A property tax levy is different from a tax lien as the lien is only a legal claim against your assets. Click on click here for the levy calculator, in red above the top blue line.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

A levy is a legal seizure of a taxpayer’s property to satisfy a tax debt.

Irs tax levy calculator. A calculator requires very few details to work. If you have a tax debt, the irs can issue a levy, which is a legal seizure of your property or assets.it is different from a lien — while a lien makes a claim to your assets as security for a tax debt, the levy takes your property (such as funds from a bank account, social security benefits, wages, your car, or your home). The consequences of a bank levy or wage garnishment can impact your credit score though, especially if you don’t have enough money to make your regular monthly payments (e.g., mortgage, student loan, and credit card payments).

How to calculate payroll with a levy from the irs. The irs exempts a certain amount of wages from withholding. When a levy is issued against a taxpayer —typically due to failure to collect on unpaid debt— the irs is legally allowed to seize assets including individual wages, bank accounts, social security benefits, retirement income, and personal property like cars, boats, and real estate.

A levy is the irs's way of getting your immediate attention. Enter mils for new levy. People with more complex tax situations should use the instructions in publication 505, tax withholding and estimated tax.

Levies can really do a lot of damage and even ruin your life. The president’s official 2016 fiscal year budget boasted that the federal government had collected $56 million from wage garnishments alone in. With an irs levy, the government actually takes your assets, which may include rental income, retirement funds, wages, bank accounts, cars, and home, if you failed to pay off your tax debt.

The irs can use a levy to satisfy a tax debt when you don’t. Levies are used to seize your wages and whatever other assets you have. In doing so, you will be given an accurate figure.

As an employer, when you receive a notice of levy from the federal government, you'll need to calculate the amount of the employee’s pay that can be withheld each pay period to satisfy the levy. If you receive an irs bill titled final notice of intent to levy and notice of your right to a hearing, contact us. Not so for the irs.

Most wage garnishments are the result of a court order. A creditor has to sue you in court, obtain a judgment, then take additional legal action to obtain the wage garnishment. When your taxes are not paid and no satisfactory course of resolution has been established with the irs, the irs may seize and sell any type of real or personal property that you own or have an interest in.

