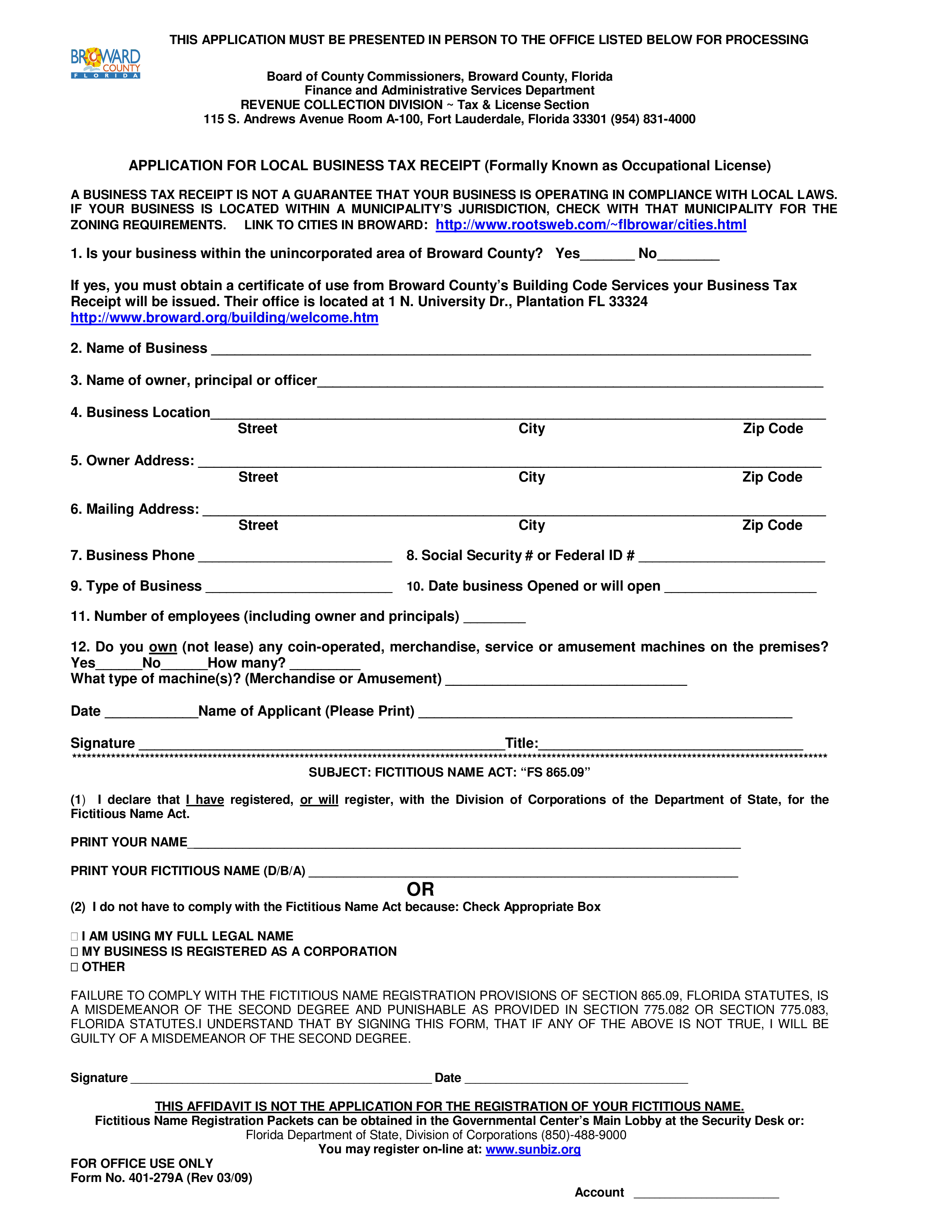

Applying for your local business tax receipt is easy. 1 hours ago the firm must be independent;

Contractors Know The Law

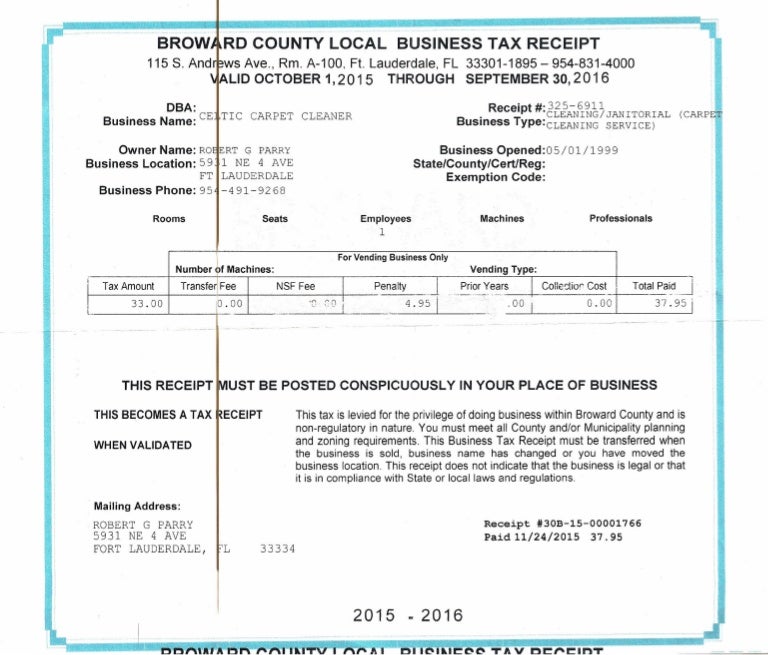

The vendor must have a broward business tax receipt, and be located in and doing business in broward county.

Broward business tax receipt search. A broward county business license search allows the public to look up public business licenses in broward county, florida. If you do not renew your county’s business tax receipt by september 30, it becomes delinquent october 1, and you will be assessed a penalty if you attempt to renew for the following year. A local business tax receipt is required for each location you operate your business from, and one for each category of business you conduct.

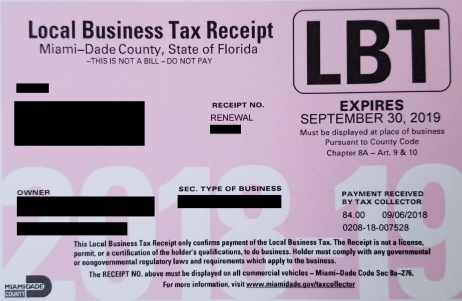

The local business tax (formerly known as occupational license) is required of any individual or entity any business, or profession in broward county, unless specifically exempted. When you pay a local business tax, you receive a. Business license records are kept by federal, florida state, broward county, and local government offices.

Orlando business owners also need an orange county business tax receipt. The vendor must have a broward business tax receipt, and be located in and doing business in broward county.each owner must not. When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30.

The orlando business tax receipt, called a business tax and certificate of use, costs about $20 and must be renewed annually. Palm beach county tax collector attn: If your business is located within an incorporated municipality (city limits), a city business tax receipt must be procured before a brevard county business tax receipt can be issued.

Broward county business tax receipt search. 9 hours ago taxes and fees local business taxes broward county. The search results may not be a complete listing of the permits required for your project.

