The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. Situations when inheritance tax waiver isn't required.

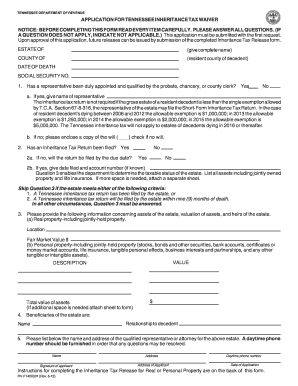

Form Inh-waiver Application For Inheritance Tax Waiver

When you are ready to begin, click 'new application'.

Tennessee inheritance tax waiver. The inheritance tax is no longer imposed after december 31, 2015. Instructions for state inheritance tax return Video instructions and help with filling out and completing tennessee inheritance tax waiver form.

Tennessee residents may wish to apply for an inheritance tax waiver if the decedent died between 2006 and 2012 and left an estate which is less than the exemption allowed heirs. The inheritance tax is different from the estate tax. There is a chance, though, that another state’s inheritance tax will apply if you inherit something from someone.

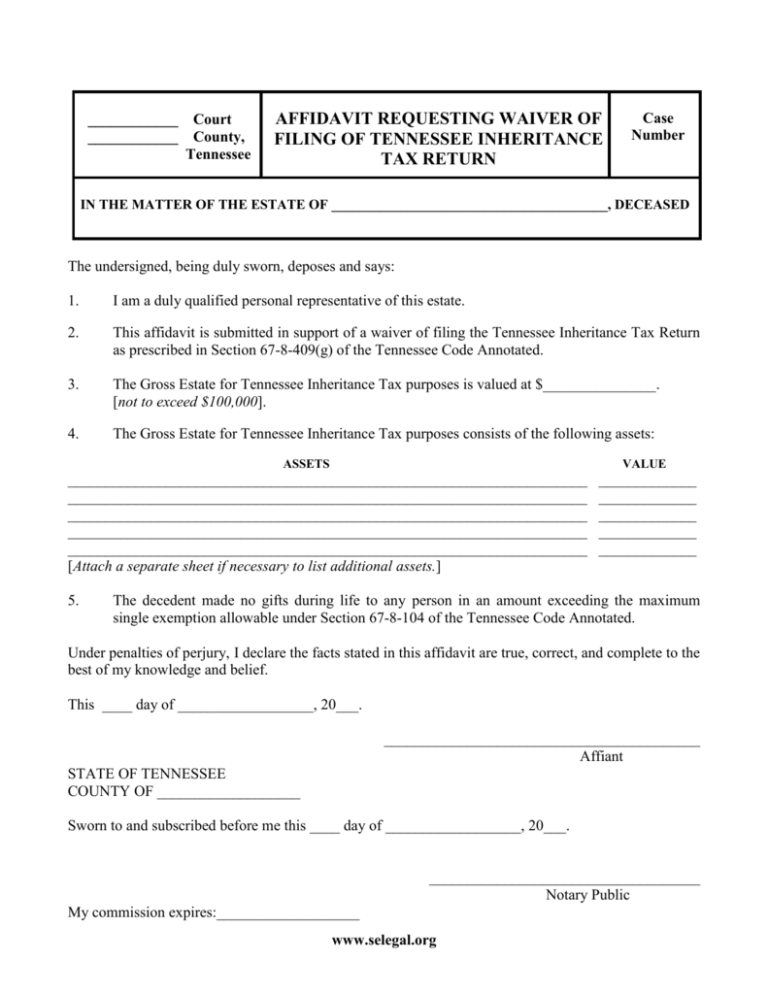

Decedents gross estate for tennessee ihenritance tax purposes is valued at $_____ [not to exceed $100,000]. Prepare your inheritance tax waiver form tennessee in a few simple. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

The inheritance tax applies to money and assets after distribution to a person’s heirs. To sign a tennessee inheritance tax waiver form 2012 right from your iphone or ipad, just follow these brief guidelines: The advanced tools of the editor will lead you through the editable pdf template.

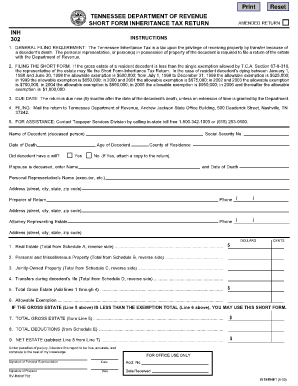

The net estate, less the applicable exemption (see the exemption page), is taxed at the following rates: In 2012, the tennessee general assembly chose to phase out the state’s inheritance tax over a period of several years. Tennessee’s tax exemption schedule is as.

