Free 10+ sample real estate tax forms in pdf | excel philadelphia real estate transfer tax — law offices of jason rabinovich mayor kenney’s budget wish list: This is a continuation of the blog post from june 22nd, which you can read about here.

Philadelphia Transfer Tax To Increase Again - World Wide Land Transfer

Philadelphia real estate transfer tax exemptions.

Philadelphia transfer tax exemption. The following transfers are excluded from the tax: First a quick refresher, there is a 2% transfer tax on real estate transfers in most municipalities across pennsylvania, with 1% going to the state and 1% to the local government.the pa transfer tax rate is higher in a handful of towns such as the city of philadelphia, where there is a 4% transfer tax. The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia.

Philadelphia transfer tax law excludes 28 transactions, while pennsylvania transfer tax law excludes 34 transactions. 1259 (approved june 11, 1987.) these regulations have been Transfers to an excluded party by gift or dedication, confirmation deeds, correctional deeds, transfers between certain relatives, transfers between.

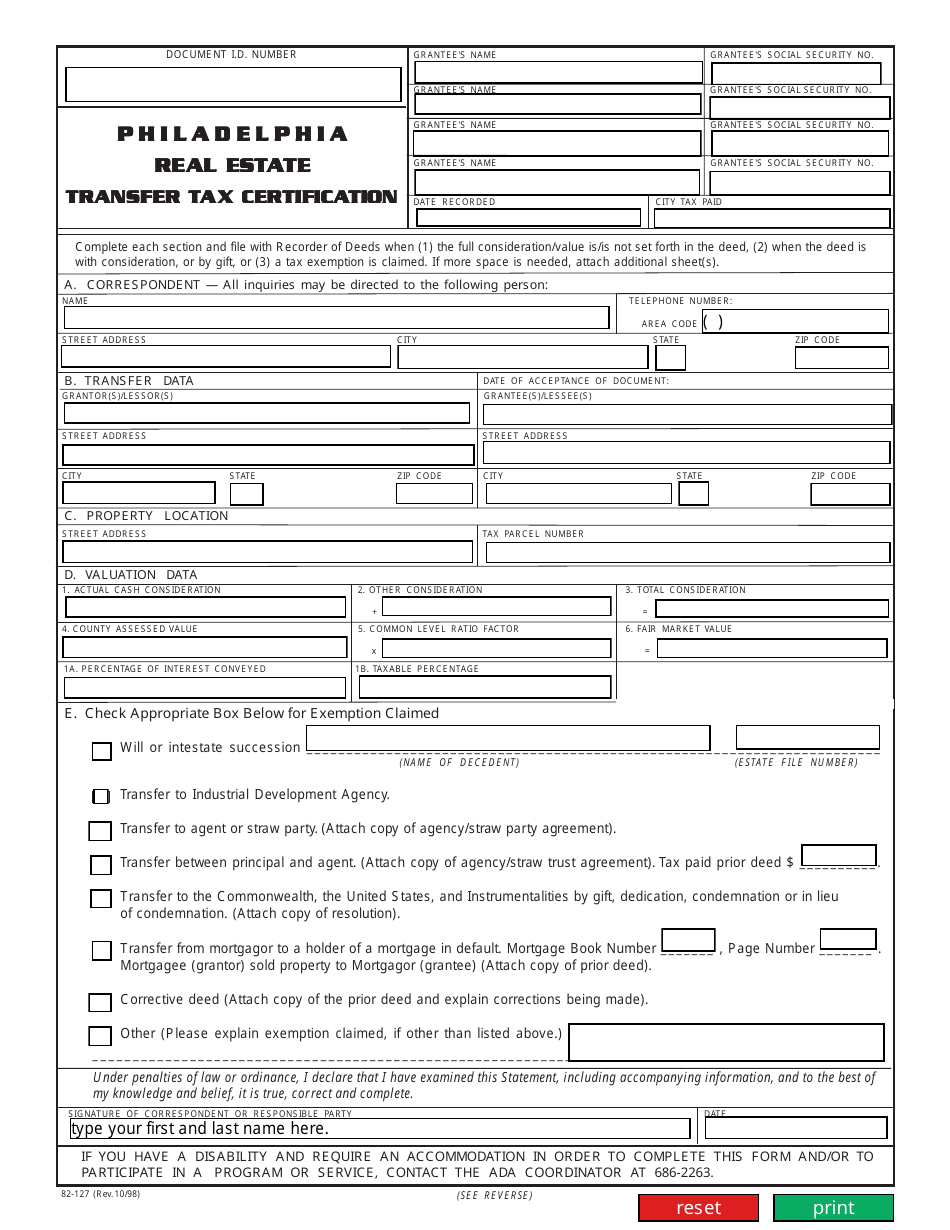

Common transactions that are excluded from real estate transfer tax include: In that post, i highlighted how the pennsylvania transfer tax system works generally, and how the taxes in certain counties (like philadelphia) are substantially higher than those in other counties. If more space is needed, attach additional sheet(s).

This is a statewide form required in every county where applicable. The new system will allow the department of revenue to provide you with better customer service. In fall 2021, philadelphia taxpayers will start using a new website to file and pay city taxes electronically:

