For 2019, the limit individual taxpayers are allowed to deduct is $2,435 or $4,865 if filing jointly. Tax years beginning on or after january 1, 2022 and before january 1, 2024.

The Or 529 Plan - No More Tax Deduction For Savers Springwater Wealth Management

You may carry forward the balance over the following four years for contributions made before the end of 2019.

Oregon 529 tax deduction changes. Families can deduct up to $4,865 worth of these contributions from their state tax returns. Here is where we are at with our oregon plan at the end of q1 2017. North carolina enhances 529 deduction (08/03/2007) oregon to increase 529 deduction in 2008 (08/03/2007) oppenheimerfunds wins bid for texas 529 (06/28/2007) north dakota to offer 529 matching contributions (06/28/2007) arizona enacts 529 tax deduction starting 2008 (06/27/2007) wisconsin subs money market for stable value, reducing expenses (06/17/2007)

Oregon is connected to federal tax law (for the most part)! For example, if a couple contributed $15,000 to their son’s oregon college savings plan account in 2019, they may subtract a maximum of $4,865 (because they file jointly) on their 2019 oregon taxes. In the past, contributions to the oregon 529 plan were deductible on your oregon state income tax return, up to certain limits.

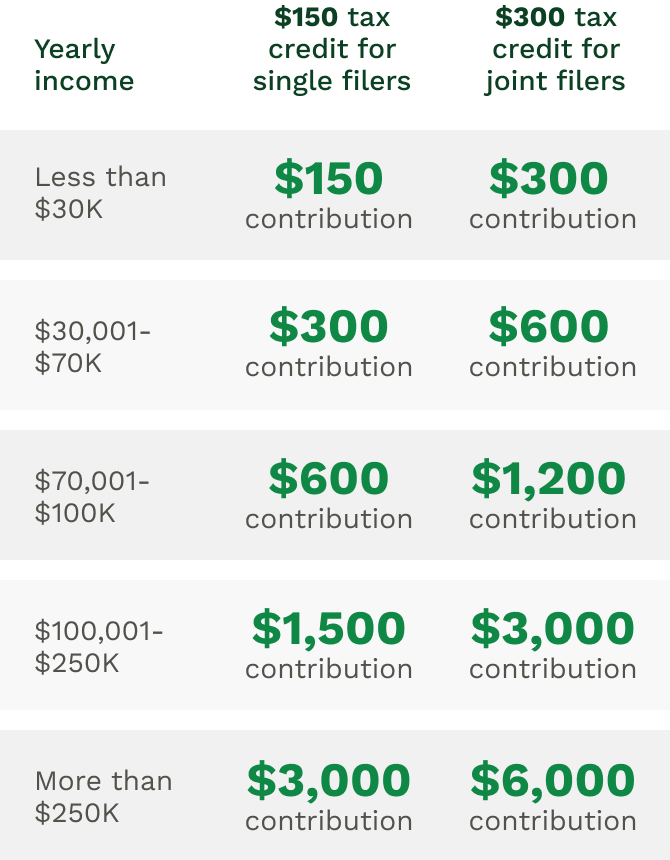

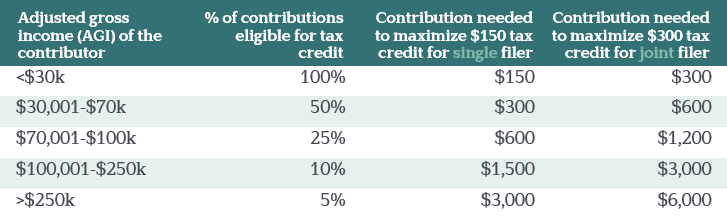

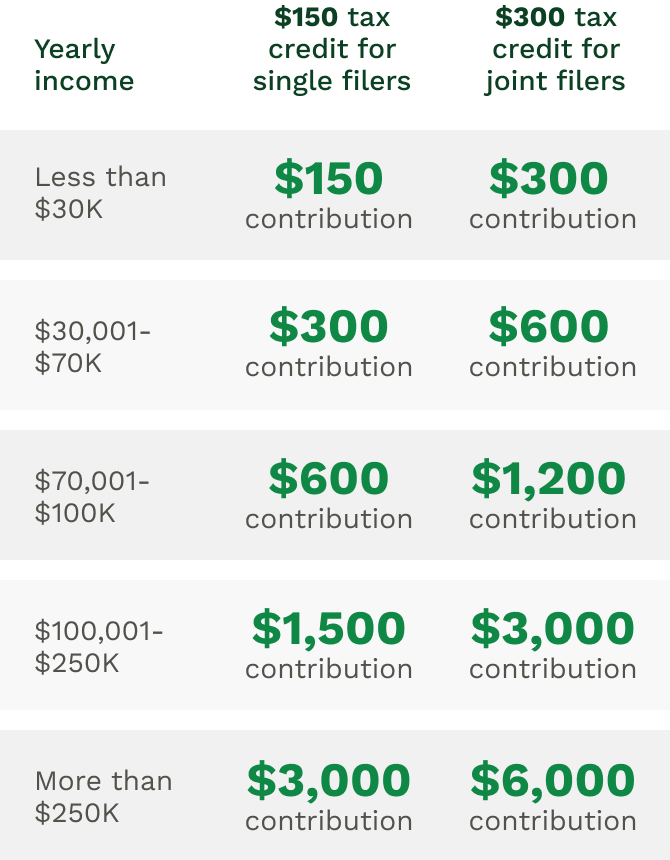

In 2019, individual taxpayers were allowed to deduct up to $2,435 for contributions made to the oregon college savings plan, while those filing jointly could deduct $4,865. It’s up to you to keep records showing the contribution in the event of an audit. Oregon now offers a tax credit capped at $150 for single filers or $300 for married couples that doesn’t benefit higher earners as much as the previous deduction.

Unclear about 529 deduction in oregon. Plus, you can get up to a $300 state income tax credit in oregon. Oregon's eic has increased to 12 percent of the federal earned income tax credit (eitc) if you have a qualifying dependent under age 3 at the end of the tax year.

This tax alert summarizes some of the provisions in sb 727. Tax benefits that make a difference. For more on the changes to the oregon plan, continue reading or 529 part 2 here.

Oregon law is unclear as to whether rollovers into the plan qualify for the deduction. And oregonians can still take advantage of this perk based on the contributions they made before december 31, 2019. For a short window of time, oregon taxpayers can qualify for both a deduction and a credit over the next four years.

As of the date of this notice, these withdrawals do not constitute “qualified expenses” for illinois income tax purposes. Single filers can deduct up to $2,435. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions.

Contributions to an oregon 529 plan of up to $2,310 (for 2016) by an individual, and up to $4,620 by a married couple. Half for single filers) in 2019. If you file an oregon income tax return, contributions made to your account before the end of 2019 are deductible up to a certain limit.

