York county maine genealogy outdoor decor, decor, genealogy. Scott county board of supervisors re:

How And When To Apply For The Homestead Tax Credit In The Iowa City Area

You can reach a customer service representative by calling 317.346.4312 or email pburton@co.johnson.in.us.

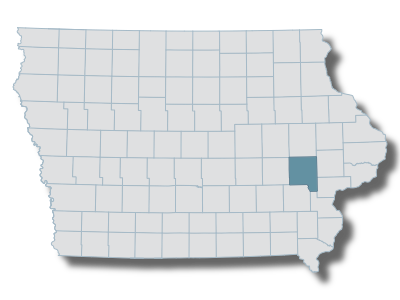

Iowa homestead tax credit johnson county. The office is open from 8:00 a.m. Iowa homestead tax credit scott county. The county’s average effective property tax rate of 1.79% is also higher than the state mark (1.53%).

The homestead credit is a property tax credit for residents of the state of iowa who own and occupy their homestead on july 1 and for at least six months of the calendar year. If you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessor’s site. 227 s 6th st, council bluffs, ia 51501.

This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the. Persons in the military or nursing homes who do not occupy the home are also eligible. With a population of around 172,000, scott county is one of the most populous counties in iowa.

Homestead tax credit | johnson county, iowa homestead tax credit | emily farber, realtor®. If your home is subject to the annual tax based on square footage, you may be eligible for a reduced square footage tax. Iowa homestead tax credit scott county.

An application form must have been received by july 1, 2020 to qualify for the 2020 credit. Your county treasurer has the details on the mobile/manufactured/modular home reduced tax rate program. The homestead tax credit is a small tax break for homeowners on their primary residence.if you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessor’s site.you’ll need to scroll down to find the link for the homestead tax credit application.

Have you applied for your homestead tax credit? We are closed all major holidays. Once accepted, the exemption is.

Iowa city ia 52240 • the homestead credit is available to all homeowners who own and occupy the residence. Must own and occupy the property as a homestead on july 1 of each year, declare residency in iowa for income tax purposes and occupy the property for at least six months each year. With a population of around 172,000, scott county is one of the most populous counties in iowa.

The local real estate marketplace. *if you owned another home prior to this, please notify us of the address so we can remove the credit. Claim the property as their primary residence (as opposed to a second home)

Attention homeowners in johnson county, iowa! Deadline for the 2021 credit is july 1, 2021. The homestead tax credit is a small tax break for homeowners on their primary residence.

To 4:30 p.m., monday through friday. You’ll need to scroll down to find the link for the homestead tax credit application. To serve you better, we have added the homestead and military applications to the muscatine area geographic information consortium (magic) website.

Originally adopted to encourage home ownership through property tax relief. The military tax credit is an exemption intended to provide tax relief to military veterans who (1) served on active duty and were honorably discharged or (2) members of reserve forces or iowa national guard who served at least 20 years qualify for this exemption. The current credit is equal to the actual tax levy on the first $4,850 of actual value.

Must own and occupy the property as a homestead on july 1 of each year, declare residency in iowa for income tax purposes and occupy the property for at least six months each year. Once you are on the beacon website and see that the property is in your name, scroll to the bottom and you will see the links for the applications to homestead tax credit application and military. The current credit is equal to the actual tax levy on the first $4,850 of actual value.

The veteran must apply with the local assessor. York county maine genealogy outdoor decor, decor, genealogy. To apply for either the military exemption or the homestead tax credit, all you need to do is print off the forms from the johnson county website and either mail or drop them off at the johnson county assessor's office, 913 s dubuque st, iowa city (before july 1st of course!)

As real estate, you may claim a credit on the property taxes due on the land where the home is located, if you own the land. Learn more opens in a new tab demo videos opens in a new tab register for webinars opens in a new tab 'like' us on facebook opens in a new tab Iowa city assessor 913 s.

Certain types of tax records are available to the general public. Occupy the residence for at least six months of the year. Dubuque street iowa city, ia 52240 voice:

Scott county board of supervisors re: Please click the following link for the instructions and form. • it is a onetime only sign up as long as you occupy the home.

The business property tax credit is available to eligible commercial and industrial properties. This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the. Johnson county assessor 913 s dubuque st.

To submit your homestead and/or mortgage deduction online visit: The homestead tax credit is a small tax break for homeowners on their primary residence.if you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessor’s site.you’ll need to scroll down to find the link for the homestead tax credit application. In the state of iowa, homestead credit is generally based on the first $4,850 of the home’s net taxable value, and to qualify for the credit, homeowners must:

Brad comer, assessor marty burkle, chief deputy assessor mary paustian, deputy assessor

Iowa City

Property Tax Credit July 1 Deadline Approaching The Gazette

Blog Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Iowa Property Tax Calculator - Smartasset

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Emily Farber Realtor

Johnson County Board To Discuss Residents Taxes On A Tower That Was Never Built The Gazette

Iowa Homestead Tax Credit - Morse Real Estate Iowa And Nebraska Real Estate

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit - Youtube

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit - Youtube

Johnson County Treasurer Iowa Tax And Tags

Johnson County Treasurer Iowa Tax And Tags

Claiming Your Homestead Credit Bankers Trust Education Center

Calculating Property Taxes Iowa Tax And Tags

Iowa Property Tax Calculator - Smartasset

Military Veteran Families Worklife Resources

Iowa Homestead Tax Credit - Morse Real Estate Iowa And Nebraska Real Estate

Johnsoncountyiowagov

List Of Johnson County Services And How To Reach Them Remotely Kgan

Jackson County Assessor Office Application For Homestead Tax Credit