Direct ascendants and descendants (grandparents to grandchildren, parents to children, etc.) siblings (including legally adopted and half siblings) spouses of these types of family members are also exempt from paying the tax. Smith (a grantor and a trustee) is still alive. One of the most popular transfer tax exemptions is the intra.

Deeds to burial sites, certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax. Realty transfer tax service city of philadelphia. Philadelphia transfer tax part ii :

Below are a few of the more notable exemptions: (1 days ago) effective october 1, 2018, the transfer tax for the city of philadelphia is 3.278%, with an additional state of pennsylvania tax of 1%, for a total of 4.278%. These documents contain the full regulations for the realty transfer tax, as well as clarifications from technical staff on how the department of revenue interprets the law.

While this tax adds an extra expense to transferring property, there are a number of transfer tax exemptions available, which may allow you to avoid paying the tax. While the majority of realty transfer tax is deposited into pennsylvania's general fund, 15 percent of collections are dedicated to the keystone recreation, park and conservation fund. (3) a tax exemption is claimed.

567 (approved june 5, 1985) and bill no. While this tax adds an extra expense to transferring property, there are a number of transfer tax exemptions available, which may allow you to avoid paying the tax. When you complete a sale or transfer of real estate that is located in philadelphia, you must file and pay the realty transfer tax.deed transfers and entity transfers have their own, unique forms.

