While there is no tax benefit in michigan or in my brother’s home state for giving to federal, state, and local candidates, several other states do offer varying tax benefits for political donations. Some people express political support by donating to political organizations, campaigns, and candidates.

Revisiting The Taxability Of Election Contributions Atty Rodel C Unciano

Are campaign contributions tax deductible?

Are campaign contributions tax deductible in 2019. State and local sales tax and other deductible taxes. If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible. The information in this article is up to date through tax year 2019 (taxes filed in 2020).

The information in this article is up to date through tax year 2019 (taxes filed in 2020). Donations utilized before or after the campaign period are subject to donor’s tax and not deductible as political contributions on the part of the donor. If this does not apply to your organization, you can change these settings in the donation tool settings for your campaign:

This means donations utilized before or after the campaign period are subject to donor's tax and not deductible as political contributions on the. The laws and issuances are harmonized for a consistent interpretation for campaign donations. Contributions or gifts to the people's campaign are not tax deductible.

The irs explicitly says that contributions to political campaigns and candidates are not tax. But the federal tax code doesn’t allow you to take a deduction for any political donations you make. While you can’t write off campaign contributions, you can set aside $3 of your taxes to go to the presidential election campaign fund on your 1040 federal income tax return.

It doesn’t matter if it is an individual, business or other organization making the donation… the campaign contribution is not deductible. This includes political action committees (pacs), as well. Taxslayer editorial team july 23, 2019.

The answer is no, political contributions are not tax deductible. Which agency monitors political campaign donations? As clarified, campaign contributions are exempt from donor’s tax only during the exclusive period for campaigning as scheduled by the comelec.

These laws must be read with the changes made by the corporation code for campaign contributions. Paid for by the people's campaign. Political donations are not tax deductible on federal returns.

Further, donations made by a corporation in violation of section 36 of the corporation code of the philippines shall be properly subjected to donor’s tax. Political campaigns from national down to local rely on contributions to operate. You may wonder if these contributions are tax deductible.

Donations utilized before or after the campaign period are subject to donor’s tax and not deductible as political contribution on the part of the donor. It has been updated for the 2019 tax year. Here's your guide to 2019 tax deductions.

It’s only natural to wonder if donations to a political campaign are tax deductible too. Wrongfully claiming political contributions can and will attract the attention of the internal revenue service and can lead to an assessment of additional taxes due, penalties and interest. The bir further strengthened that provision by issuing revenue memorandum circular nos.

The short answer is no. If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible. Start for $0 today get your maximum refund with all the deductions and credits you.

Some people express political… read more. The federal election commission (fec) administers and enforces the regulations in association with campaign donations. A state can offer a tax credit, refund, or deduction for political donations.

You cannot deduct expenses in support of any candidate running for any office, even if. No, donations to political parties are not tax deductible. The rmc notes that only donations or contributions that have been utilized or spent during the campaign period as set by the comelec shall be exempt from donor’s tax.

So you might feel that you deserve a tax break when you support the democratic process by making a campaign contribution. As clarified, campaign contributions are exempt from donor’s tax only during the exclusive period for campaigning as scheduled by the comelec. The bir further strengthened that provision by issuing revenue memorandum circular nos.

The same goes for campaign contributions. If you made a contribution to a candidate or to a political party, campaign, or cause, you may be wondering if your political contributions are tax deductible. Are political donations tax deductible in 2019?

