcom

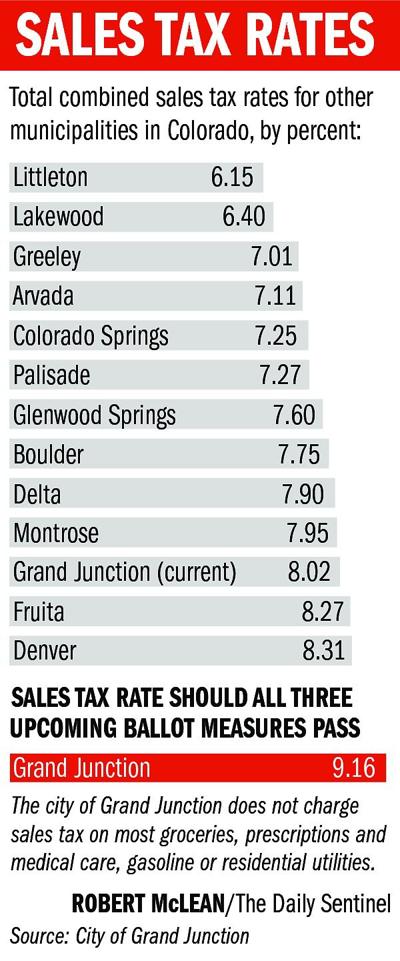

Gjs Combined Tax Rate Would Be Among States Highest If Measures Pass Western Colorado Gjsentinelcom

States With Highest And Lowest Sales Tax Rates

Sales Tax Rate - Jeffcoedc

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap - Clevelandcom

States With Highest And Lowest Sales Tax Rates

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

State And Local Sales Taxes In 2012 Tax Foundation

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks - Clevelandcom

Colorado Sales Tax Rates By City County 2021

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work - Auto Dealers - Dealrtax

Why Do Us Sales Tax Rates Vary So Much

Ohio Sales Tax Guide For Businesses

Sales Use Tax - City Of Lakewood

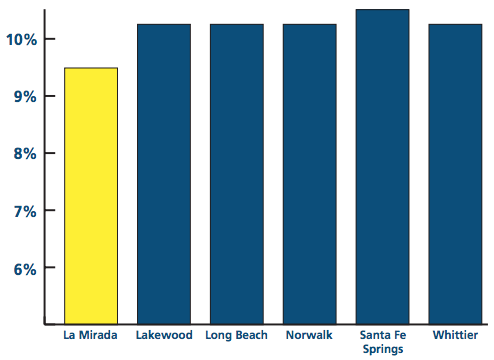

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Los Angeles Countys Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizens Voice