West virginia tax law {w.va. You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent of your estimated tax.

When I Was Running My Etsy-based Business The Number One Thing I Dreaded Was Having To Deal With My Taxes From Local Paying Taxes Creative Business Business

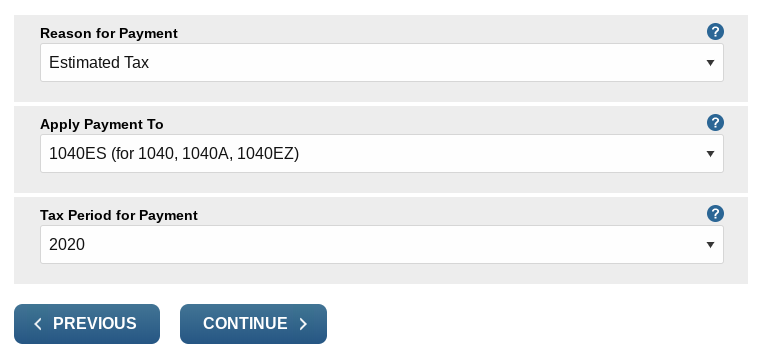

Please enter your payment details below.

Virginia estimated tax payments corporate. The interest waiver applies to any individual, corporate, or fiduciary estimated virginia income tax payments that are required to be paid during the period from april 1, 2020 to june 1, 2020. Figure the amount of their estimated tax payments. If west virginia taxable income is expected to be at least $10,000 when the annual income tax return is filed, estimated payments of the corporate income tax liability are required and due in four equal installments on the 15th day of the fourth, sixth, ninth and twelfth months of the tax year.

Make tax due, estimated tax, and extension payments. Some banks may charge a fee for this service. A payment of estimated tax on any installment date shall be considered a payment of previous underpayment only to the extent such payment exceeds the installment which would be required to be paid if the estimated tax were equal to 90% of the income tax.

Pay bills or set up a payment plan for all individual and business taxes. Thus, each installment should be at least 25% of the company’s current year income tax or 25% of the prior year’s income tax, whichever is smaller, in order to avoid an underpayment penalty. Estimated corporation net income tax payments are required for any corporation which can reasonably expect its west virginia taxable income to be in excess of $10,000 (which equals a tax liability after tax credits in excess of $650.00) and are due in four equal installments on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year.

Please contact your bank to confirm their participation in the ach credit program before applying with us. Note, however, that first quarter estimated payments for taxable year 2021 remain. How to make an estimated payment we offer multiple options to pay estimated taxes.

Every corporation subject to state income taxation must make a declaration of estimated income tax for the taxable year if the Virginia form 500es corporation estimated income tax payment vouchers all corporation estimated income tax payments must be made electronically. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must provide them with this debit filter number:

All corporation estimated income tax payments must be made electronically. The interest waiver also applies to payments associated with composite returns. More in forms and instructions.

Use these vouchers only if you have an approved waiver. At least 90% of the tax liability is required. Corporate estimated tax payments safe harbor.

Pay all business taxes including sales and use, employer withholding, corporate income, and other miscellaneous taxes. The safe harbors for corporate estimated tax are both 100%. Taxpayers who are required to make estimated tax payments but wait until

An electronic payment guide is available with information on how to submit ach credit payments to virginia tax. A corporation may also pay its estimated tax and extension payments by initiating an ach credit transaction through its bank. Form 500es corporation estimated income tax.

If you are unable to file by such due dates. The individual income tax filing and payment deadline in virginia is extended to monday, may 17, 2021. The date on which any portion of the underpayment is paid.

We last updated the estimated corporate income tax payment (formerly cnf120es) in april 2021, so this is the latest version of cit120es , fully updated for tax year 2020. • business ifile may be used to file sales and use tax or employer withholding tax, quarterly estimated corporate income tax for the current year as well as corporate extensions. At present, virginia tax does not support international ach transactions (iat).

Corporate estimated payments may also be submitted via tax’s web site. General information every corporation subject to state income taxation must make a declaration of estimated income tax for the taxable year if the Use these vouchers only if you have an approved waiver.

The corporate net income tax rates, based on wv net taxable income, are. Virginia requires taxpayers to file their 2019 corporate tax returns by april 15, 2020, and individual income tax returns are due by may 1, 2020. If you are required to file a tax return and your virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Payment options for business west virginia accepts ach credits, ach debits and credit cards. Under normal circumstances, quarterly estimated tax payments for tax year 2020 would have come due april 15, june 15, and september 15 of this. The interest waiver applies to any individual, corporate, or fiduciary estimated virginia income tax payments that are required to be paid during the period from april 1, 2020 to june 1, 2020.

Who must make estimated tax payments? In addition, business ifile also accepts estimated insurance premium license tax payments as well as digital media fee transactions.

Important Tips For Your First Va Loan Mortgage Tool Va Loan Calculator Va Loan Loan Calculator

Quarterly Tax Payment Calculator - Amy Northard Cpa - The Accountant For Creatives Small Business Accounting Small Business Tax Quarterly Taxes

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire Us Business Tax Irs Taxes Tax Debt

Use Irs Direct Pay To Pay Their Taxes Including Estimated Taxes Direct Pay Allows Taxpayers To Pay Electronical Estimated Tax Payments Tax Payment Accounting

How To Record Paid Estimated Tax Payment

Business Taxes Annual V Quarterly Filing For Small Businesses - Synovus

Tumblr

What Happens If You Miss A Quarterly Estimated Tax Payment

2017 Estimated Tax Refund Timeline Tax Refund Irs Taxes Tax Preparation

Va Loan Calculator For Florida Va Loan Calculator Va Loan Loan Calculator

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

1040 - Apply Overpayment To Next Year

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

Https Wwwadvisoryhqcom Wp-content Uploads 2017 02 Va -loan-calculator-with-taxes-minpng Va Loan Calculator Loan Calculator Life Insurance Calculator

Virtual Assistant Training Which Va Course Is Best The Common Cents Club Virtual Assistant Virtual Assistant Training Virtual Assistant Jobs

2

Pin By Elizabeth M Tolbert On 111tom Business Expenses In 2021 Business Signs Business Expense Business

Quarterly Tax Calculator - Calculate Estimated Taxes

Pin On Amortized Loan Calculator With Amortization Schedule