All vehicles in the state of massachusetts are subject to an annual motor vehicle excise tax. For your convenience payment can be made online through their website www.kelleyryan.com.

Excise Tax Gloucester Ma - Official Website

Massachusetts motor vehicle excise tax information:

Pay my past due excise tax massachusetts. 2018 excise tax commitments unless past due. If not paid, pursuant to massachusetts general law chapter 60 section 15, a demand fee of $10.00 will be added. The excise rate, as set by statute, is $25 per thousand dollars of valuation.

An motor vehicle abatement application (available on this web site or in the assessors office at the town hall) may be filled out and submitted with supporting documentation to the assessors office. If your bill is not past the due date for payment, you have the following options: For excise tax warrants, final notices, & marked registrations, please see below.

When are the payments due for motor vehicle excise? The option for only receiving an ebill is not available and you will continue to receive a bill in the mail/email. Excise tax demand bills are due 14 days from the date of issue.

Payment of the motor vehicle excise is due within 30 days from the date the excise bill is issued. Flagged bills will take up to 1 business day to electronically clear at the rmv. Bills are assessed on a calendar basis.

Please note, if you are going to pay with a credit card, a convenience fee will be charged. The excise for any particular year is due to the municipality in which the vehicle was registered on january 1. Pay the motor vehicle excise to the city or town in which the vehicle was registered on january 1.

In order to avoid interest charges and fees, your excise tax bill must be paid thirty (30) days from the bill's issue date. Call for payoff figure through a specific date as interest accrues daily. Effective january 1, 2013 there will be a small fee of $0.25 to pay directly from your checking account.

You need to enter your last name and license plate number to find your bill. According to chapter 60a, section 2 of the massachusetts general laws, failure to receive notice shall not affect the validity of the excise. You may pay the following bills online now!

Please note all online payments will have a 4.5% processing fee added to your total due. This information will lead you to the state attorney. You may mail your payment coupon and a check in the envelope provided.

Filing an application does not mean that collecting the excise has stopped. Majority of bills are due in march. Jones & associates 98 cottage street p o box 808 easthampton, ma 01027 ph:

It appears that your browser does not support javascript, or you have it disabled. For excise tax bills that have gone to warrant you will need to contact and pay to our deputy tax collector. If you move within massachusetts and have not paid an excise tax for the current year, you should:

Tax title payments also accepted. Please use this page to search for delinquent motor vehicle excise tax bills. Even if you did not timely file an application, assessors can still grant you an exemption, but only if.

Click on motor vehicle excise tax if you want further information concerning excise tax. Interest will be charged at 12% per year on any payment not received by the collector’s office by the due date. Online bill payment links | town of wareham ma

You may reach the deputy of. If javascript is disabled in your browser, please. There are several ways you can make payment on your outstanding bills.

The following bills can be paid online: If you have any past due balances, then the payment made today could be applied first to past due. All information provided on an excise tax bill comes directly from the registry of motor vehicles.

3 years after the date the excise was due, or; You can pay your excise tax through our online payment system. This will send your payment to the city’s lockbox vendor for automated.

Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. 1 year after the excise was paid; Go to our online system

Other ways to make a payment. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued (not mailed, as is popularly believed). For immediate clearance of marked bills, payments in cash can be made at the deputy collector’s office in brockton city hall monday through friday.

What if i do not receive an excise tax bill? Past due real estate or personal property tax payments can be made by mail or in person directly to the tax collector's office, or in payment drop box.

1 The Effect Of An Excise Tax Download Scientific Diagram

2

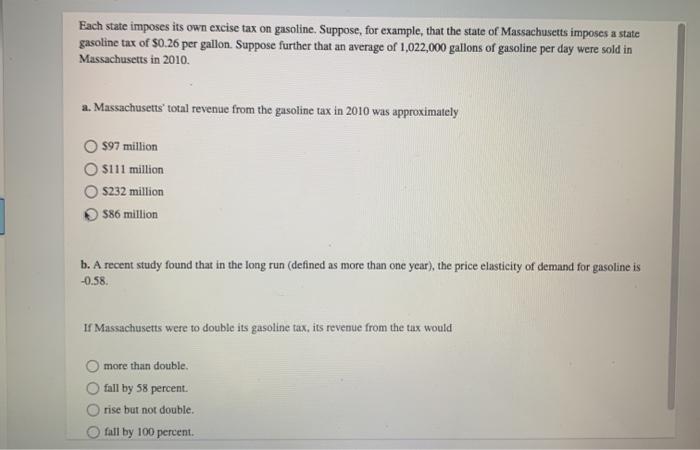

Solved Each State Imposes Its Own Excise Tax On Gasoline Cheggcom

What Is Excise Tax And How Does It Differ From Sales Tax

1 The Effect Of An Excise Tax Download Scientific Diagram

1942 Town Of Braintree Massachusetts Excise Tax-2 Trailer-auto Ephemera Braintree Braintree Massachusetts Trailer

Excise Tax What It Is How Its Calculated

2021 Motor Vehicle Excise Tax Bills Fairhaven Ma

Motor Vechicle Excise Tax Bills Plainville Ma

Tax Collector Littleton Ma

Motor Vehicle Excise Tax Demand Fee Postponed Marlborough Ma

Getting Answers Springfield Mans 35-year-old Excise Tax Bill News Westernmassnewscom

Pdf Tax Policy In Sub-saharan Africa Examining The Role Of Excise Taxation

2

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Getting Answers Springfield Mans 35-year-old Excise Tax Bill News Westernmassnewscom

Pdf Excise Tax Calculation For The Eu Member States Third Countries Using Sap Cloud Solution Scp

Excise Tax Milton Ma

Hingham Excise Tax - Fill Online Printable Fillable Blank Pdffiller