Does colorado have an inheritance tax or estate tax? Until 2005, a tax credit was allowed for federal estate taxes, called the “state death tax credit.” 2 the colorado estate tax is equal to this credit.

Download Free Will Forms F5 Free Download Last Will And Testament Forms Last Will And Testament Will And Testament Estate Planning

This really depends on the individual circumstances.

Do you pay taxes on inheritance in colorado. An heir's inheritance will be subject to a state inheritance tax only if two conditions are met: If there are two names on a bank account and one dies, you may have to pay inheritance tax. Questions answered every 9 seconds.

Bypassing probate does not give you a free pass on taxes, however. There is no inheritance tax or estate tax in colorado. They may have related taxes to pay, for example if.

How much tax do you pay on inheritance? The federal government doesn’t charge inheritance tax, which means you don’t pay federal taxes on any money you inherit. 04 aug 2021 qc 66054.

If the inheritance tax rate is 10%, and you inherit $100, you pay $10 in inheritance tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. The terms inheritance tax and estate tax are sometimes used interchangeably on the state level, depending upon the wording of.

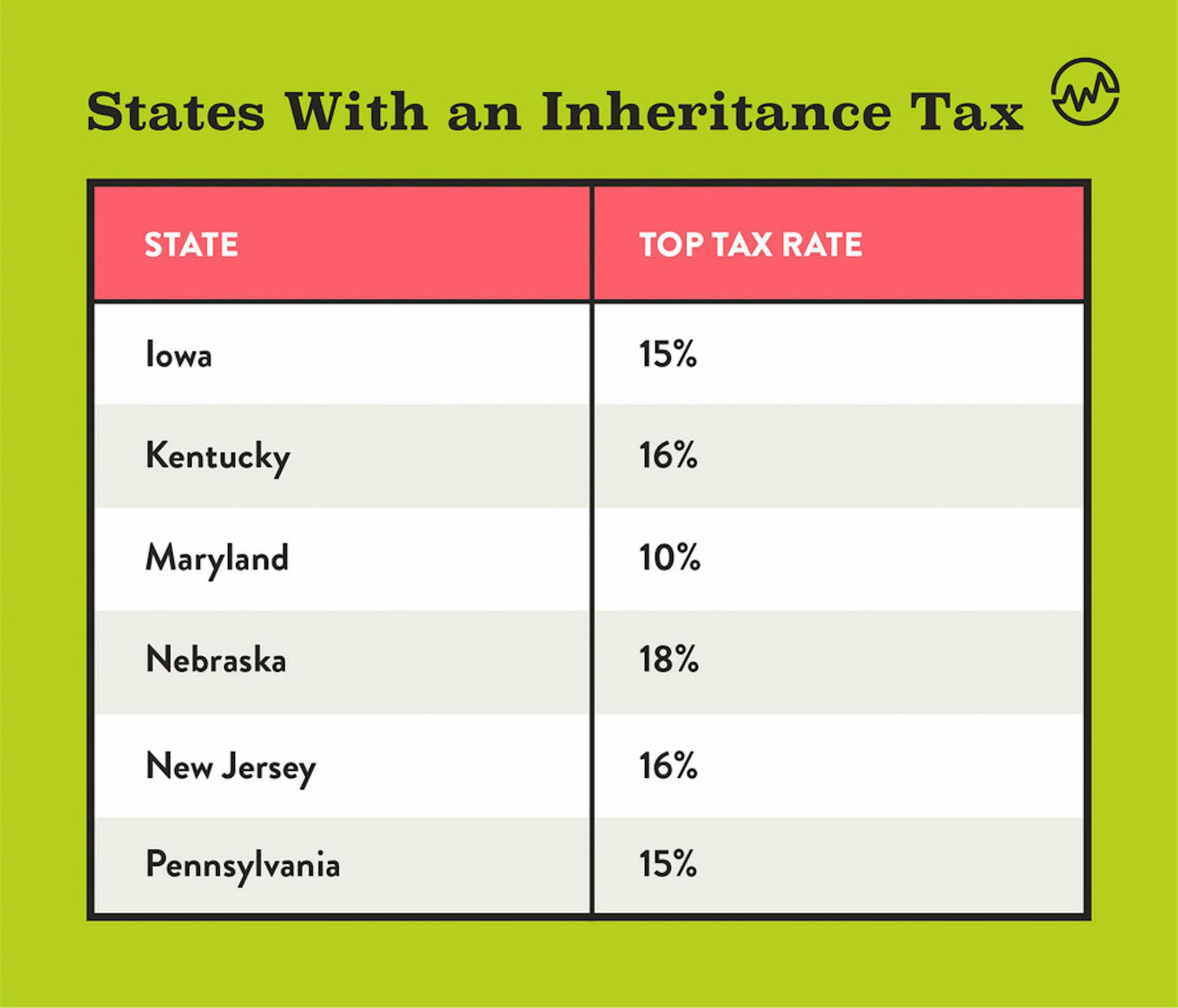

States with an inheritance tax. They do charge estate tax, but only if the estate is worth over $11.7 million. An inheritance tax is a state levy that americans pay when they inherit an asset from someone who’s died.

The good news is that since 1980 in colorado there is no inheritance tax, and there is no us inheritance tax, but there are other taxes that can reduce inheritance. Questions answered every 9 seconds. There is no inheritance tax in colorado.

Colorado also has no gift tax. As a matter of fact, you may have to file one or more of these returns: In 1980, the state legislature replaced the inheritance tax with an estate tax 1.

The first rule is simple: Each state differs in its tax rate and exemptions. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there, and the heir is in a class that isn't exempt from paying the tax.

In colorado, you’ll pay capital gains taxes at the same rate you pay on your general income. Some decedents leave instructions that their estates should pay any inheritance taxes due, in order to take the burden off the beneficiary. If you inherit a property and later sell or dispose of it, you may be exempt from capital gains tax (cgt).

But that there are still complicated tax matters you must handle once an individual passes away. When a person dies, the legal personal representative dealing with the deceased person's tax affairs have some important tax and superannuation issues to attend to. This is 4.63 percent, putting it on the lower end of.

Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. That's because federal law doesn't charge any inheritance taxes on the heir directly. An inheritance tax is levied only against a specific gift or bequest, and it's payable by the person who receives the asset, not the estate.

There are no colorado inheritance tax. A state inheritance tax was enacted in colorado in 1927. An inheritance tax is a state tax that you (the beneficiary) pay to the state on the proceeds you inherit once your parents’ estate is settled.

Colorado form 105, colorado fiduciary income tax return, is the colorado form for estate income taxes. Spouses in colorado inheritance law. Federal legislative changes reduced the state death.

Ad a tax advisor will answer you now! In kentucky, for instance, inheritance tax must be paid on any property in the state, even if the heir lives elsewhere. There’s no inheritance tax at the federal level, and how much you owe depends on your.

If the inheritance tax rate is 10%, and you inherit $100, you pay $10 in inheritance tax. The main difference between a state inheritance tax and an estate tax is that an inheritance tax is assessed against each beneficiary’s individual share of a decedent’s estate, whereas an estate tax is assessed against the whole estate. If you receive property in an inheritance, you won't owe any federal tax.

Your beneficiaries (the people who inherit your estate) do not normally pay tax on things they inherit. There are no inheritance or estate taxes in australia. Ad a tax advisor will answer you now!

If it is, the estate (not those who inherited), pays taxes on the amount exceeding the limit. Inheritance tax and inheritance tax rates are often misunderstood. Colorado inheritance tax and gift tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Use Your Learning Style To Be A Better Student Learning Style Good Student Learning

Compare Insurance Rates Online Life Insurance Infographic Infographicality Life Insurance Facts Life Insurance Quotes Variable Life Insurance

Trusts And Taxes Trusts And Inheritance Tax - Govuk Inheritance Tax Tax Inheritance

Why Billions Of Dollars In Estate Taxes Go Uncollected Estate Tax Tax Attorney Estate Planning

Why Billions Of Dollars In Estate Taxes Go Uncollected Estate Tax Tax Attorney Estate Planning

The Best Reasons To Buy Rental Property - Biggerinvestingcom Real Estate Investing Rental Property Rental Property Small Business Tax

A New Era In Death And Estate Taxes

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Do I Have To Pay Taxes When I Inherit Money

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

All About Life Insurance Infographic On Httpwwwbestinfographiccouk Life Insurance Facts Life Insurance Quotes Variable Life Insurance

Title Insurance Fort Myers Title Insurance Insurance Marketing Insurance Meme

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Beware Of These Important Red Flags In Home Inspections Fox Business Sell My House Buy My House We Buy Houses

You May Not Want To Hear How Much Money You Have To Make To Live In Northern California Map 30 Year Mortgage Northern California

Car Finance Including Insurance No Deposit Ten Things You Most Likely Didnt Know About Car Finance Including Insuranc Car Finance Finance Cheap Car Insurance

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die