So, for example, if a suffolk county homeowner was successful in their tax grievance for the 2016/17 tax year, they can not file a grievance until the 2017/18 tax year. There’s no home inspection required, if you don’t win a reduction, we don’t charge a fee.

Nassau County Property Tax Grievance Real Estate Attorneys

Long island property tax grievance professionals.

Tax grievance lawyer suffolk county. Guerriero were in the nassau county attorney’s office handling tax certiorari and condemnation matters. A person named in the records of the suffolk county clerk as a homeowner; In nassau county, a property tax grievance can be filed every year.

The assessor(s) of each town prepares a tentative assessment roll for that tax year which is available for public review on or about the preceding april 1st based upon the value of the property on the preceding july 1st. If your assessment is not reduced, you pay nothing. Is recognized as fair and honest.

Many of our attorneys initially worked for municipalities in new york city, nassau, suffolk and westchester counties or as special counsel. Fill out and send the application by april 2nd to file a tax grievance in nassau. We are committed to zealously representing clients who are overcharged for property taxes.

In bohemia, ny, our team offers assistance to our clients in suffolk county. Our clients have saved over $1 billion dollars on their property taxes!! All island tax grievance specializes in representing homeowners in suffolk county.

We research your case, file all required paperwork, and, if necessary, represent you in court. We have won over 84,935 reductions on long island!! The tax year for each of the towns in suffolk county runs from december 1st to the following november 30th.

Suffolk deadline may 17, 2022. The estate of a deceased homeowner, is eligible under law to receive a tax assessment reduction and a. There is no cost to grieve an assessment and it does not require you to hire a lawyer.

There are instructions on how to grieve and he also does seminars. A person who has contracted to buy a home; You can do this yourself (if you love doing paperwork and dealing with town hall) or you can hire a firm on your behalf.

Tax grievance lawyer suffolk county. Rosen worked for the nassau county. Jacobowitz & gubits, llp, has offices in orange and sullivan county, new york, and serves clients throughout the hudson valley including the communities of newburgh, new windsor, middletown, monticello, kingston, beacon, poughkeepsie, port jervis, pine bush, cornwall, hyde park, patterson, warwick, goshen, wallkill, fishkill, nyack, new city, monroe, tuxedo, campbell hall, ellenville, florida,.

Serving suffolk county homeowners for over 30 years!! Our main objective is to minimize our client’s property tax assessment with personalized service. To reduce your property taxes, you have to file a property tax grievance.

No reduction = no fee. Filing the grievance form properties outside new york city and nassau county. If you still don't want to grieve, his firm charges a.

Patsis, pllc is highly experienced in preparing and filing property tax grievances in nassau & suffolk county including brookhaven, smithtown, islip, babylon, huntington, east hampton, southold, shelter island, southampton and riverhead. We are an attorney and licensed tax griever team located in suffolk county. If a taxpayer is unhappy with an assessment, the taxpayer may file a grievance.

1) hire a tax grievance company and pay them at least 50% of your tax savings. We are one of the largest voluntary bar associations in the state. Suffolk county executive commissioner suffolk county department of labor, licensing & consumer affairs p.o.

At lighthouse tax grievance, corp. File your tax grievance petition with your local bar (board of assessment review) by the filing deadline step 2: You can find on our website a contact form that you can fill out if you wish to have us as your agent.

If your assessment is reduced, you pay 50% of the first year's savings, plus the $30 filing fee and the $75 appraisal fee. Our clients benefit directly from the close working relationships we have established with the assessing units throughout the years. We are one of the leaders in property tax challenges on long island.

The form can be completed by yourself or your representative or attorney. Nassau tax protest processing deadline: We are a private organization representing lawyers of.

2021 tax grievance authorization/suffolk county. Heller & consultants tax grievance specializes in grieving property taxes on long island for both suffolk and nassau counties, saving homeowners thousands. Grievance day deadline may 17, 2022 hurry, there's only 164 days to go!!

In suffolk county any property tax grievance is a good grievance if homeowners don't lower their property tax to properly reflect full market value they are not only cheating themselves, they are cheating all the homeowners. The process of filing for a tax grievance in suffolk county: Schroder & strom is a leading real estate tax appeals and litigation law firm with a proven record of lowering residential and commercial property taxes in nassau county, suffolk county, on long island, and throughout new york state.

We do the work for you. Even if you still do not know the outcome of filings from years prior. Suffolk county bar association website!

Expertise in condemnation, eminent domain and exemptions. I hereby authorize zapmytax to process my application for a property tax reduction in 2021 for the applicable tentative assessment roll, to represent me before the board of assessment review and/or small claims assessment review pursuant to my rights guaranteed by nys property tax law, and to negotiate any. If you want to learn more about our service, feel free to get in touch with us.

Understanding Your Nassau County Assessment Disclosure Notice

Property Tax Information East Northport Ny - All Information Storage

Heller Consultants Tax Grievance - How Far Back Can I Grieve My Long Island Property Taxes Facebook

Property Tax Grievance Attorney Long Island Patsis Law New York

Looking To Grieve Your Taxes On Long Island Be Sure To Read These 11 Sure-fire Tips First Longislandcom

Tax Grievance - Gold Benes Llp

Suffolk County

Long Island Property Tax Grievance Company The Heller And Clausen Tax Grievance Group Helped Save Homeowners Over 25 Million Dollars In Tax Grievance Cases - Property Tax Grievance Heller Consultants Tax Grievance

Property Tax Grievance Attorney Long Island Patsis Law New York

Property Tax Grievance The Heller Clausen Grievance Group Llc 5 Reasons To Hire A Firm To File Your Li Tax Grievance Property Tax Grievance The Heller Clausen Grievance Group Llc

Learn The Key Differences Between The Nassau County Suffolk County Tax Grievance Processes

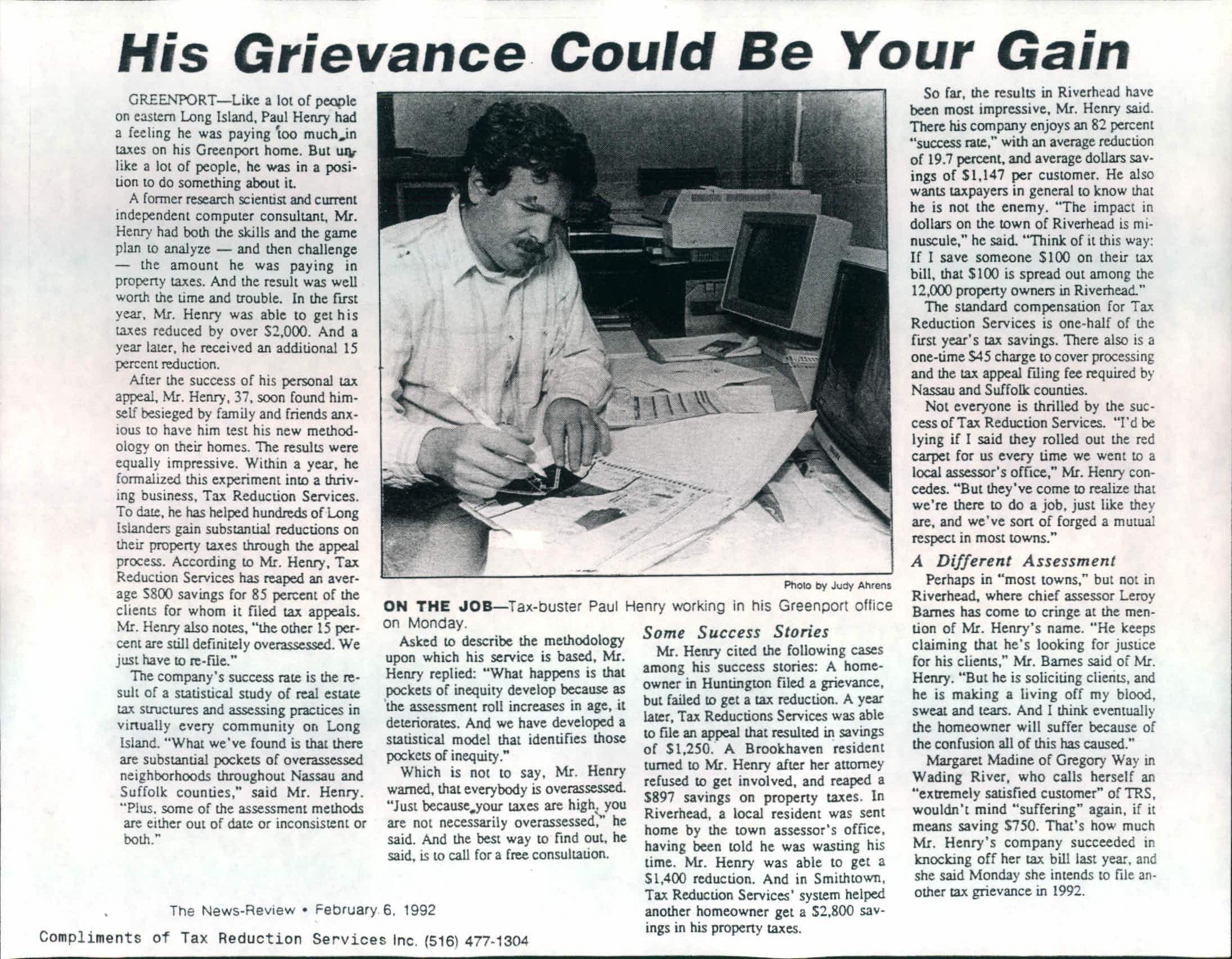

Trs In The News - Tax Reduction Services

All Island Tax Grievance - Home Facebook

Top 5 Reasons Why You Should Hire A Tax Grievance Firm To File Your Tax Grievance - Property Tax Grievance Heller Consultants Tax Grievance

All Island Tax Grievance - Home Facebook

Mark Davella - Appraiser - Tax Grievance Consultant Linkedin

Property Tax Grievance Attorney Long Island Patsis Law New York

How To Lower Your Long Island Property Tax Bill In Covid Times - Property Tax Grievance Heller Consultants Tax Grievance

Looking To Grieve Nassau Or Suffolk Property Taxes Heller Consultants Have A Proven Track Record In Saving You Money - Property Tax Grievance Heller Consultants Tax Grievance