The bill is pending action by the governor (who has 30 days to sign, veto or allow the bill to become law without his action). Governor larry hogan vetoed the bill, but the legislature will have the opportunity to override his veto in 2021.

The Work Lions Entry The Homeless Bank Account In 2021 Problem And Solution Bank Account Opening A Bank Account

The tax, which is set to take effect next year, applies to large companies that sell digital advertising and is imposed on a sliding scale.

Maryland digital advertising tax statute. “digital advertising services” includes “advertisement services on a digital interface, including advertisements in the form of banner advertising, search engine advertising, interstitial advertising, and other comparable advertising services.” As mandated by the maryland constitution, the tax will take effect in 30 days. For purposes of the dat, digital advertising services are defined as advertisement services on a digital interface,.

Maryland’s digital advertising tax, which becomes effective march 14, 2021 (30 days after the governor’s veto), has been preemptively challenged in u.s. The digital advertising provisions of maryland's new tax law could raise an estimated $250 million in its first year, with revenues being earmarked for. Digital advertising gross revenues tax ulletin tty:

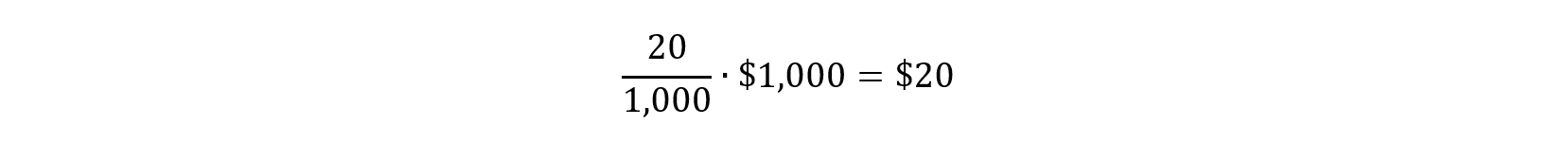

Taxation of digital advertising services. The tax passed the maryland legislature as part of h.b. Now suppose the taxpayer receives $1 more in total revenue, so now it has $1,000,000,001.

Maryland’s proposed digital advertising gross revenues tax came closest to taking effect. On march 18, 2020, the maryland general assembly passed the digital advertising gross revenues tax (mdagrt). Maryland estimates the digital tax could raise as much as $250 million in its first full year by taxing annual gross revenues derived from types of.

On 12 february 2021, the maryland legislature overrode maryland governor larry hogan's veto (pdf) of legislation that imposes a new tax on digital advertising.the new tax had been approved by the state’s legislature in early 2020 but, rather than signing hb 732 into law, governor hogan rejected the bill, noting that it would “be unconscionable” to raise taxes and. Hogan’s subsequent veto of the mdagrt on may 7, 2020, over concerns that “ these misguided bills would raise taxes and fees on marylanders at a time when many are already out of work and financially struggling ,” the general. Chapter 771 of 2019 established in statute

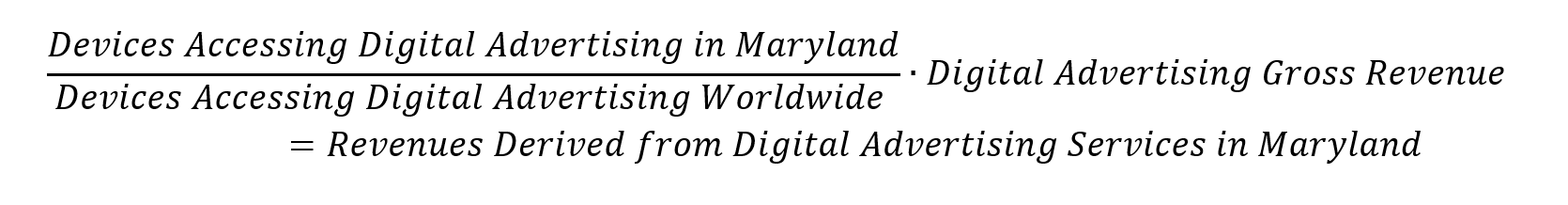

• the tax rate ranges from 2.5% to 10% and applies to the taxpayer’s global annual gross revenue from digital advertising services in maryland. We'll assume that's all maryland advertising revenue. Effective on january 1, 2022, the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in maryland.

The total tax now would double to $50 million, 5%. The maryland general assembly on april 12, 2021, passed senate bill 787—legislation that revises two digital services tax laws enacted earlier this year. House bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in maryland.

The tax is applicable to all taxable years beginning after december 31, 2020. • in order to be subject to the tax a taxpayer must have $100,000,000 in global annual gross revenue and $1,000,000 of maryland annual gross revenue from digital advertising services in maryland. Maryland digital advertising gross revenues tax.

Maryland has now enacted the nation’s first gross receipts tax targeted on digital advertising. The maryland digital advertising tax, applied to gross revenue derived from digital advertising services, has a rate escalating from 2.5 percent to 10 percent of the advertising platform’s assessable base based on its annual gross revenues from all sources (i.e., not just digital advertising, and not just in maryland). The dat is currently scheduled to take effect on january 1, 2022, and will apply to persons with annual gross revenues of at least $100 million globally and at least $1 million of revenue derived from digital advertising services within maryland.

One Business Plan Four Different Ways Youtube Background Of Entrepreneurs In Sample Maxresde Business Intelligence Law Firm Marketing Writing A Business Plan

Httpfiles1coloribuscomfilesadsarchivepart_155115516405filecerveza-salta-rugbeer-image-1600-30105 Advertising Awards Presentation Board Concept Board

Pin By Starter Story Learn From Succ On How To Earn Money Online Successful Business Owner Smart Camera Success Business

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Digital Advertising Taxes - Eversheds Sutherland

Holding Company Website Design Holding Service Website Design Corporate Website Design Website Design Services

Pin On Html Website Templates 2021

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Digital Marketing With Seo Digital Marketing Seo Seo Services

Vidnext - Movie Video Html Template In 2021 Html Templates Templates Website Template

How To Start A Digital Marketing Agency In India - 7 Step Guide Updated

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities - Salt Savvy

Microsoft Bing Updates Search Results Interface To Make It More Visually Immersive In 2021 Microsoft Seo Guide Seo

Pin On Blog

Maryland Enacts First-in-the-nation Digital Advertising Tax Pwc

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Things To Know About App Seo - Bloggers Path Search Engine Optimization Business Search Engine Optimization Search Engine Optimization Seo

Menuju Banjarmasin Smart City Finance How To Plan Commercial Property

Sales Tax On Digital Goods By State Tax Guide Sales Tax Tax