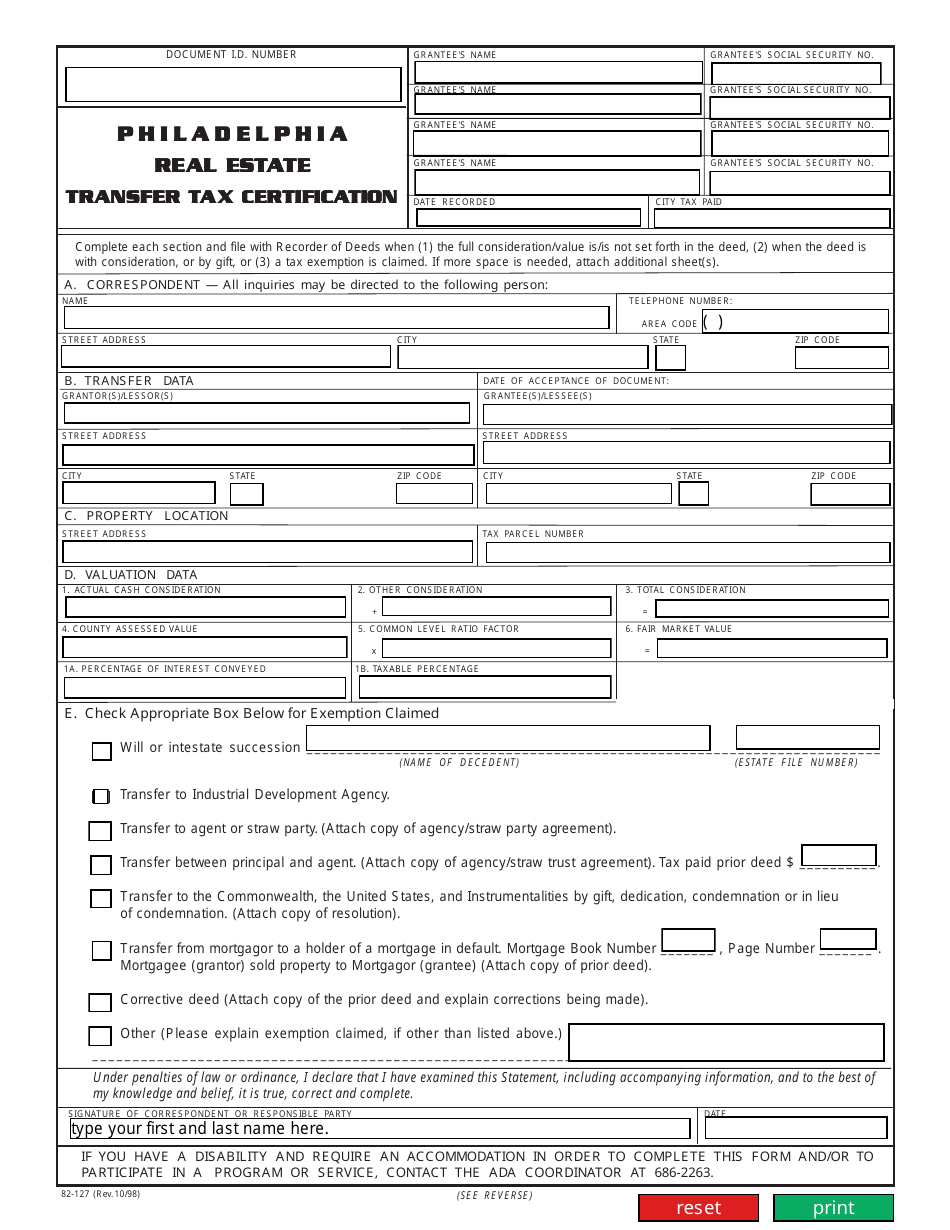

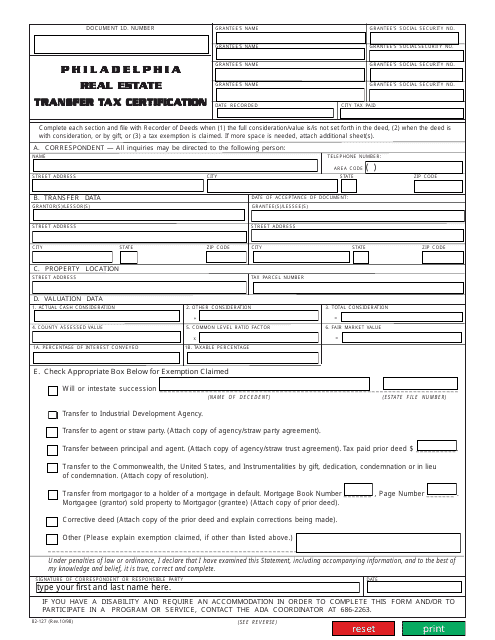

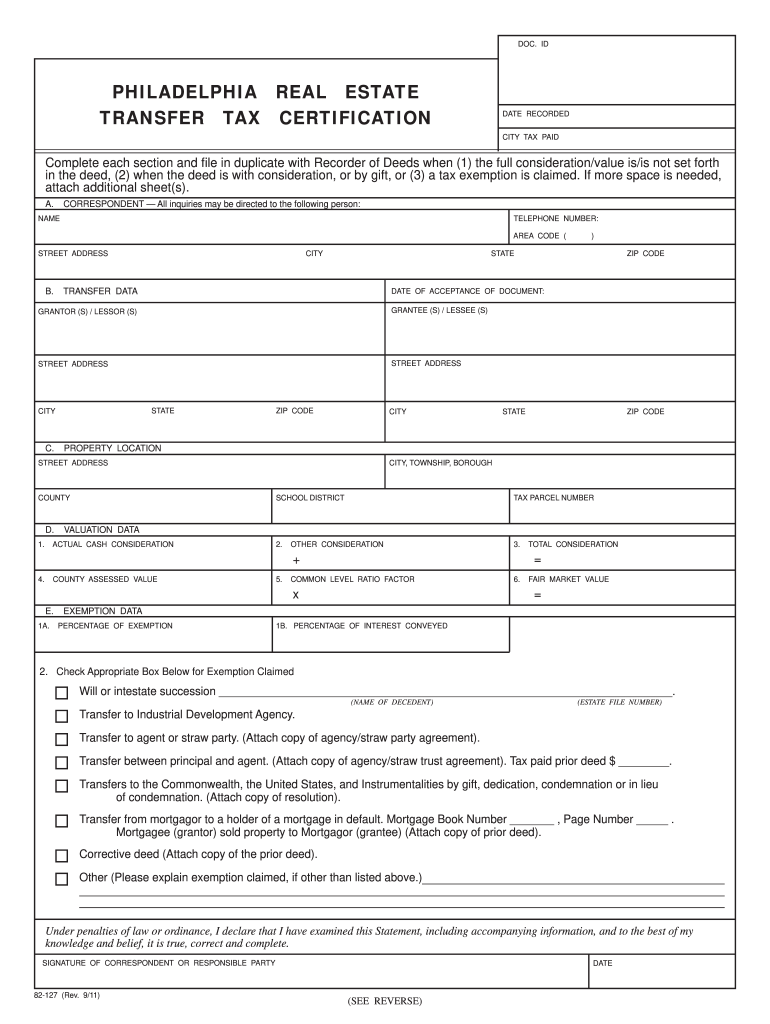

Higher property taxes, transfer fees to fund extra $1 billion for schools workbook: Most real estate transfers between family members are exempt from this tax, such as transfers between: Philadelphia real estate transfer tax certification complete each section and fi le in duplicate with recorder of deeds when (1) the full consideration/value is/is not set forth in the deed, (2) when the deed is with consideration, or by gift, or (3) a tax exemption is claimed.

Is there an exemption from real estate transfer tax when the property is transfered back from xxxxx xxxxx revocable living trust to a family member. Philadelphia transfer tax part ii : Below are a few of the more notable exemptions:

Philadelphia transfer tax part ii : The family exemptions published on july 28, 2016 july 28, 2016 • 3 likes • 0 comments

Update To Philadelphia Transfer Tax Calculation - World Wide Land Transfer

Philadelphia Transfer Tax Part Ii The Family Exemptions - Console Matison

2011-2021 Form Pa 82-127 - Philadelphia Fill Online Printable Fillable Blank - Pdffiller

Form 82-127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

2011-2021 Form Pa 82-127 - Philadelphia Fill Online Printable Fillable Blank - Pdffiller

When Are Non-residents Exempt From Philadelphias Wage Tax Department Of Revenue City Of Philadelphia

Form 82-127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Philadelphia Real Estate Transfer Tax Law Offices Of Jason Rabinovich

Aidslawpaorg

Pgn 1-09-09 Edition By The Philadelphia Gay News - Issuu

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Aidslawpaorg

Philagov

2011-2021 Form Pa 82-127 - Philadelphia Fill Online Printable Fillable Blank - Pdffiller

Form 82-127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Philadelphia Transfer Tax Form - Fill Online Printable Fillable Blank Pdffiller

Philadelphia Real Estate Transfer Tax Philadelphia-real-estate-transfer- Taxpdf Pdf4pro

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia