File your return and pay all the tax you owe by the 1st day of the 3rd month after the end of your tax year. Time and method for paying estimated tax;

North Carolina Sales Tax - Small Business Guide Truic

The due dates are generally april 15, june 15, september 15, and january 15 but if they fall on a weekend or holiday, the deadline is moved to the next workday.

Nc estimated tax payment due dates. 15 of the following year The north carolina general assembly offers access to the general statutes on the internet as a service to the public. For details, visit www.ncdor.gov and search for online file and pay. for calendar year filers, estimated payments are due april 15, june 15, and september 15 of the taxable year and january 15 of the following year.

Installment payments are due as follows: Failure to pay the required amount of estimated income tax will subject the corporation to interest on the underpayment. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before april 15, june 15, september 15 and january 15 of the following year.

September 1, 2021 to december 31, 2021. Due dates for estimated taxes; When the due date for the estimated income tax payment falls on a saturday, sunday or holiday, the payment is due on or before the next business day.

Generally you must make your first estimated income tax payment by april 15. Year 2019 of $10,000,000 or less. While every effort is made to ensure the accuracy and completeness of the statutes, the north carolina general assembly is not responsible for any errors or.

(a) due dates of declarations. Timely mailing of returns, documents, or payments Estimated nyc income tax payments are included with nys estimates due june 15.

The ncdor will also waive late payment penalties on income taxes originally due april 15 If the monthly deposit rule applies, deposit the tax for payments in september. Fiscal year farmers and fishermen.

In march, the ncdor extended the deadline for filing north carolina individual income, corporate income, and franchise taxes due on april 15, 2020 to july 15, 2020. April 1 to may 31: Payments of tax are due to be filed on or before the 15th day of the 4th, 6th, 9th and 12th months of the taxable year.

Installment payments are due as follows: Due date extended due date ; The north carolina department of revenue (ncdor) is also extending until july 15 the filing deadline for north carolina income and franchise tax returns otherwise due april 15.

You can also pay your estimated tax online. The extension of time to file through july 15, 2020, applies to individual income tax returns, corporate income and franchise tax returns, partnership tax returns, and estate and trust tax returns due april 15, 2020. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before april 15, june 15, september 15 and january 15 of the following year.

(a) due dates of declarations. 54 rows in some states, 2020 estimated tax payments are due before 2019 taxes are. (1) if, before the 1st day of the 4th month of the taxable year, the corporation's estimated tax equals or exceeds five hundred dollars ($500.00), the corporation shall.

You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types. Pay all your estimated tax by the 15th day after the end of your tax year, or. Visit this page on your smartphone or tablet, so you can view the online tax calendar on your mobile device.

When the due date falls on a saturday, sunday, or legal holiday: If you're a farmer or fisherman, but your tax year doesn't start on january 1, you can either: View the online tax calendar (en español)

In addition, the march 31, 2020 due date for license fees collected on behalf of the department of public health, fire When the due date for the estimated income tax payment falls on a View due dates and actions for each month.

It does not apply to trust taxes such as sales and use taxes or withholding taxes. The relief also applies to estimated income tax payments due between the same dates. These quarterly estimated tax liabilities must instead be paid along with annual tax payments for tax year 2020, which will generally be due by march 1, 2021.

