Sep 27, 2021 / 05:10 pm edt. To help eligible families track the status of their payments , the agency launched an online portal, however, users have to.

Child Tax Credit 2021 Changes - Grass Roots Taxes

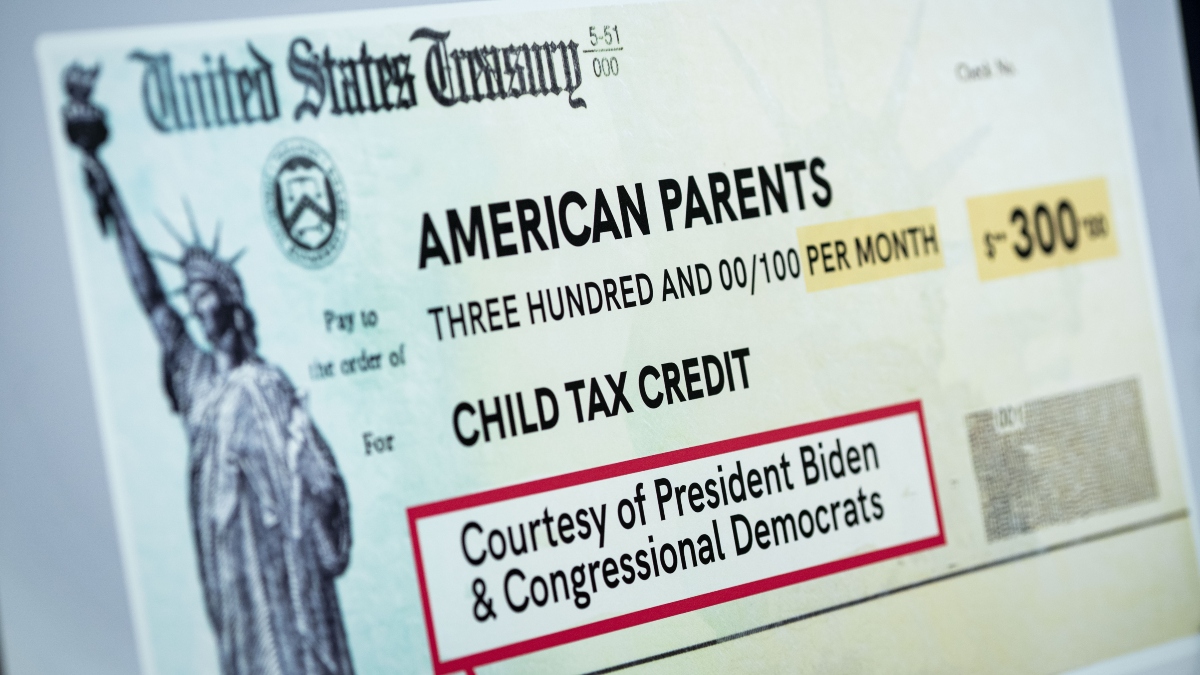

Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021.

Irs child tax credit problems. Some americans may be blocked from receiving their expanded child tax credit payments due to an error on the irs' website. An overpayment from the irs may occur if your income went up this year (meaning you're getting too much money based on old tax info) or if your child is aging out of a payment bracket this year. Your family never filed a.

At least four million families are experiencing delays with their child tax credit due to a technical issue. the irs has warned that families may be experiencing delays as a technical glitch reportedly saw checks mailed in the post rather than sent electronically. Here’s how to contact the irs with any child tax credit check issues news. Make sure you have the following information on.

A group of parents who received their july payment via. There are a number of possible reasons why your family hasn't received a july, august or september payment. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

That translates to $250 per month. The child tax credits are worth $3,600 per child under six, $3,000 per child between six and 17 and $50 for college students aged up to 24. My child tax credit payments haven't been processed.

“ this means that by accepting advance child tax credit payments, the amount of your refund may be reduced or the amount of tax you owe may increase,” according to the irs. According to the irs, some households received too much money for september's child tax credit money, and the irs is now correcting the issue by issuing lower payments to those households this month. Starting 15 july, the agency will begin sending out monthly advance payments.

The irs is taking on a new challenge. We’ll issue the first advance payment on july 15, 2021. The internal revenue service (irs) has admitted that there is an issue, releasing a statement to clarify what is going on with the september child tax credit payments.

Make sure you have the following information on. Families are weeks away from getting the first installment of the $3,000 child tax credit, but this could lead to parents owing more money to the irs. The irs announced a technical issue that could affect up to 15 percent of recipients of the child tax credit.

The payments are going out in the form of either a paper check or direct deposit into a bank account, with the majority of recipients opting for direct deposit. The irs has designated $15billion to go out to around 36million taxpayers as part of president biden's extension of the child tax credit. Will there be problems receiving irs child tax credit payments?

For parents of children up to age five, the irs will pay $3,600 per child, half as six monthly payments and half as a 2021 tax credit. Combined with the $1,400 checks and other items, it could reduce the number of children living in poverty by more than half, according to the center on poverty and social policy at columbia university. Sep 27, 2021 / 05:10 pm edt / updated:

This month's checks went out on october 15 credit: Claiming the child tax credit may be a way for you to reduce your tax liability, particularly if you’re facing tax issues.

Irs Sends Nearly 15 Billion Of Advance Child Tax Credit Payments

Irs Number For Child Tax Credit How To Get Your Questions Answered - Cnet

Irs Notice Cp79 - We Denied One Or More Credits Claimed On Your Tax Return Hr Block

Does That Irs Letter Bring Good News About Next Months Child Tax Credit Payment - Cnet

Child Tax Credit Will The Irs Have Problems Sending Out Monthly Checks Cbs Philly

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

Child Tax Credit Why Are Some Parents Having Problems Cbs Boston

Child Tax Credit Why Are Some Parents Having Problems Cbs Detroit

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

Will There Be Problems Receiving Irs Child Tax Credit Payments - Ascom

October Child Tax Credits Issued Irs Gives Update On Payment Delays

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs Glitch Halted Child Tax Credit Payments For Families With An Immigrant Spouse - Cbs News

How The New Expanded Federal Child Tax Credit Will Work

Tax Tip Irs Statement On September Advance Child Tax Credit Payments

Irs Notice Cp79 - We Denied One Or More Credits Claimed On Your Tax Return Hr Block

2021 Child Tax Credit Advanced Payment Option - Tas