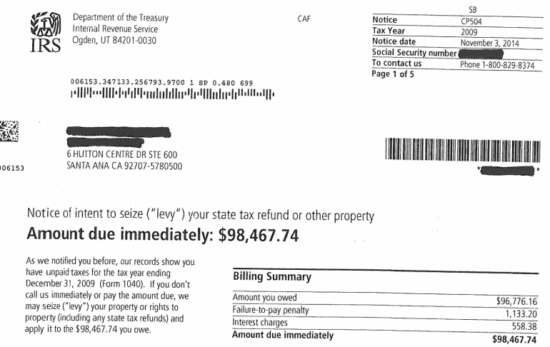

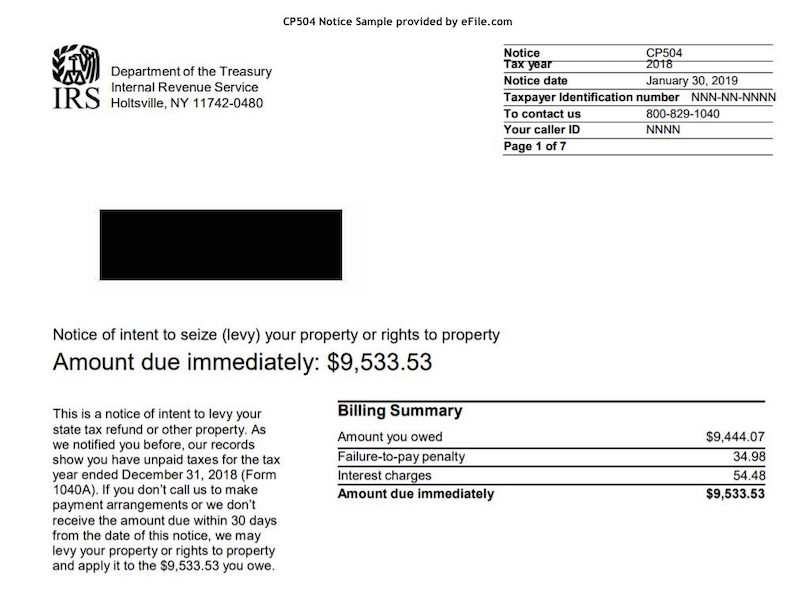

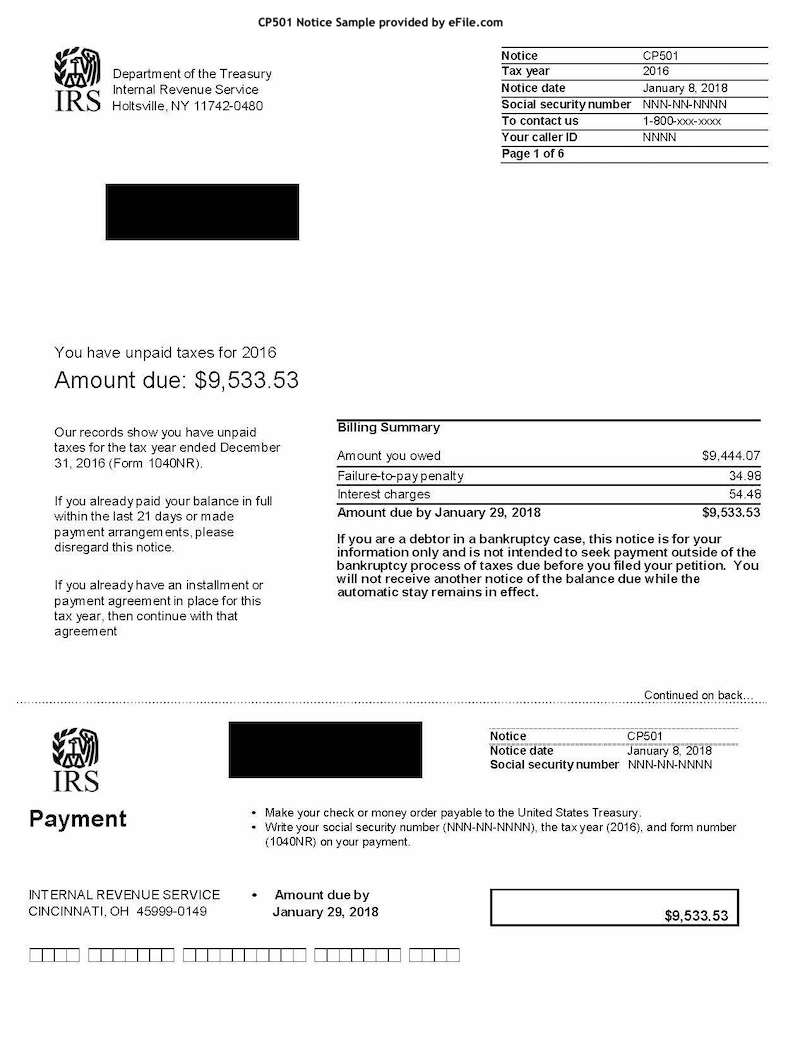

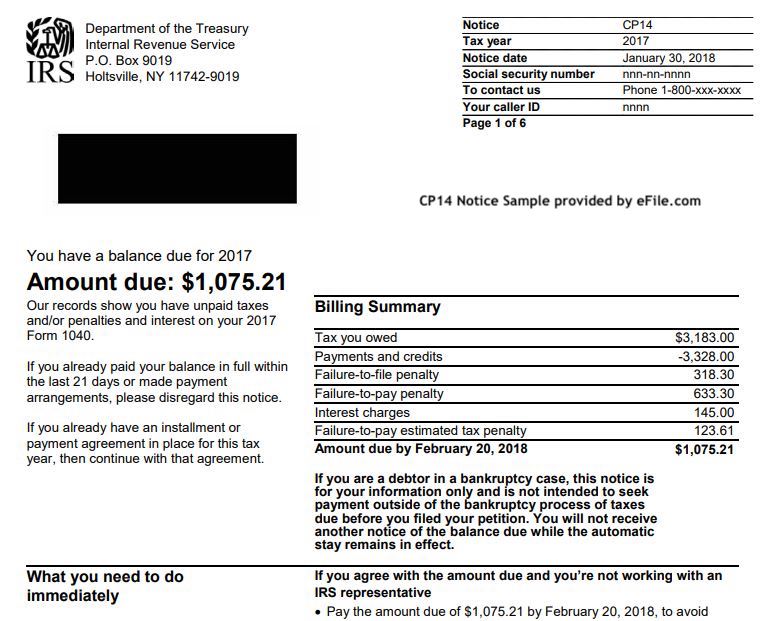

Open connect payroll > organization calculation tables. Failure to pay federal taxes can result in the irs levying the delinquent taxpayer’s property, such. Irs issues notice of intent to levy in a letter numbered cp504 asking you to pay the tax due within 10 days of service of that letter.

How to calculate wage tax levy. The irs doesn’t need a court order to levy assets, so the process can move fairly quickly once the irs has decided that a tax levy is its only recourse. If the irs decides to levy your social security benefits it will only take up to 15% of each check.

Upgrade to one month for $24. What they are saying is, we have tried to communicate with you but you have ignored us. In rare cases, the irs may seize your car or home.

