How do i fix my return? He said glitches and mistypes happen and someone probably typed my ssn by mistake, so just paper file it.

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdkcom

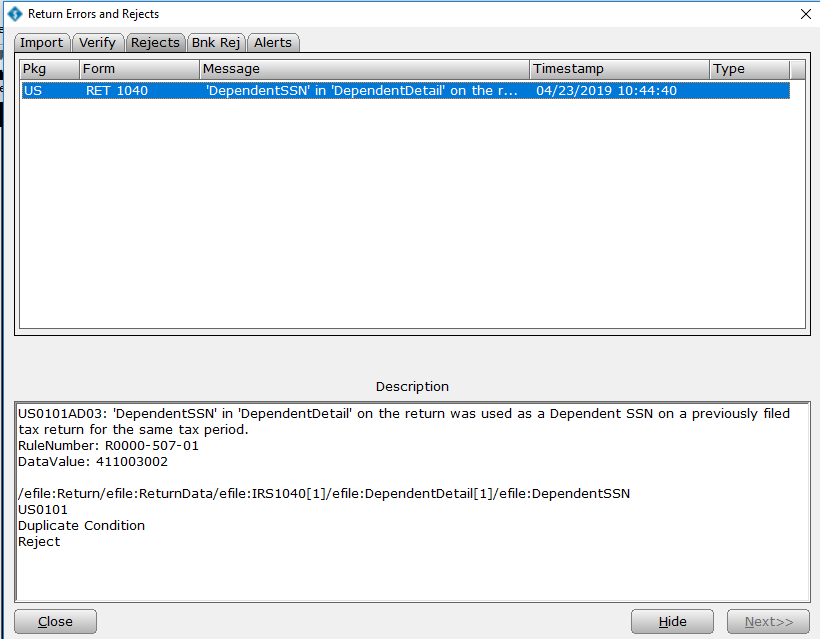

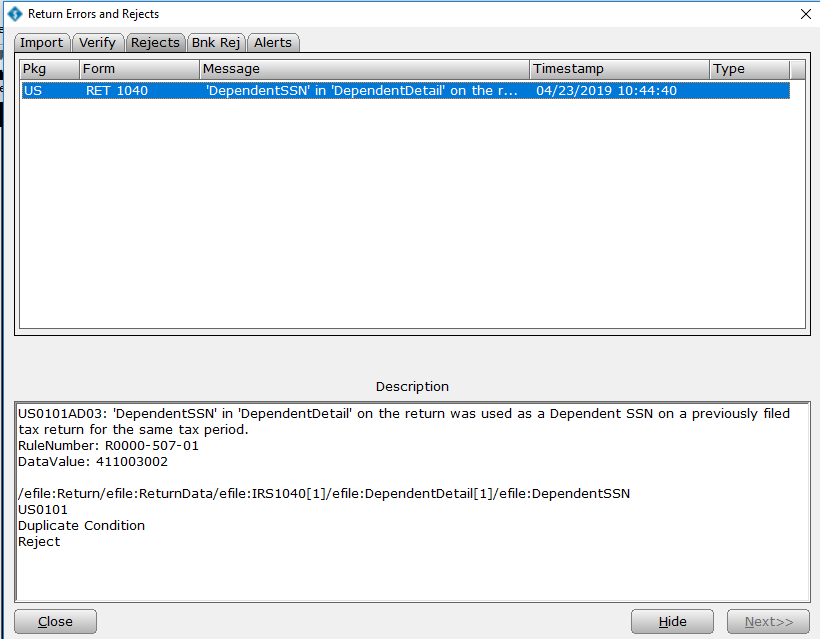

The reject code is sent when the irs has already accepted a tax return with the social security number (ssn) that has been seen as your dependent.

Irs rejected return ssn already used. Ssn has been used on a previously accepted return. What is the procedure for aleck to have the irs put an indicator on his tax records for questionable activity. Only one return with the same ssn will be accepted.

The irs will, in some cases, contact taxpayers using the same ssn to claim a benefit and ask them to reconsider their eligibility or to provide supporting. In most cases, the taxpayer's social security number (ssn) was entered incorrectly. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependent's ssn, the irs has security measures in place to ensure the accuracy of returns submitted.

This means that the return is being rejected as a duplicate return. Client has legal custody of grandchild. Most common rejection reason for a tax return is erroneous social security number (ssn) or taxpayer identification number doesn’t match the taxpayer’s name or you misspelled a name or the payer’s identification number, such as your employer’s employer identification number, isn’t correct.

The social security number or itin was entered incorrectly. My federal electronic tax return was rejected by the irs because my social security no. When you receive a message saying that your tax return was rejected because an ssn has already been used, a few things might have gone wrong.

The irs will, in some cases, contact taxpayers using the same ssn to claim a benefit and ask them to reconsider their eligibility or to provide supporting. If someone uses your ssn to fraudulently file a tax return and claim a refund, your tax return could get rejected because your ssn was already used to file a return. There are several possible scenarios for receiving this code:

This is an internal error code. We use cookies to give you the best possible experience on our website. Publication 5199, tax preparer guide to identity theft.

If you find that someone's social security number on the tax return was used and you have the legal right to claim the person listed then you would need to print and mail in your returns. Use a fillable form at irs.gov, print, then attach the form to your return and mail according to instructions. The irs is stating they have already received and accepted a federal return for the current tax year with the primary taxpayer's ssn.

Don’t let panic get the best of you. This means that your social security number has already been used on a return. I called the irs and the guy didn’t seem to give a crap and just said to paper file it.

This will happen every year. If someone uses your ssn to fraudulently file a tax return and claim a refund, your tax return could get rejected because your ssn was already used to file a return. The first thing to do in this situation is to make sure that your social security number and those of your spouse and dependents are correct.

Contact the irs identity protection specialized unit toll free at A tax return has already been filed with your social security number! Is there a way (a form) to inform.

Publication 5027, identity theft information for taxpayers. “your electronic filing was rejected by the irs” says an email in your inbox “your social security number (ssn) or the ssn of someone listed on your tax return has been used on. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependent's ssn, the irs has security measures in place to ensure the accuracy of returns submitted.

When this happens, you’ll need to print your tax return and file it with form 14039, identity theft affidavi t. Report the identity theft to the federal trade commission at www.identitytheft.gov. Efile rejected due to dependent ssn already used.

In this scenario, you need to contact the irs and the social. I know i have not filed previously this year. Aleck income tax return was rejected, irs reject codes indicated his ssn had already been used.

There’s a sinking feeling in your gut and an enveloping sense of dread. Primary ssn was used as a primary ssn more than once. You may want to review the irs’s guide to identity theft , which includes recommended procedures and warning signs of identity theft and monitor your credit report(s) going forward to ensure that the thieves don’t open any new accounts in your name.

Complete irs form 14039, identity theft affidavit, if your efiled return rejects because of a duplicate filing under your ssn or you are instructed to do so. Irs rejection codes for returns.

Are Irs Security Tools Blocking Millions Of People From Filing Electronically

Tax Return Rejected Ssn Already Used - Internal Revenue Code Simplified

What To Do When Your Tax Return Is Rejected Credit Karma Tax

2

Irs Tax Pross Tweet - Taxpros Should Watch Out For Client E-filed Returns Rejected By Irs Because The Clients Ssn Was Already Used On Another Return This Is A Common Sign Of

