Just so, how does debt provide a tax shield? Depreciation tax shield formula = depreciation expense * tax rate.

Tax Shield Formula Step By Step Calculation With Examples

Depreciation tax shield = tax rate x depreciation expense

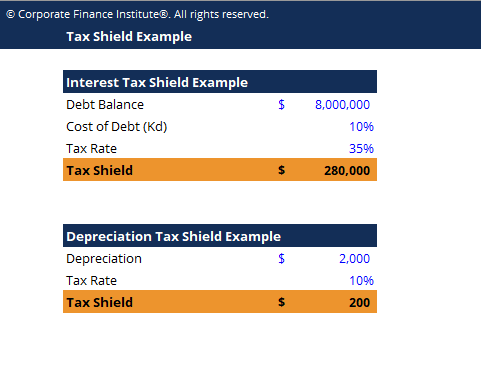

Tax shield formula for depreciation. Depreciation tax shield = depreciation expense x tax rate. The formula for calculating a depreciation tax shield is easy. Interest tax shield formula = average debt * cost of debt * tax rate.

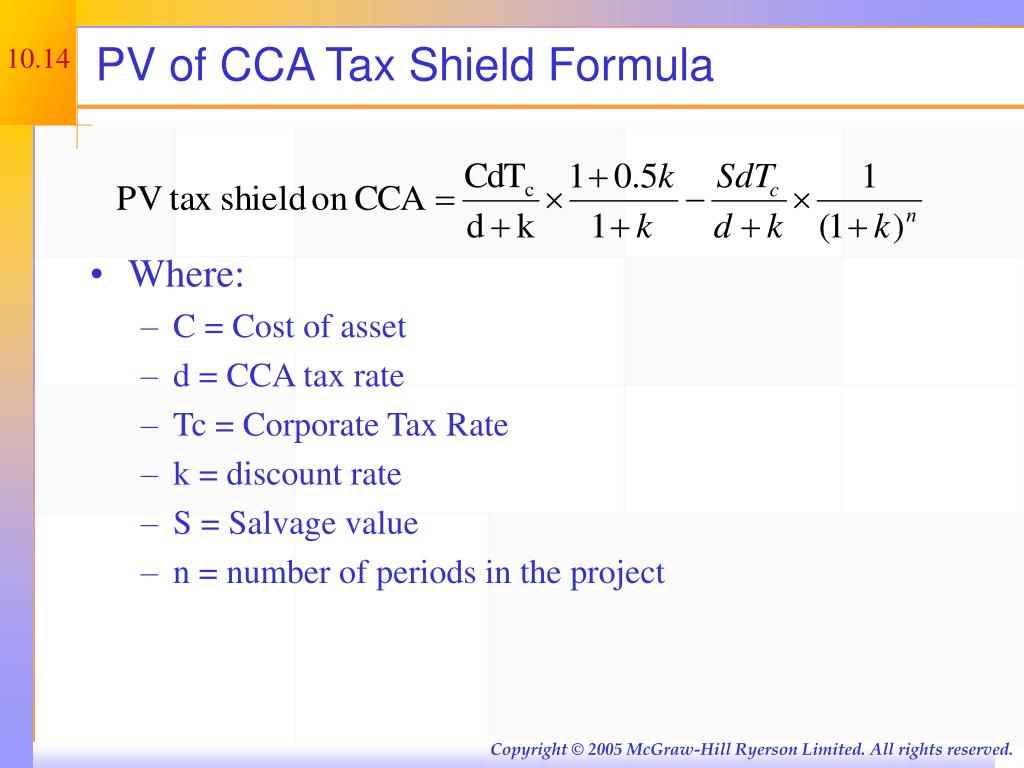

The formula for this calculation can be presented as follows: Pv of cca tax shield = cdtc k +d 1+0:5k 1+k uccdtc k +d (1+k) n; For example, below we have two segments:

Consider the following formula for the present value of cca tax shields: To figure out how much you'll save with depreciation, use the tax shield formula: Content what are tax savings?

In other words, the tax shield protects part of the taxpayers income from being taxed. All you need to do is multiply depreciation expense for tax purposes (not financial purposes) and multiply by the effective income tax rate. Multiply the amount of depreciation by the tax rate.

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. Calculating the tax shield can be simplified by using this formula: A tax shield is the future tax saving attribute of tax by determining the firm’s present value and helps to predict the deductibility of a particular expenditure in the profit & loss account.

Read more is a tax reduction technique under which depreciation expenses are subtracted from taxable income. What are the benefits of tax shields? A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

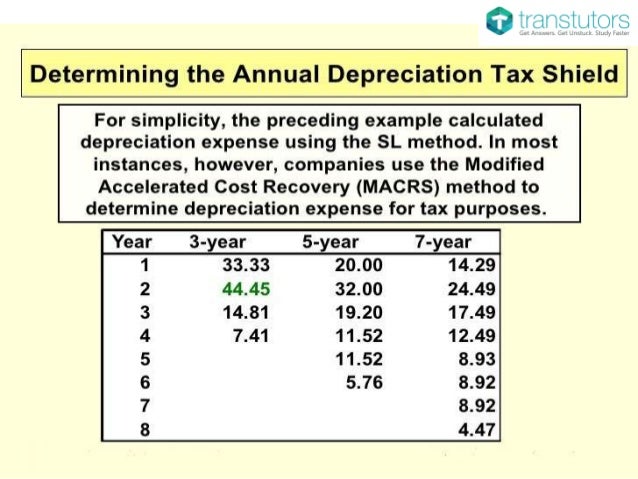

This is simply to bring the pv of tax Companies using a method of accelerated. To understand the concept of depreciation tax shield read the entire article provided by the brilliant author.

To learn more, launch our free accounting and finance courses! Can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest expense and depreciation expense in the case. Definition of depreciation tax shield.

In other words, y ou will lose $35,000 (which is salvage value, s) from the capital base. Free cash flow to the firm (fcff) from earnings before interests and taxes (ebit) defined in cfa curriculum [1] as: The devaluation deduction lets taxpayers improve certain losses associated with the depreciation of succeeding possessions.

A depreciation tax shield is the savings of the tax due to depreciation expense in the company and it is calculated as depreciation debited to profit and loss account multiplied by the applicable tax rate where the depreciation tax shield is directly related to the depreciation debited i.e., higher the depreciation debited to the profit and. Companies using accelerated depreciation methods (higher depreciation in initial years) are able to save more taxes due to higher value of tax shield. A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on.

The following formula is used to calculate a depreciation tax shield. Click to see full answer. Tax shield = deduction x tax rate.

A depreciation tax shield depreciation tax shield the depreciation tax shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. When the depreciation tax shield is most effective. It can be calculated by multiplying the deductible depreciation expense by the tax rate applicable to your business.

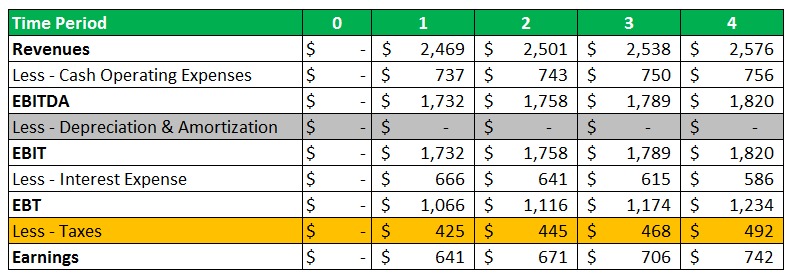

( tax rate = 40%) the first two columns of taxable income with depreciation; The calculation of depreciation tax shield depreciation tax shield the depreciation tax shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. The result equals the depreciation tax shield as the company will pay lower taxes.

If you're paying the 21% corporate tax rate and you claim $10,000 in depreciation, the depreciation tax shield is $2,100. To calculate the interest tax shield, you simply multiply the interest expense by the tax rate. This is usually the deduction multiplied by the tax rate.

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation.for example, if the applicable tax rate is 21% and the amount of depreciation that can be deducted is. Year n), tc be the corporate tax rate, k be the opportunity cost of capital, and d be the cca depreciation rate for the relevant asset class. Where dts is the depreciation tax shield ($)

It is calculated by multiplying the tax rate with the depreciation expense. Tax and accounting how to calculate a depreciation tax shield how do you calculate tax shield of debt? The effect of a tax shield can be determined using a formula.

Dts = atr/100 * dd. To arrive at this number, you can simply use the tax shield formula, where you would multiply the depreciation amount of $10,000 by the tax rate of 35%, which would give you $3,500. The tax shield benefits are determined by the overall tax […]

The tax shield formula assists everyone to calculate the taxable income. As you will see below, the interest tax shield formula is nearly the same as with the depreciation tax shield.

Tax Shields Financial Expenses And Losses Carried Forward

Present Value Of Tax Shield On Cca-evaluation And Computations In Corporate Finance-lecture Slides - Docsity

Cash Flow After Deprecition And Tax - 2 Depreciation Tax Shield - Youtube

Tax Shield Definition Example How Does It Works

Tax Shield Finance

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Ppt - Making Capital Investment Decisions Powerpoint Presentation Free Download - Id5190078

Tax Shield Formula Step By Step Calculation With Examples

10-0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According - Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Example Template - Download Free Excel Template

Ppt - Chapter 21 Powerpoint Presentation Free Download - Id4710282

Chapter 18

Depreciation Tax Shield Calculator - Calculator Academy

Tax Shield - Formula Examples Interest Depreciation Tax Deductible

Tax Shield Meaning Importance Calculation And More

Depreciation Tax Shield Formula Examples How To Calculate