The irs will then convert these assets into cash and use that money to pay down the debt you owe. The notice of intent to levy is issued as per internal revenue code section 6331 (d).the cp504 or the notice of intent to levy explains why this notice was issued and what may happen , if the tax due is not paid within 10 days. Tax changes as a result of the tax cuts and jobs act have altered the way employers calculate the amount of an employee’s wage that’s exempt from a federal tax levy.

What is a tax levy? How a tax calculator works. The irs can take as much as 70% of your wages until your debt has.

If the levy is 4.2 mils, enter 4.2. Without ever going to court, an irs employee and their manager can issue a wage garnishment against you. Part of your wages may be exempt from the levy and the exempt amount will be paid to you.

You make other arrangements to pay your overdue taxes, the amount of overdue taxes you owe is paid, or; An irs levy permits the legal seizure of your property to satisfy a tax debt. However, it must be stressed you should only use one that specifically deals with the irs.

The irs can levy, or legally seize, a taxpayer’s property to satisfy an outstanding back taxes.; It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle (s), real estate and other personal property. The irs may levy a variety of assets:

Wage garnishment occurs when the irs automatically takes money from your paycheck to collect back taxes. The irs provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employee’s paycheck. If the irs levies (seizes) your wages, part of your wages will be sent to the irs each pay period until:

In the field titled calculation table name, type the irs tax levy name. An irs tax penalty calculator is easy to operate. * trial calculations for tax owed per return over $750 and under $20,000.

The calculation table to calculate the irs tax levy for the head of household is set up. A tax levy itself should not directly affect your credit score since irs levies are not public record. Upgrade to two years for $90.

If you own it, they can take it. A tax levy is the next step in the collection process after a tax lien and occurs when the irs seizes your property to pay taxes owed. The irs continues to take amounts from the bank account pending the ability to satisfy the tax debt owed, plus any penalties and interest incurred over time.

Check whether property is residential, agricultural or commercial. This tax withholding estimator works for most taxpayers. You will see your current taxes, calculated additional for the new levy, and calculated total including the new levy.

Every year, the internal revenue service (irs) sends out nearly two million wage garnishment notices and notices to levy bank accounts. The irs uses a tax lien to secure that you pay off what you owe. A lien is a claim used as security for the tax debt, while a levy actually takes the property to satisfy the tax debt.