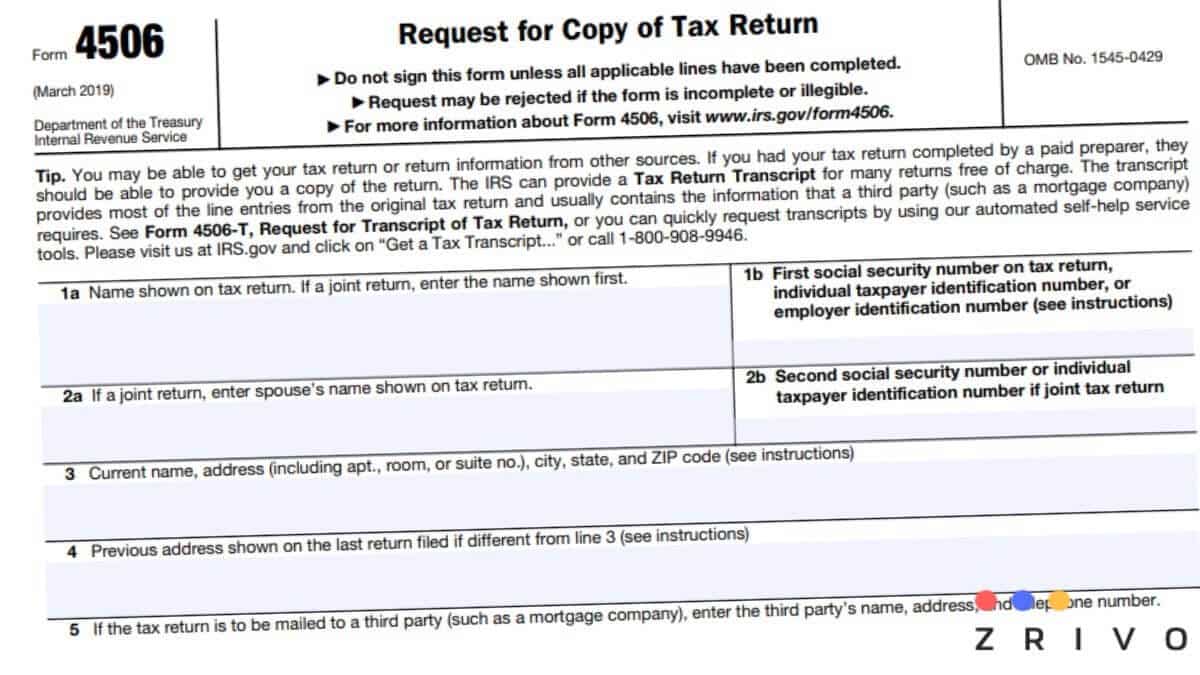

4506 Form 2021 - Irs Forms - Zrivo

Common Irs Wheres My Refund Questions And Errors 2022 Update

What To Do If Your Federal Return Is Rejected Due To A Duplicate Ssn

Beware The Ides Of February Your Identity Has Been Stolen David Boles Blogs

Ssn Already Used By Someone Else On A Tax Return - Crossborder Planner

Top Reasons Irs Rejects The Hvut Form 2290 By Heavy Vehicle Tax Trucktax Medium

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

Childs Stolen Social Security Number Creates Tax Nightmare Wthrcom

Solved Re Why Was My Stimulus Package Registration Via D

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name - Dont Mess With Taxes

Rejected Tax Return Common Reasons And How To Fix

Is Your Tax Return Rejected Follow These Steps To Correct It

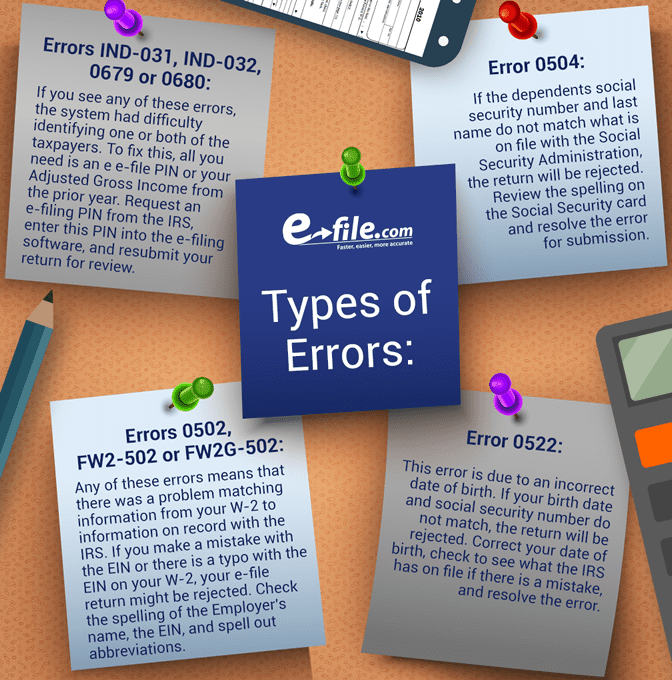

How To Correct An E-file Rejection E-filecom

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support