If funds are not used for qualified education expenses, the investment growth is subject to ordinary income taxes and a 10% penalty. I went to the learn more that you referenced and i can see it may be confusing as it is worded there. You also get federal income tax benefits as you do not pay income tax on your earnings.

The contributions to an oregon 529 plan are tax deductible up to a $2,265 annual limit for individuals and $4,530 for joint returns. Since you are rolling over from a plan where you did not previously take a state deduction, i would claim a deduction for the rollover. For all other qualified taxpayers, the oregon eic is now 9 percent of your federal eitc.

However, unlike other plans, the oregon laws do not make it clear if a taxpayer can roll over contributions. This deduction is annually indexed for inflation purposes. Thus, if an illinois income tax deduction was previously claimed for contributions to a 529 account and withdrawals for the above purposes are made, all or part of the deduction previously claimed may be added back to income for illinois income tax purposes.

**say thanks by clicking the thumb icon in a post. With marginal income tax rates of 5%, 7%, 9% or 9.9%, a family that contributed the maximum would get a deduction worth between $243.50 and $482.13. 529 plans typically increase the contribution limit over time, so you may be able to contribute more.

The current plan offers a tax deduction for contributions up to $4,870 (married filing joint; Starting january 1st, 2020 the oregon college savings plan is moving to a tax credit. Oregon state income tax deduction is available for contributions up to $4,750/year (married filing jointly) and $2,375/year (all other filers) for 2018.

Oregon residents may qualify for an income tax deduction. · a state income tax deduction in many states for contributions · the ability to change the beneficiary if needed, which makes the 529 account very flexible for account owners with multiple. The credit replaces the current tax deduction on january 1, 2020.

Contributions of up to $2,435 for individuals and $4,865 for joint filers are eligible for the 2019 tax year.

Oregon 529 Plan How To Save On Your Contributions - Brighton Jones

Moving Our Oregon College Savings Plan 529 To Vanguard - Retire By 40

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Mfs 529 Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oregon 529 Plan How To Save On Your Contributions - Brighton Jones

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Big Changes To Oregon 529 And Able Accounts - Jones Roth Cpas Business Advisors

Oregon College Savings Plan Transition Still Rocky For Some - Oregonlivecom

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your States Tax Benefit Morningstar

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It - Oregonlivecom

10 Things Parents Should Know About College Savings -

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oregon College Savings Plan To Offer Tax Credit - Ktvz

Saving For College The Oregon College Savings Plan - The H Group - Salem Oregon

2

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Oregons College Savings Plan Rankings Unchanged On Morningstar - Oregonlivecom