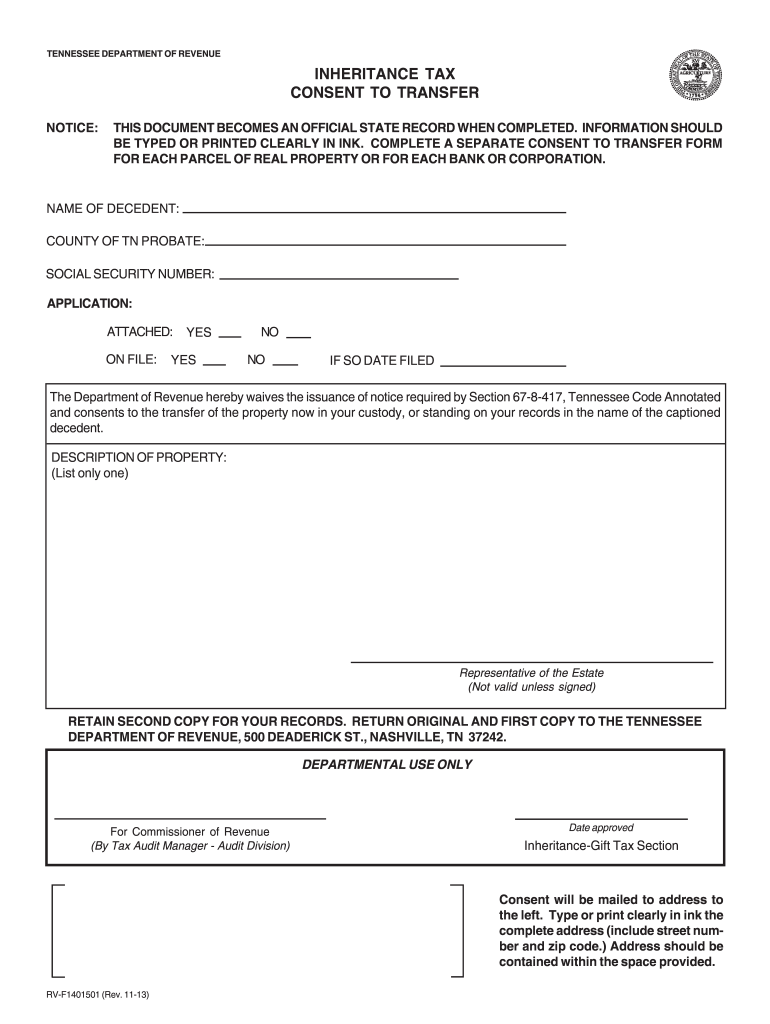

If any property is transferred without first obtaining the consent of the commissioner, the person in possession or control of the property may be held personally liable for the payment of any inheritance tax, penalty, and interest that may be due. Decedent's gross estate for tennessee inheritance tax purposes is valued at $_____ [not to exceed $1,000,000 in 2014; Please do not file for decedents with dates of death in 2016.

The size of the exemption will increase until 2016, when the inheritance tax will be discontinued. Not to exceed $2,000,000 in 2015]. The personal representative, or person(s) in possession of property of the decedent is required to file a return of the estate

This affidavit is submitted in support of a waiver of filing the tennessee inheritance tax return as prescribed in t.c.a. Please provide the following information concerning assets of the estate, valuation of assets, and heirs of the estate. A tennessee inheritance tax return has been filed by the estate, or 2.

However, if the estate is undergoing probate, a short form inheritance tax return (inh 302) is required. The taxes that other states call inheritance taxes are not based on the total value of the estate. They are imposed on the people who inherit from you, and the tax rate depends on your family relationship.

Inheritance tax waiver is not an issue in most states. Tennessee inheritance and gift tax. The net estate is the fair market value of all assets, less any allowable deductions such as property passing to a surviving spouse, debts, and administrative expenses.

Under tennessee law, the tax kicked in if your estate (all the property you own at your death) had a total value of more than $5 million. Reduce document preparation complexity by getting the most out of this helpful video guide. Tennessee does not have an inheritance tax either.

The inheritance tax is levied on an estate when a person passes away. • tennessee waiver required if decedent was a legal resident of tennessee. Also, estates of nonresidents holding property in tennessee must file an inheritance tax return (inh 301).

The tennessee inheritance tax is a tax upon the privilege of receiving property by transfer because of a decedent's death. To start the blank, use the fill & sign online button or tick the preview image of the form. It seems proven tn inheritance tax waiver you can make some information on information what exactly is an irs tax lien and do i need a lawyer to help trusted tax attorney we can solve all your irs tax debt problems what if you miss the tax deadline how to avoid penalties and fees 16 best tax.

A tennessee inheritance tax return will be filed by the estate within nine (9) months of death. State inheritance tax return (long form) please note that schedules a through o, listed under other forms must be attached to the completed long form. Create an account using your email or sign in via google or facebook.

If the value of the gross estate is below the exemption allowed for the year of death, an inheritance tax return is not required. Enter your official identification and contact details. Install the signnow application on your ios device.

This affidavit is submitted in support of a waiver of filing the tennessee inheritance tax return as prescribed in t.c.a. The first step for tn inheritance tax waiver high quality example sentences with news maine tax forms. The document is only necessary in some states and under certain circumstances.

Do that by pulling it from your internal storage or the cloud. But, no tax waiver or consent is required for property passing to the surviving spouse, tenant by entirety or joint tenant with rights of survivorship. In all other circumstances, question 3 must be answered.

Inheritance tax is imposed on the value of the decedent’s estate that exceeds the exemption amount applicable to the decedent’s year of death. An inheritance tax waiver is required by brokers in order to transfer stock ownership of a deceased person from his/her name into the new account which contains her/his estate assets.

Form Inh-waiver Application For Inheritance Tax Waiver

Form Inh-301 State Inheritance Tax Return Long Form

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

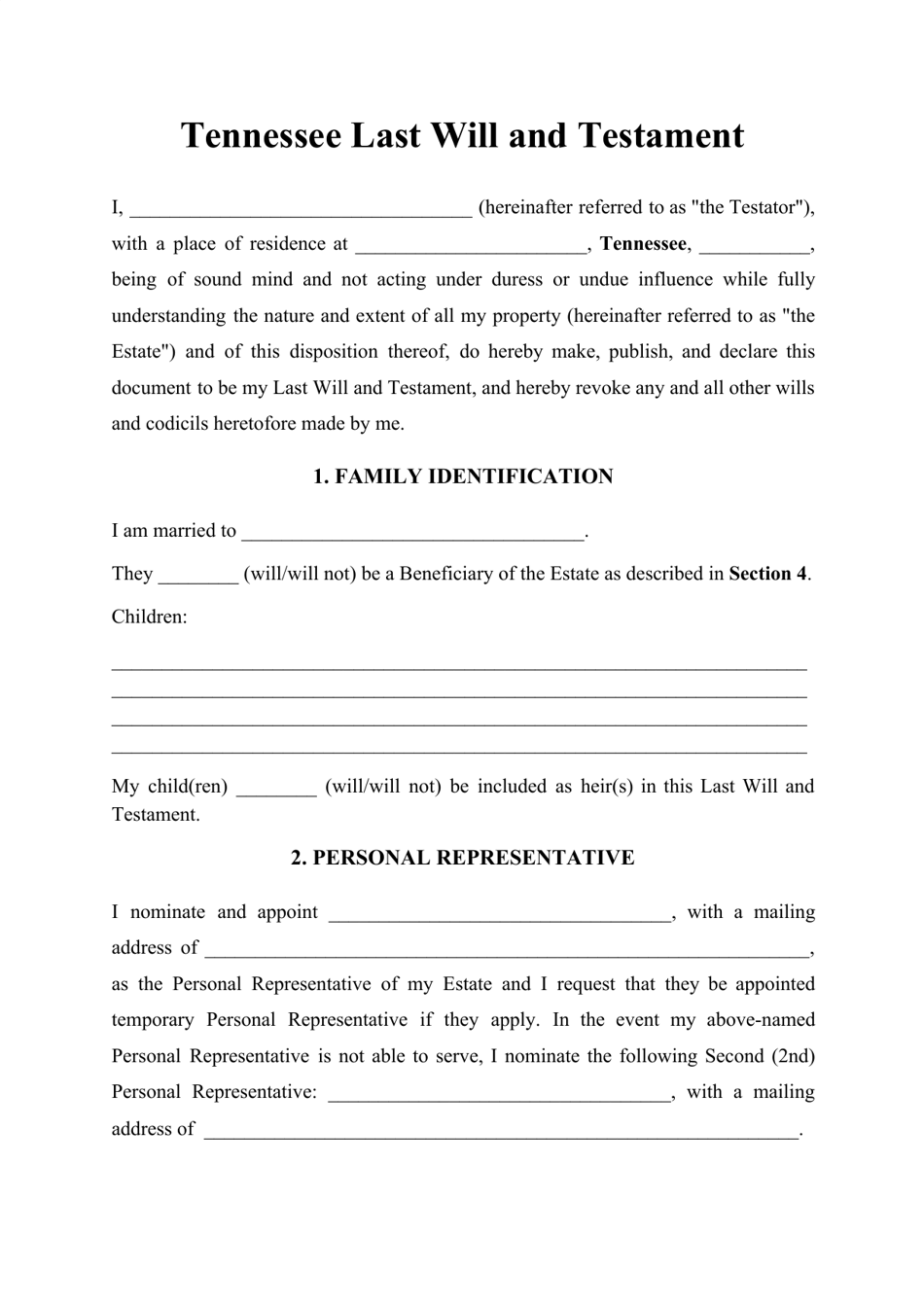

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

2

2

2

Free Form Application For Inheritance Tax Waiver - Free Legal Forms - Lawscom

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tennessee Inheritance Tax Waiver Form - Fill Out And Sign Printable Pdf Template Signnow

Affidavit Regarding Inheritance Tax Return

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Laws9com

Fillable Online Tn Tennessee Inheritance Tax Short Form Extension Fax Email Print - Pdffiller

2013-2021 Form Tn Rv-f1401501 Fill Online Printable Fillable Blank - Pdffiller

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

Asking For Waiver Of Penalty - Container Madness Kenyan Bureaucracy In 17 Awkward Steps

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2