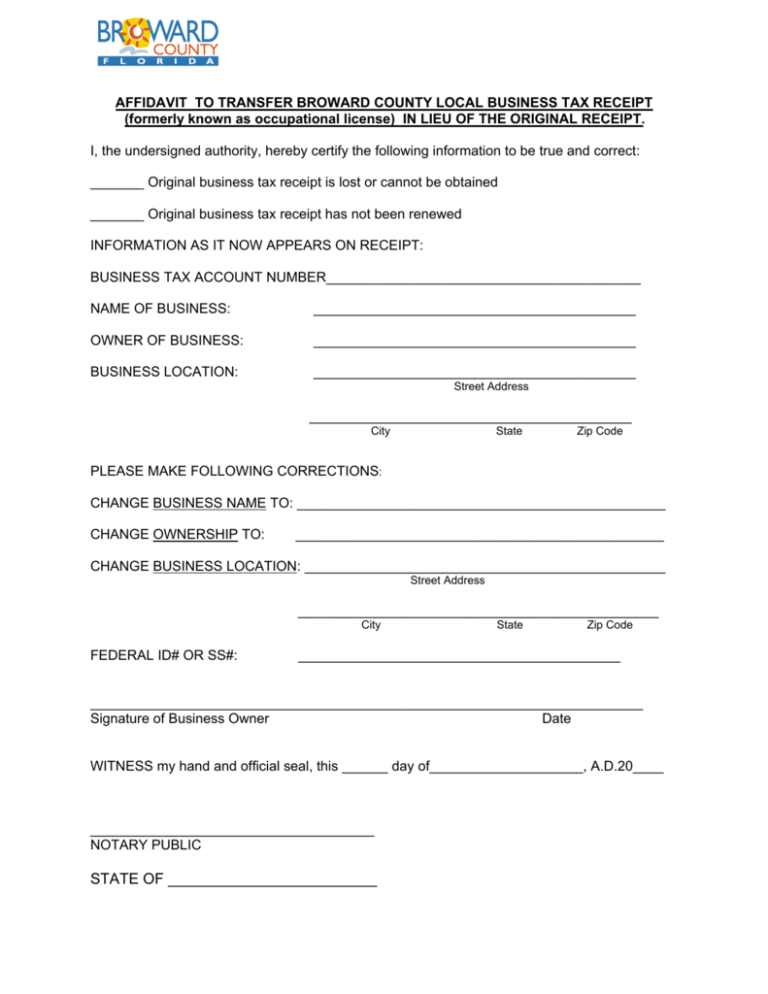

The firm must have a continuing operating presence in broward county for at least one year prior to submitting an application. Local business tax receipt broward county. Return completed form to our office:

Small business — useful for existing or new businesses. Records, taxes and treasury division currently selected. Each owner must not have a personal net worth exceeding $1,320,000.

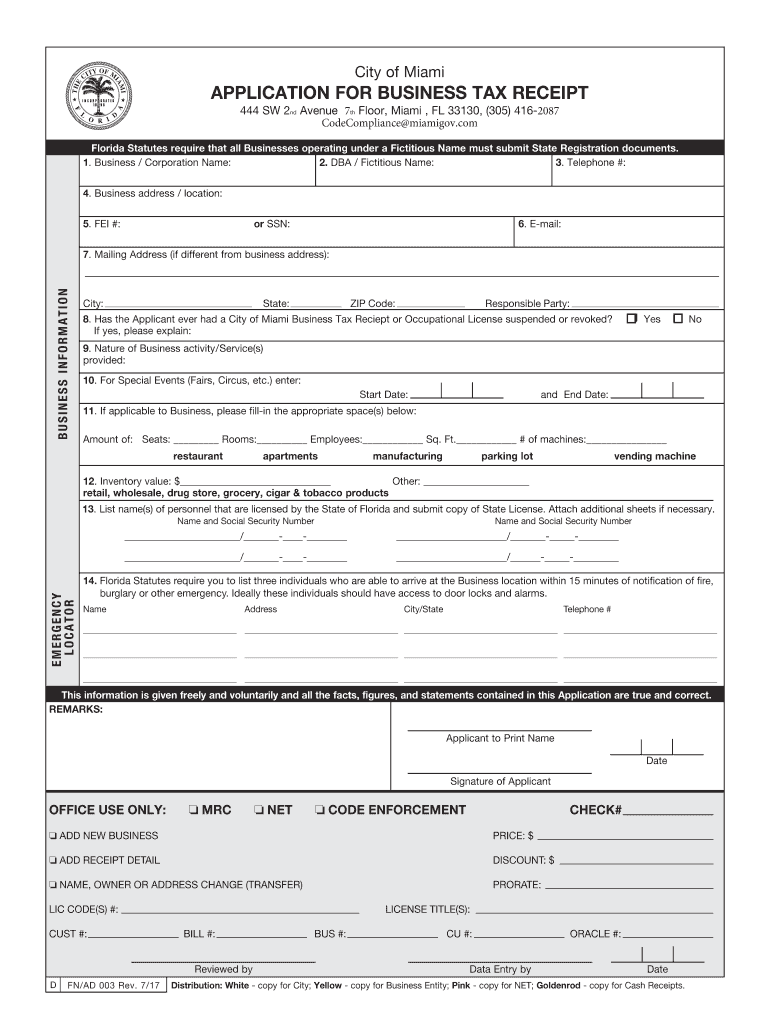

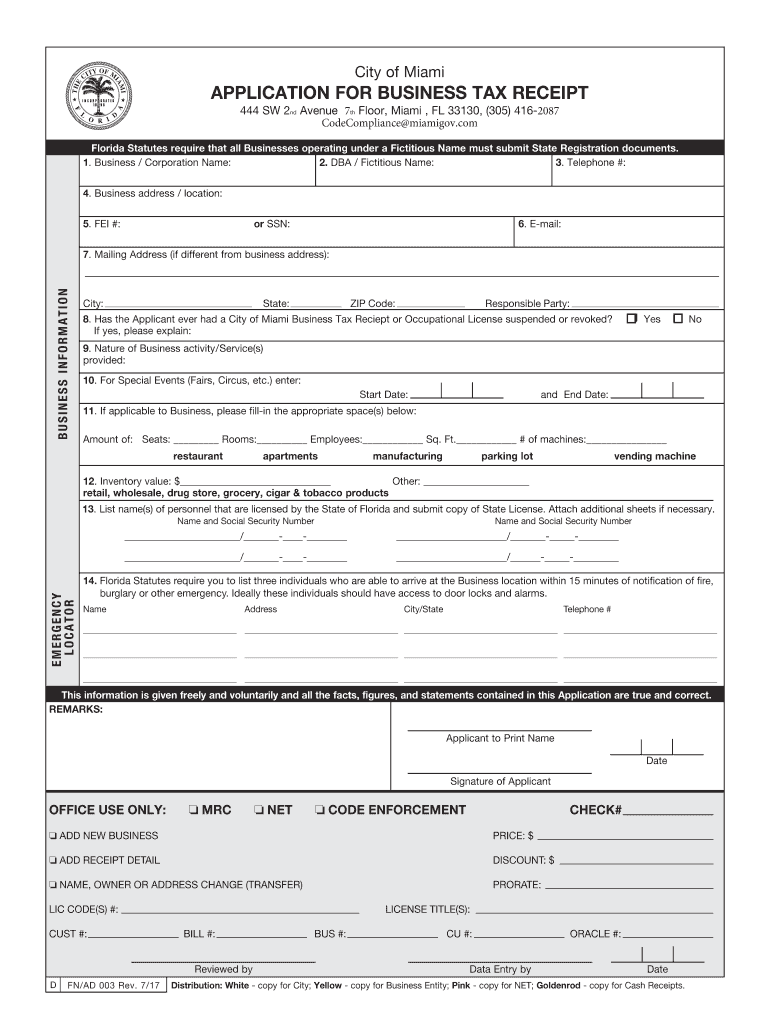

4 hours ago the local business tax (formerly known as occupational license) is required of any individual or entity any business, or profession in broward county, unless specifically. Application for local business tax receipt. Categories include permits that small businesses often seek on their own.

Some permit applications are required to be submitted by a licensed contractor or design professional. If you do not receive your renewal notice, you should contact. Complete the application for local business tax receipt 2.

2021 property tax bill brochure (pdf 220 kb) 2021 taxing authorities phone list (pdf 72 kb) frequently asked. Business licenses include information about the type of business, ownership, and contact information.

Permit Source Information Blog

2017-2021 Form Fl Fnad 003 - Miami Fill Online Printable Fillable Blank - Pdffiller

Licenseandinsurance

Affidavit To Transfer Broward County Local Business Tax Receipt

Redirect - Taxsys - Broward County Records Taxes Treasury Div

Business Tax Search - Taxsys - Broward County Records Taxes Treasury Div

Contractors Know The Law

How To Check For Broward County Business License Ictsdorg

Listing Suspension - Google Business Profile Community

Contractors Know The Law

Economic And Small Business Development Surtax

Miami Dade County Local Business Tax Receipt 305-300-0364

Oakland Park Area - Broward County Local Business Tax Receipt 305-300-0364

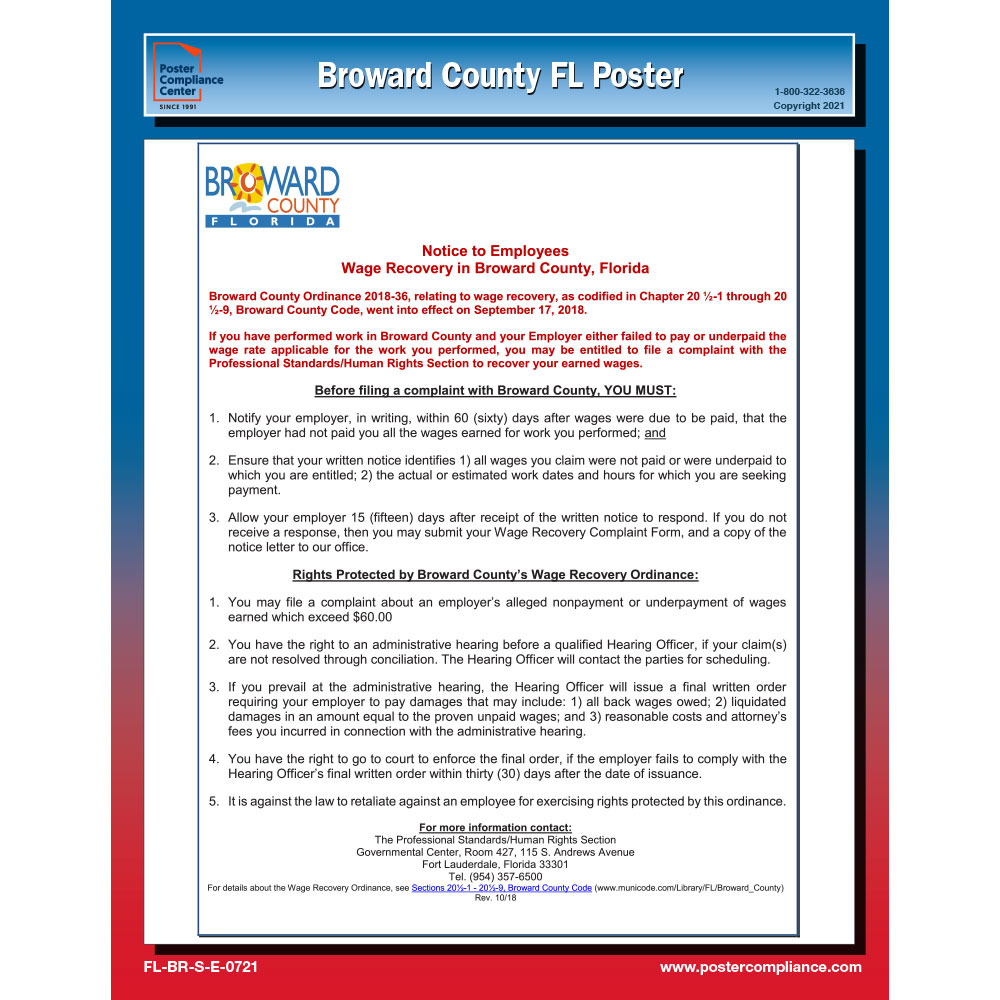

Broward County Labor Law Poster Poster Compliance Center

About Novodom

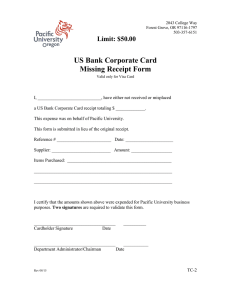

Original Receipts Not Available Traveler Employee Id

Fortlauderdalegov

Gratis Application For Local Business Tax Receipt

Browardorg