Gifts From An Ira Uu Congregation Of Saratoga Springs

Are Campaign Contributions Tax Deductible

Are Political Contributions Tax Deductible Hr Block

Susie Lee On Twitter Campaign Finance Susie

Taxability Of Campaign Contributions

Are Political Contributions Tax Deductible - Turbotax Tax Tips Videos

Ask The Tax Whiz Should Candidates Parties Campaign Donors Pay Taxes

Are Political Contributions Tax-deductible Personal Capital

Taxability Of Campaign Contributions

Are Political Donations Tax Deductible Credit Karma Tax

Taxability Of Campaign Contributions

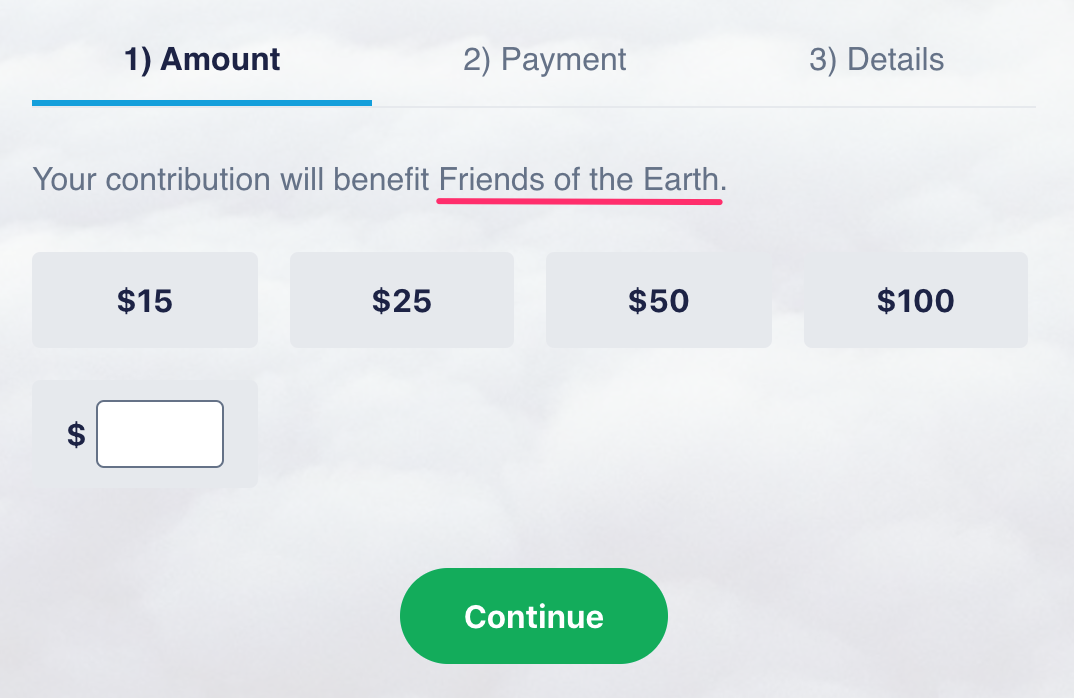

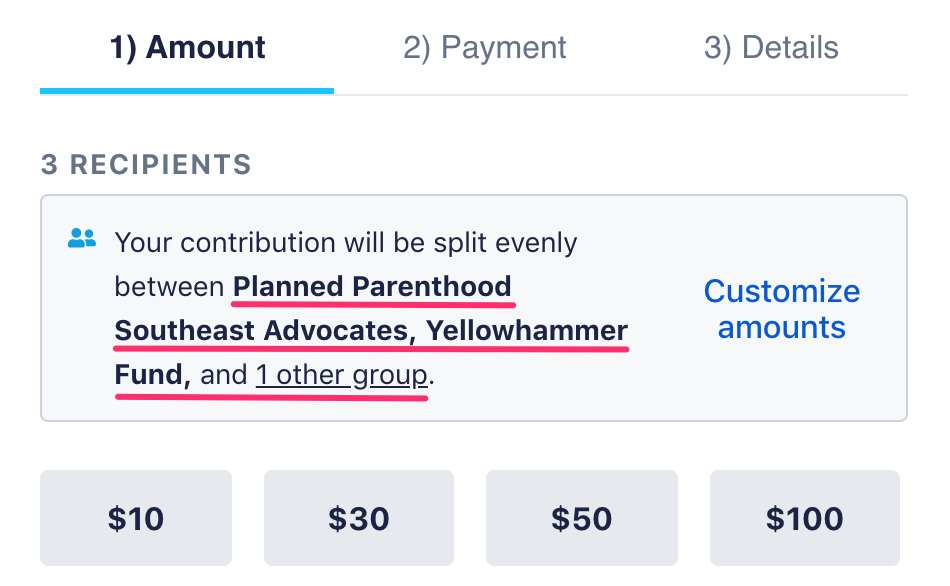

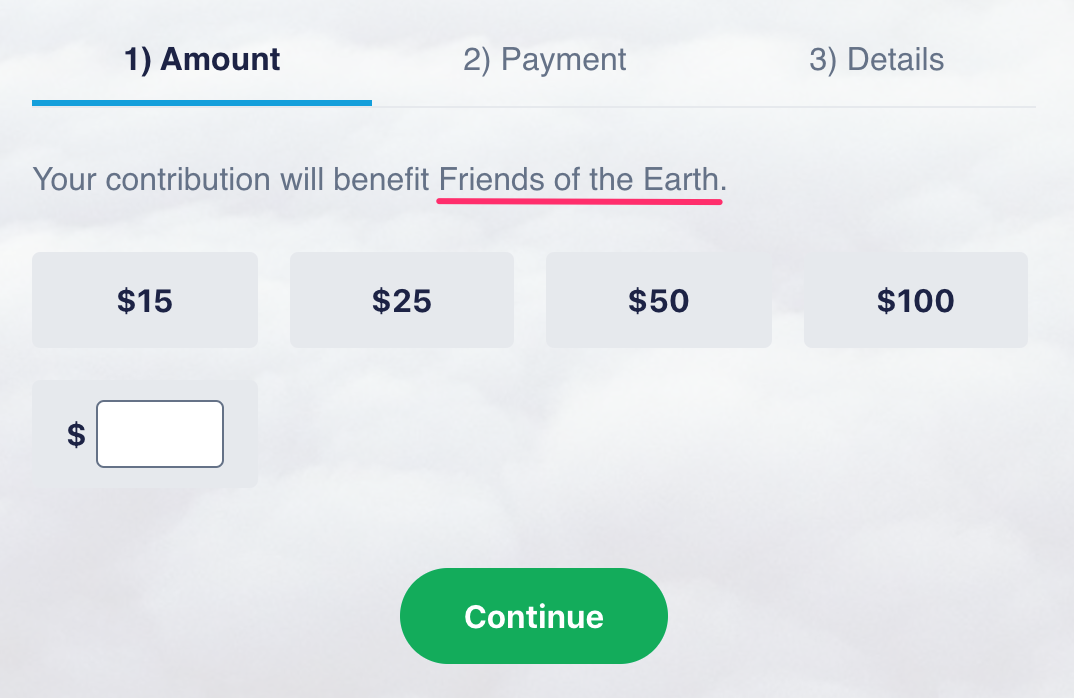

What Happens To My Money When I Donate Actblue Support

This Is A Reminder That Registration Is Still Open For The 2020 Usabo Please Share This Announcement With Teachers Studen Biology Stem Teacher Stem Education

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

Taxability Of Campaign Contributions Atty Rodel C Unciano

You Didnt Check The Presidential Election Campaign Box On Your Taxes Did You Its All Politics Npr

What Happens To My Money When I Donate Actblue Support

Are Political Contributions Tax Deductible Hr Block

What Happens To My Money When I Donate Actblue Support