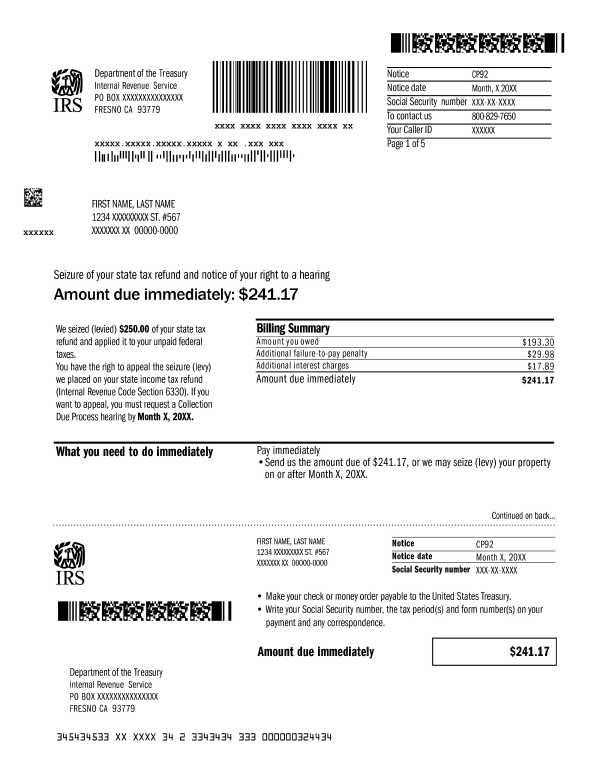

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

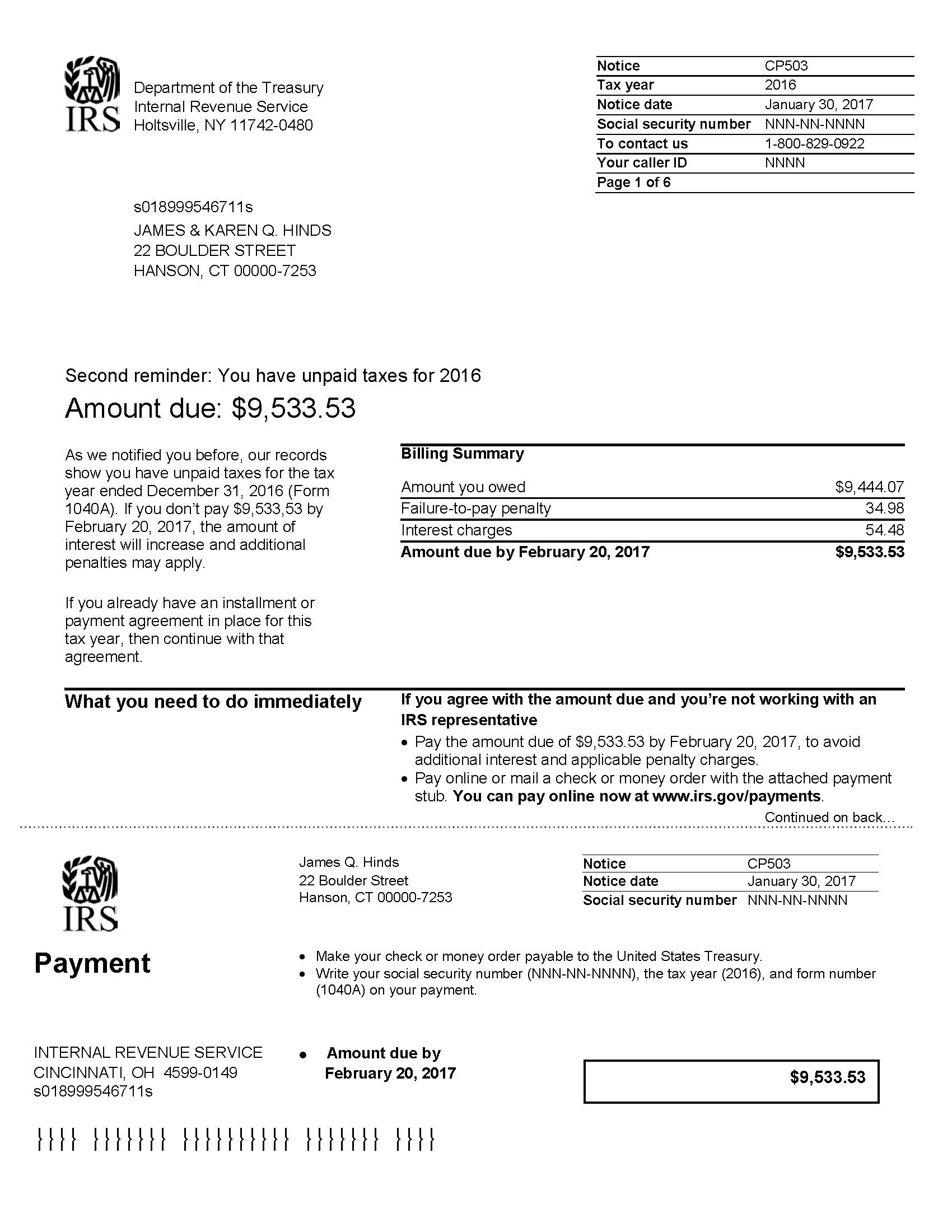

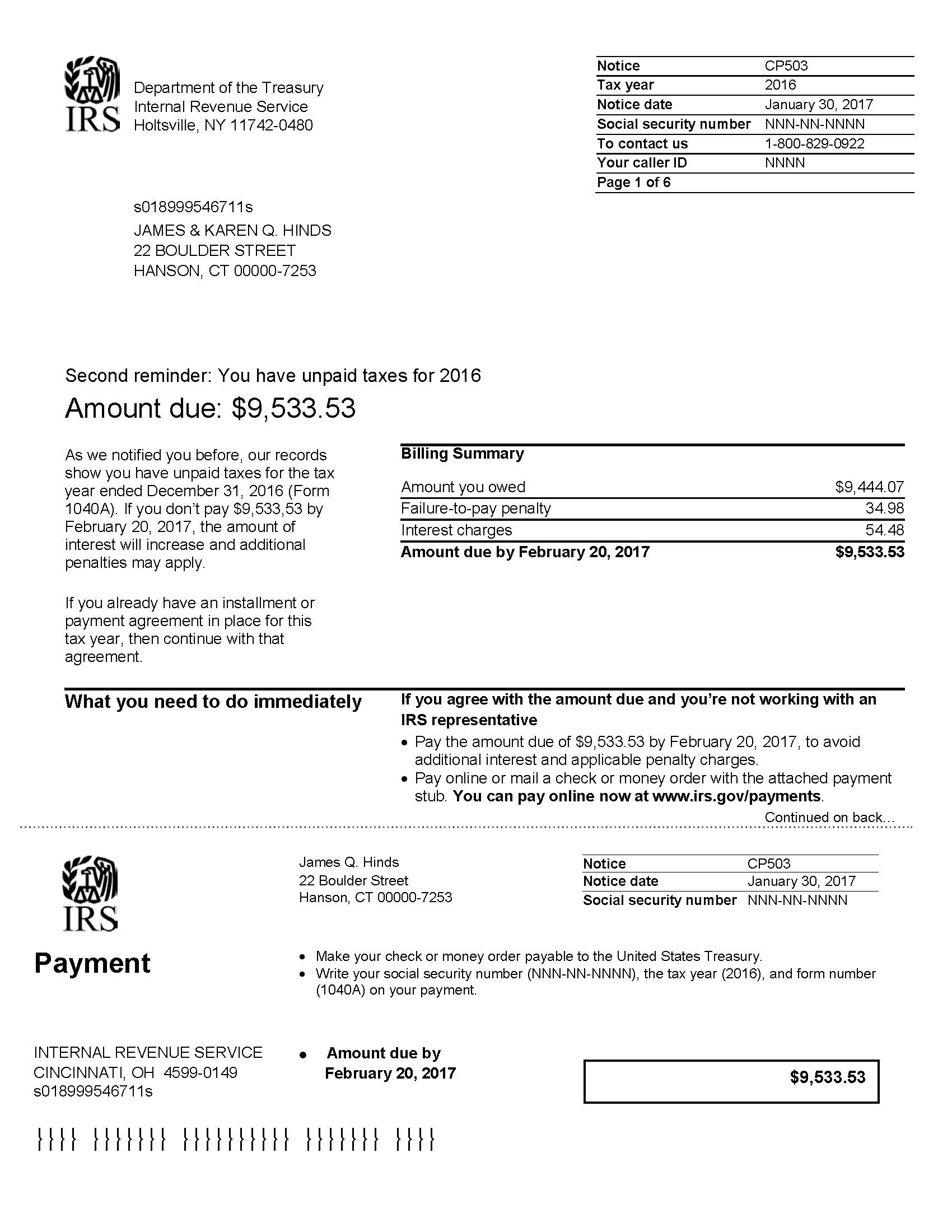

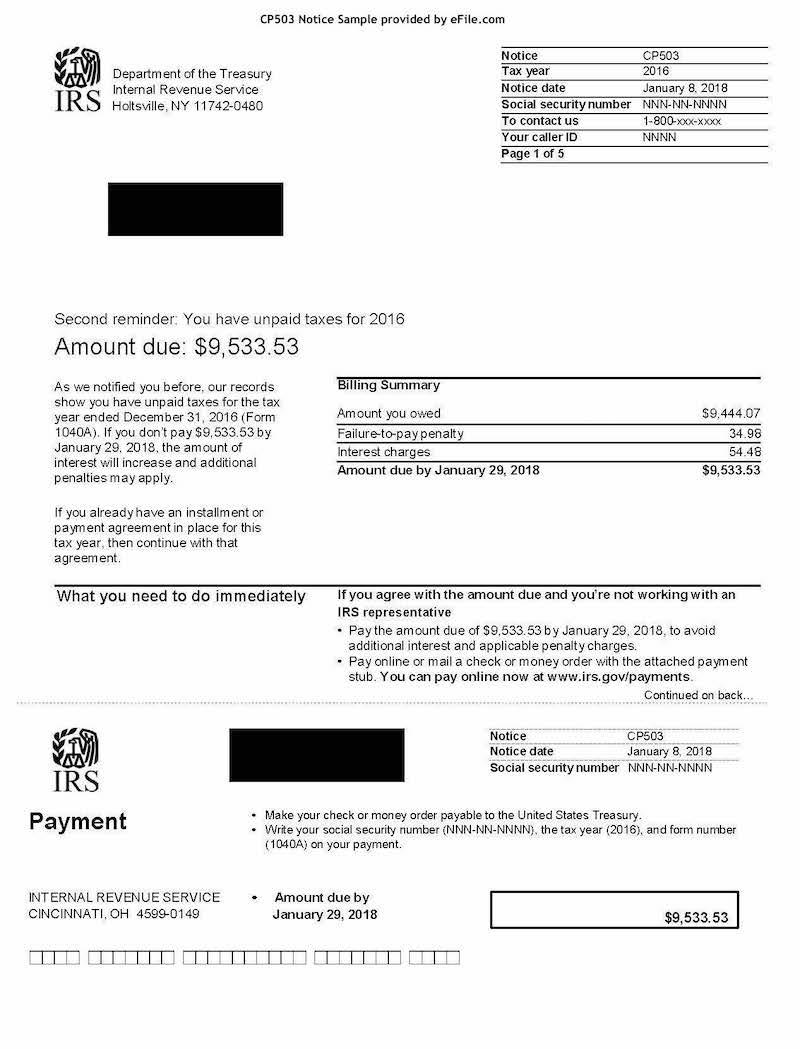

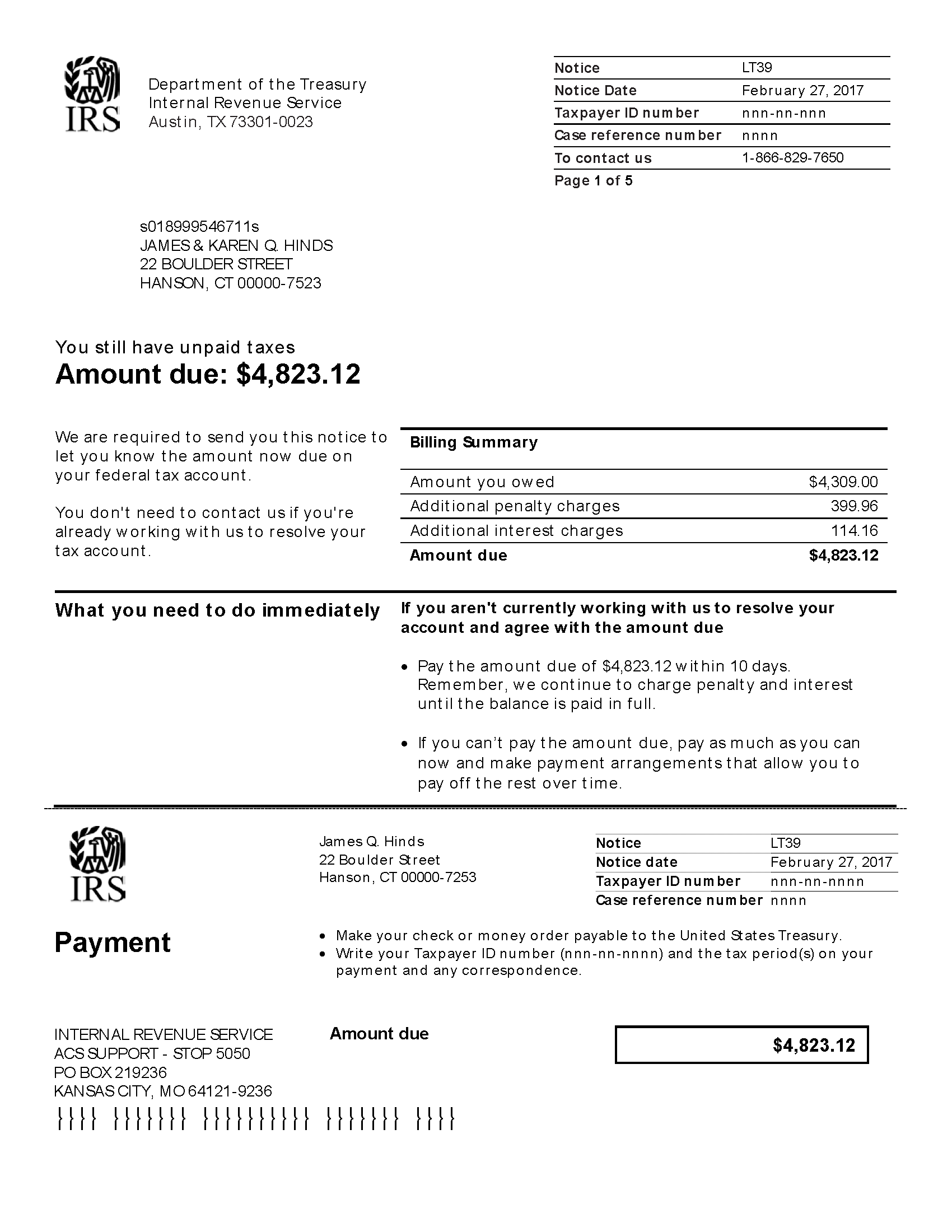

Irs Notice Cp503 - Second Reminder For Unpaid Taxes Hr Block

Failure To File Pay Penalty Calculator -fastest Easiest

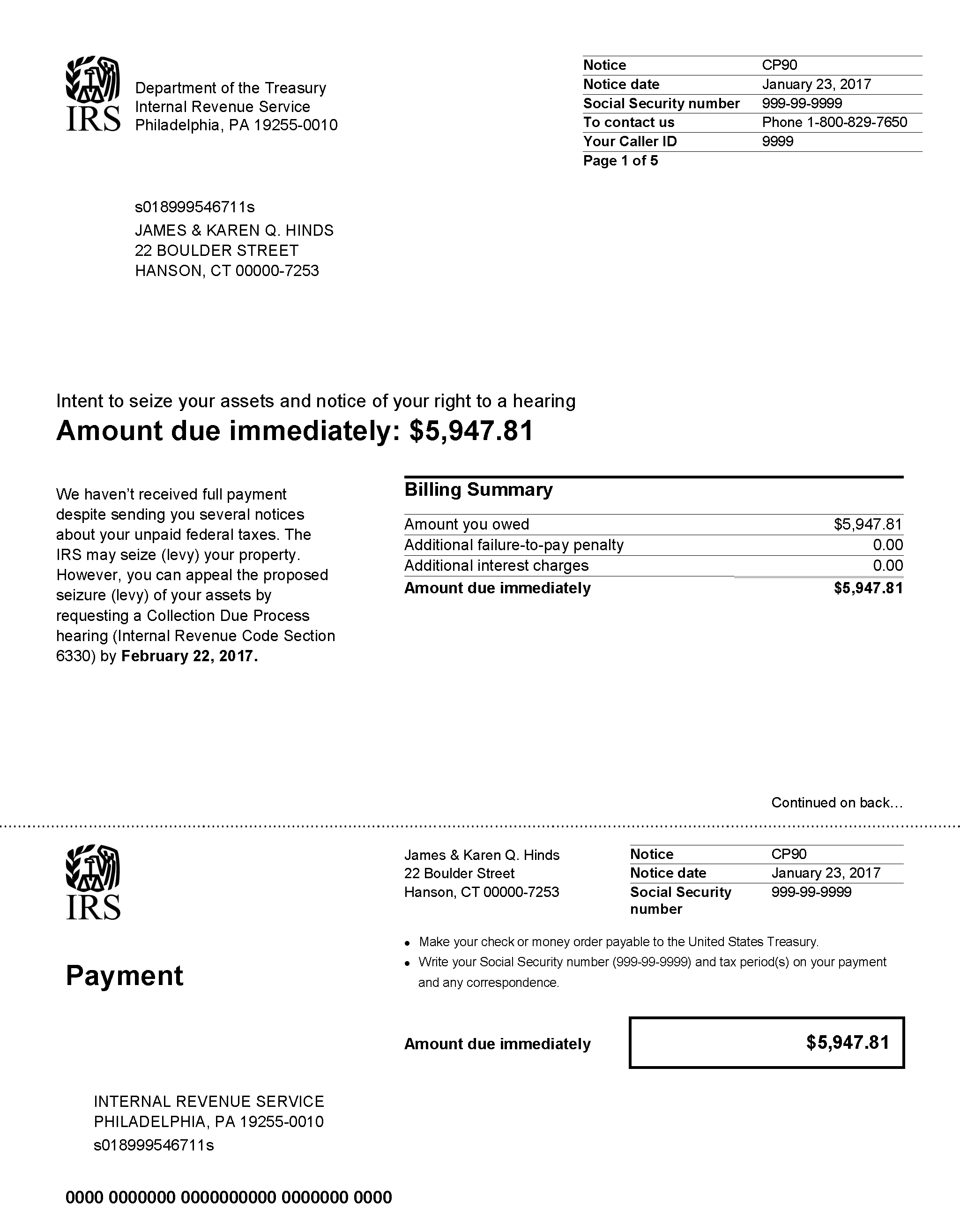

Irs Notice Cp90 - Final Notice Of Intent To Levy And Your Right To A Hearing Hr Block

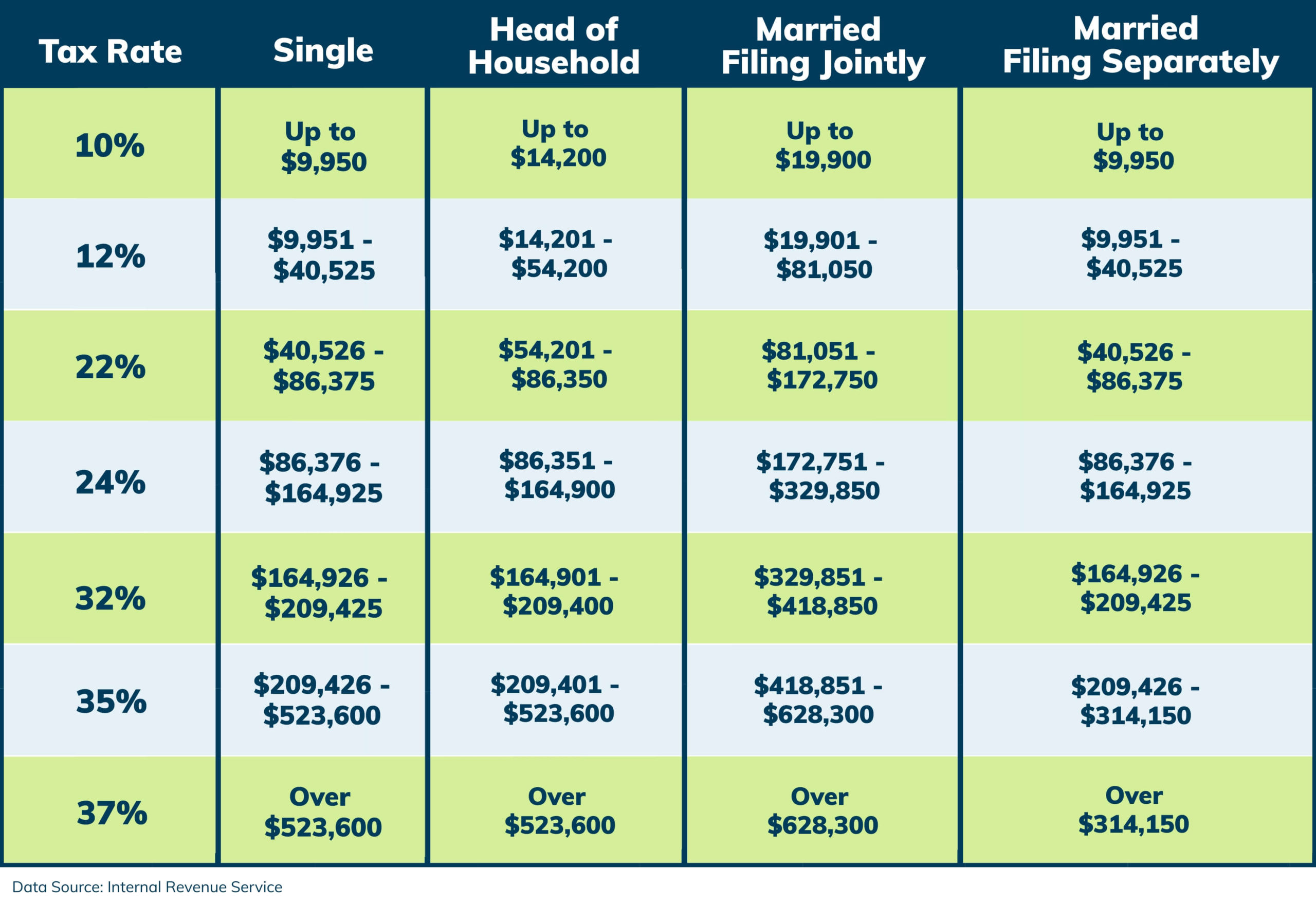

2021 Tax Brackets And Other Irs Tax Changes - Tax Defense Network

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa Pc

Irs Tax Withholding Estimator Irscom

Irs Tax Brackets Heres How Much Youll Pay In 2021 On What You Earned In 2020

Top 10 Tips For Filing Irs Tax Returns In 2014 Defense Tax Partners

Irs Tax Notices Explained - Landmark Tax Group

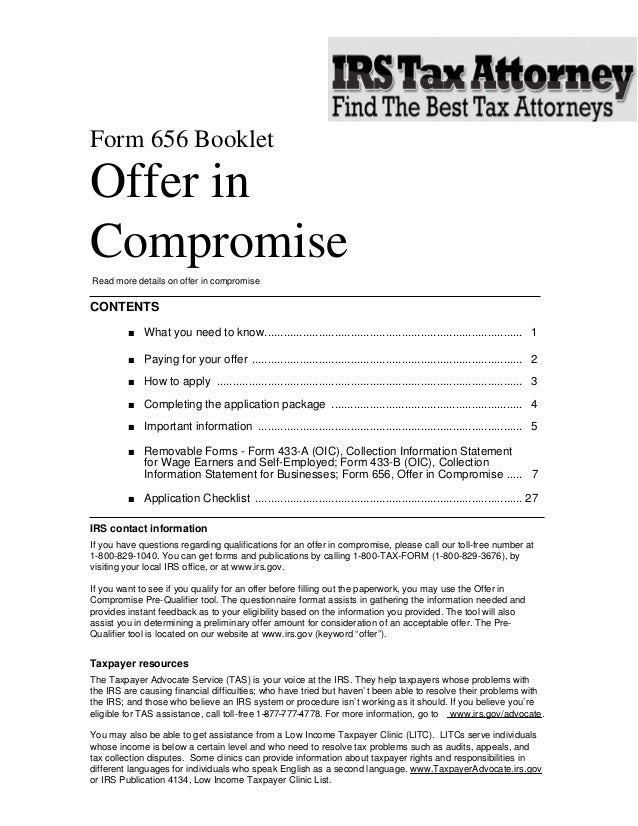

How Do I Find A Good Irs Tax Attorney

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Letter 39 Lt39 - Reminder Of Overdue Taxes Hr Block

Faqs On Tax Returns And The Coronavirus

When Does An Irs Tax Lien Expire - Rjs Law - Tax And Estate Planning

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Federal Tax Lien - Irs Lien - Call The Best Tax Lawyer

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien