In general, the dutch tax and customs administration (belastingdienst) distinguishes between driving a private or rental car, a company car or a lease car. You never own the car.

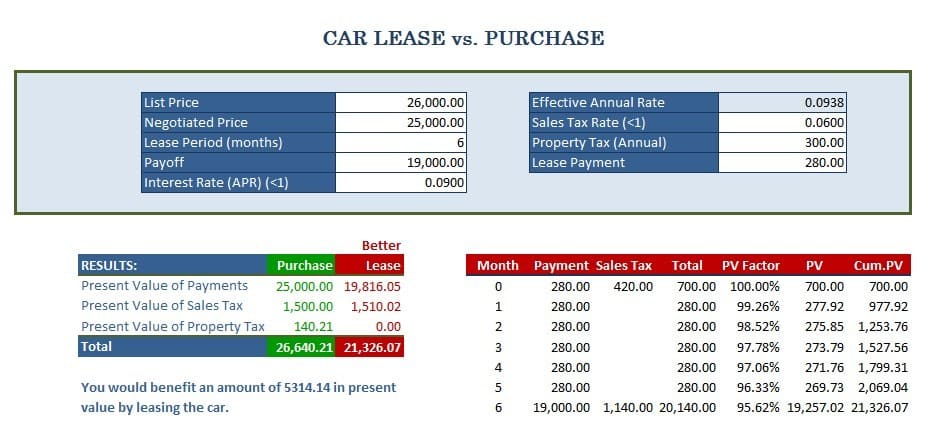

Car Lease Vs Purchase

No down payment car leasing provides the option of making no down.

Car lease tax benefit. When you lease a car through a personal contract hire (pch) agreement, the monthly price quoted will be inclusive of vat, which will be charged at 20% of the total cost of your agreement. If the car provided by the employer is solely used for personal reasons and if the expenditure is borne by the employer completely, the entire amount will be taxable. Leasing a vehicle could help you save as much as 30% on your taxes.

It depends on your career level. It’s referred to as the motor vehicle sales and lease tax. That means you must pay this additional amount with the agreement.

Here is a detailed analysis of tax benefits of leasing a car from your company vs. The tax liability on perquisite for reimbursement of fuel and driver expenses will be as below: Some states require you to pay an additional tax on a car lease.

The lease amount you pay for a vehicle is eligible for tax relief. If you pay sales tax on your car lease, you may be able to take a deduction for it on your federal income taxes. Deducting sales tax on a car lease.

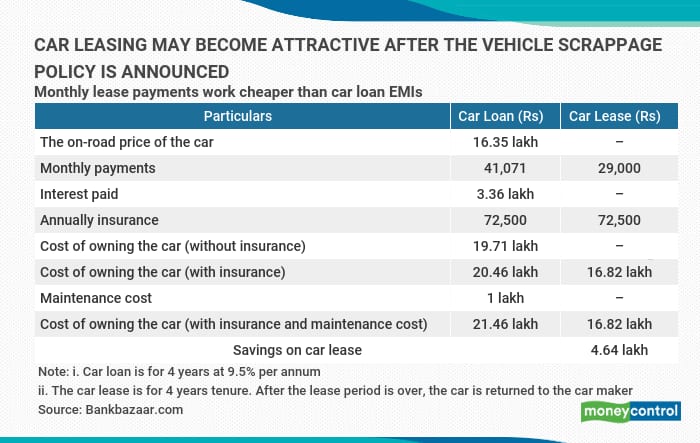

Benefits of leasing through a company include vat relief and cheaper car tax, although this depends on the vehicle itself and how it is used. Right now, you can use the bankbazaar website to lease a car from revv. In most occasions it won’t be necessary to make extensive repairs on a vehicle that is under lease since it can be returned or traded in.

You can deduct the business portion of your lease payments and other car expenses. In case the car is owned by employee and the expenses are reimbursed by the employer the perquisite value will be computed. Before entering into a car leasing arrangement (including novated leases) with an employee, it's important an employer or lessor understands the fringe benefits tax (fbt) implications.

You pay tax on the value to you of the company car, which depends on things like how much it would cost to buy and the type of fuel it uses. As such, you reduce your taxable income and retain a higher net salary. For example, leasing a vehicle through a vat registered company allows you to claim back 50 per cent of the vat on monthly payments and up to 100 per cent of the vat on the maintenance agreement.

Rcw 82.09.020(3) in washington state requires an additional tax of 0.3% on the sale or lease of all motor vehicles. On the other hand, business leasing allows you to claim back up to 50% of tax on the rentals and up to 100% on a maintenance package. No benefit can be availed by the employee in this regard.

Expenditure incurred by the employer (i.e. On the other hand, make sure you know the downsides of car leasing: Only 85% of the value of the car leasing costs qualify for tax relief.

An arm’s length dealing is where each party acts independently and without influence or control over the other. Value of the car that you can purchase will be 50% of your annual package. If the lease rental of the car is part of your salary package, it means the lease amount would be reduced from your salary before taxes are paid, thereby reducing your taxable income and giving you a considerable tax advantage as compared to someone who hasn’t.

Tax advantages of leasing a car for business there are a lot of reasons for leasing a car, whether it’s business leasing or personal contract hire. For example if your annual package is 20l, you can get the car worth 10l which initially will be on ac. Car lease options in your city.

When you own a car there is no tax benefit is available, but if you take car on lease from company and using for both official and personal purpose, you may avail following tax benefits; Hire charges, if car is on rent or normal wear and tear at 10% of actual cost of the car) plus salary of chauffeur if paid or payable by the employer minus amount recovered from the employee. And some of these benefits, like a car allowance, can help you reduce your tax liability significantly.

Generally, employees on higher tax brackets tend to benefit more from salary packaging as the savings are higher for every dollar that gets deducted under a novated lease. The tax advantages of leasing a car. This value of the car is reduced if:

The emi paid by your employer to the leasing company is deducted from your monthly salary resulting in reduction in your taxable income. It is advisable to maintain a logbook (especially when purchasing a luxury car) as the higher the business use, the lower the taxable value of the fringe benefit. But leasing may get you section 179 tax advantages section 179 of the internal revenue code allows you to fully deduct the cost of some newly purchased assets in the first year—but your company can also lease and still take full advantage of the section 179 deduction.

With a lease however, the payment is made by your employer to the financier before your salary is taxed. Car leasing policy is applicable if your career level is 9 and above. Driving your own car or a rental car you may offset €0.19 per kilometre against your revenue for.

Leasing a car can have tax benefits. If always driving a new car is important to you, you can lease another new car after this lease is up. The advantages range from the sheer thrill of driving a brand new car through to the reassurance of a low, regular monthly payment to help with budgeting, but there is one benefit that is often overlooked:

If car is used exclusively for the personal purposes of the employee or any member of his household.

Novated Leases And Fbt Explained

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Vehicle Scrappage Policy Leasing Is A Cheaper Option Than Buying A Car On Loan Now

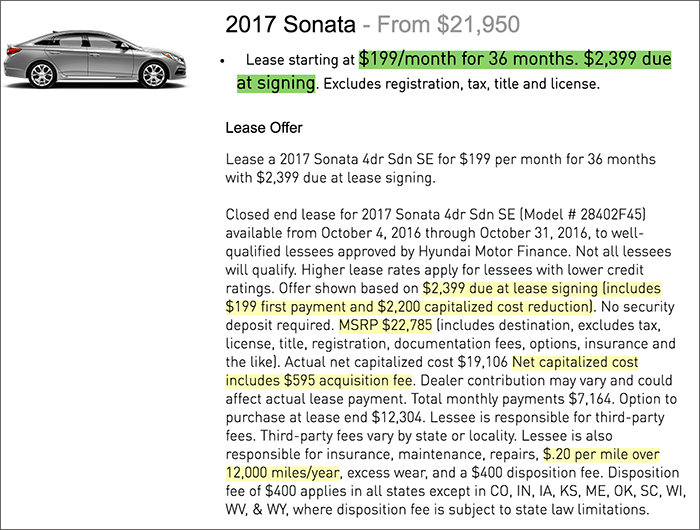

Quickly Figure Out If Your Lease Deal Is Good

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example - Quora

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Buy Or Lease A Car Moneysupermarket

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Is It Better To Buy Or Lease A Car Taxact Blog

What Are The Tax Benefits Of Leasing A Car For Business - Debtcom

Tax Implications Of Business Car Leasing Company Car Lease Tax

Is It Better To Buy Or Lease A Car Taxact Blog

How Does Leasing A Car Work - Earnest

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High-mileage Lease Right For Me

Is It Better To Buy Or Lease A Car Taxact Blog

Are Car Lease Payments Tax Deductible Lease Fetcher

Is It Better To Lease Or Buy A Car For A Business In Canada