With all the related interpretations and cases. Cpas have some similarities to tax attorneys in that they both provide tax services to their clients, but there are many key differences that set them apart.

New York Tax Attorney Tax Attorney New York Tenenbaum Law

A professional with this designation typically makes between $15,000 and $20,000 more than cpas annually.

Tax attorney vs cpa reddit. Perhaps summed up best by brad huntington, a multimillionaire business strategist, when trying to decide whether to consult with your attorney or your cpa, ask yourself the following three questions: Ad study the cpa program with the level of support you need to succeed. Using a tax attorney for help with certain tax issues has it’s benefits.

I did an undergraduate degree in accounting, with the intention of getting a law degree after a couple years of work experience, but i've been in accounting for 8 years and am not looking back. A professional with this designation typically makes $15,000 to $20,000 more than cpas annually. I suppose the benefit of being a cpa and not attorney is that you graduate sooner and don't spend all that money on tuition.

An ea is the highest credential the irs awards. I had always been filing my taxes for free while i was a student using h&r block. The purpose of this blog is to explain what tax attorneys and cpas do while also detailing the distinctions between the two.

The ceiling for cpa is much lower and compensation reflects that. Get a free consultation today & gain peace of mind. One of the biggest differences is that a cpa is a better fit in the event that the tax situation is more complicated.

Students in tax at the graduate level going for an mtax are often sitting side by side with llm and jd students briefing the same cases. Every tax problem has a solution. Study the cpa program with the level of support you need to succeed.

They pay depends on the individual. The ceiling for cpa is much lower and compensation reflects that. I think there are two important questions you need to answer:

While both cpas and tax attorneys can represent your best interests in communications with the irs, a tax attorney is generally the better choice if you're involved in trouble with tax authorities, such as owing thousands in back taxes or facing liens and levies. Tax attorneys and cpas often occupy the same space, but there are several key differences between the two professions. A tax attorney who plans during college can easily become a cpa as well.

Hello alli am currently studying for the cpa exam and i had to put my study on hold to study for the lsat. Understanding those distinctions will help you plan your finances, submit your taxes, improve your tax. Tax attorney vs cpa reddit :

A cpa lawyer is simply someone who is both a cpa and a lawyer. A tax attorney is a. Every tax problem has a solution.

Here's what you need to know about getting a tax appraisal. Ad professional tax relief attorney & cpa helping to resolve complex tax issues. Certified public accountants (cpas) know the tax code and can help you maximize your tax savings, among other things.

Additionally, eas can also provide tax advice, tax return filing and more. Ad professional tax relief attorney & cpa helping to resolve complex tax issues. Last year, i was set to get a $300 return according to h&r block, but i used a cpa my family uses and received almost $2,000.

The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument. Study the cpa program with the level of support you need to succeed. I know tax lawyers who make under six figures and some that make much much more.

That’s a long 5 years filled with busy seasons and lots of stress. Now you should better understand the key differences between a tax attorney vs cpa. He's kind of living the life right now.

It is title 26 of united states code. While both cpas and tax attorneys can represent your best interests in communications with the irs, a tax attorney is generally the better choice if you’re involved in trouble with tax authorities, such as owing thousands in back taxes or facing liens and levies. They both offer helpful tax services for your business, but a tax attorney wields greater power when dealing with serious tax issues.

The lesson here is clear. Ad study the cpa program with the level of support you need to succeed. Following that year, i studied for and passed the cpa exam.

Get a free consultation today & gain peace of mind. Study the cpa program with the level of support you need to succeed. Honestly, tax lawyer is an entirely different path from a cpa.

It is best to use a tax attorney when there is either a large sum of money involved, the irs is accusing you of criminal tax fraud or you are heading to court. Might not be very relevant as i work in the uk but i'm dual accountancy and solicitor qualified (plus the cta, don't recommend heh!) so just my 2c. Tax attorneys can help with many complex tax issues just like a cpa or an enrolled agent can provide tax relief.

Tax code, and who uses that knowledge to help. Cpa vs tax attorney reddit. A big reason everyones voting for cpa is because a tier 2 jd is mediocre and a tier 3 mba.

Why You Need A Small Business Tax Attorney Silver Tax Group

Im A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irss Crosshairs Ama Rcryptocurrency

Why You Need A Small Business Tax Attorney Silver Tax Group

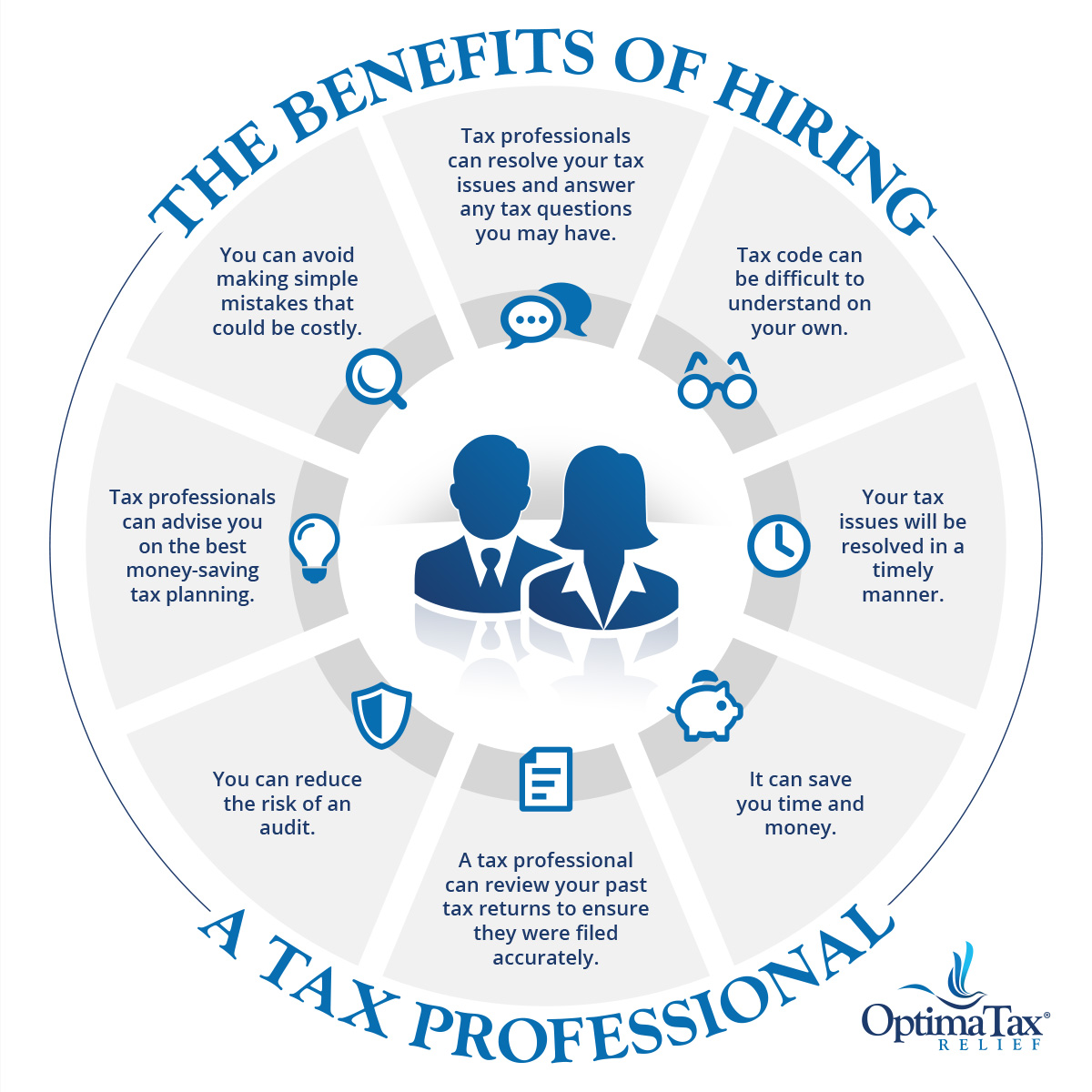

Hiring A Tax Professional - Your Complete Guide Optima Tax Relief

What Can A Tax Attorney Do For You Hchgchamber

Cannabis Businesses Accounting Tax Consulting In New England

What Do I Need To Know Before I Hire A Bankruptcy Attorney Bankruptcy Attorney Atlanta Debt Relief Debt Relief Programs Bankruptcy

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Five Steps To A Successful Business Turnaround Success Business Cryptocurrency Crypto Coin

When Do You Need A Tax Attorney Los Angeles Tax Attorneys

International Tax Lawyers Manhattan New York Tax Lawyer Tax Accountant Accounting Firms

8 Reasons Why You Should Hire A Tax Attorney - Silver Tax Group

Im A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irss Crosshairs Ama Rcryptocurrency

Tax 101 Accounting Humor Law School Humor Accounting

When To Hire A Tax Attorney Luis Anssif

Top Rated Tax Resolution Firm Tax Help Polston Tax

New York Tax Attorney Tax Attorney New York Tenenbaum Law

Why You Need A Small Business Tax Attorney Silver Tax Group

Why You Need A Small Business Tax Attorney Silver Tax Group