Tax Department Wilson County

Pin By Mary Myers On Pool Robot Cleaner Pool Automation

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

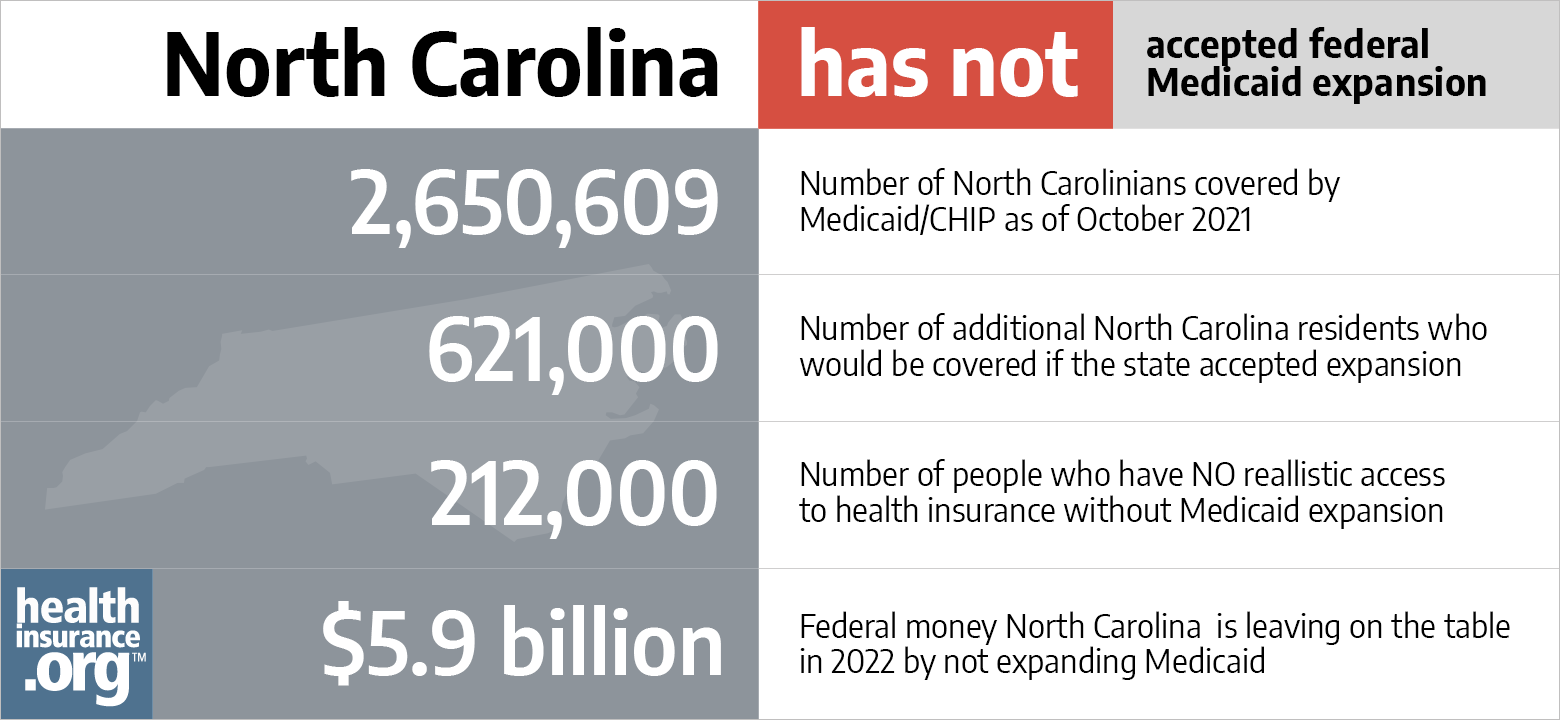

Aca Medicaid Expansion In North Carolina Updated 2021 Guide Healthinsuranceorg

To Calculate Estimated Taxes For Business From Schedule You Must Combine Other Income Information With Business Tax Attorney Small Business Saving Attorneys

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

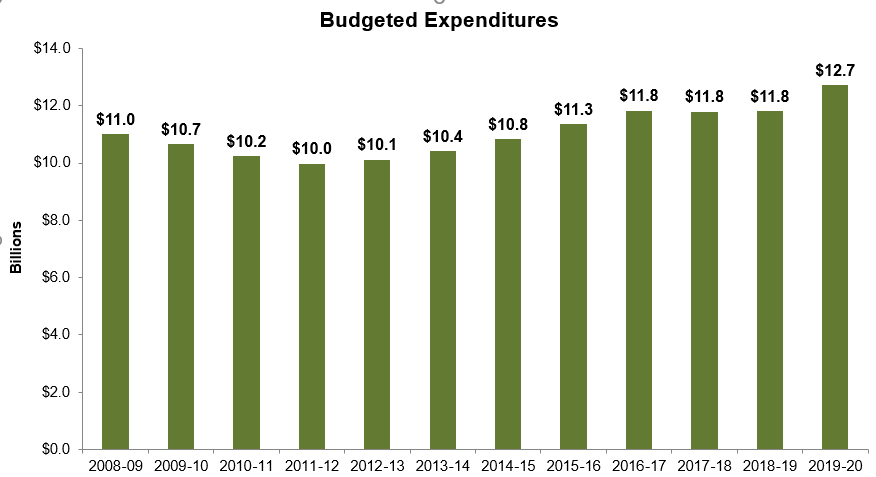

County Budget And Tax Survey - North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Dk4-c8ojwrkwxm

North Carolina Income 2021 2022 Tax Return Nc Forms Refund Status

Des Unemployment Benefits Data

Pin On Us Tax Forms And Templates

Solar Schools Saving Big Money Going 100 Renewable - The Green Divas Solar Energy Aquaponics Solar

Self Employed Builder Invoice Templates Work Invoice Template Reading About Details Of Work Invoice Templa Invoice Template Invoice Template Word Templates

Pin On Taxgirl

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Separation Agreement Template Estimated Tax Payments Tax Return

Gia Platinum 18k Yellow Gold 128ct Yellow Oval Diamond Emerald Engage In 2021 Emerald Engagement Ring Fancy Yellow Diamond Oval Diamond

Tumblr

File Pay Ncdor