Generally, the irs files suit for the collection of back taxes. This bill starts the collection process, which continues until your account is satisfied or until the irs may no longer legally collect the tax;

Elk Grove Ca Irs Tax Problems Help Wpgtax

The irs generally has 10 years to collect tax debts.

How long does the irs have to collect back payroll taxes. How long can the irs collect back payroll taxes. First and foremost, the statute is carefully crafted to read: The irs considers unpaid payroll taxes a very serious violation.

By law, the irs only has ten years to collect the unpaid taxes from the time of the initial tax assessment. The time period (called statute of limitations) within which the irs can collect a tax debt is generally 10 years from the date the tax was officially assessed. It is not in the financial interest of.

This notice provides instructions on the deferral (delayed collection) of the employee’s portion (6.2%) of the oasdi tax. 10 years from the date of assessment. However, we’ve covered that a number of factors can extend the collection period on your specific debt.

How long can the irs collect on my debt? After that, the debt is wiped clean from its books and the irs writes it off. The agency will send out reminder notices once a business has missed a payment or two, but it may not wait long before it sends a revenue officer out to the business in person, unannounced.

This means that under normal circumstances the irs can no longer pursue collections action against you if 10 years have passed since the clock started on your tax debt. If you file early, let’s say january 31, 2020, the irs has until april 15, 2030 to collect. This is called the 10 year statute of limitations.

You can escape this statute of limitations and get caught up with you owe the irs by filing missing returns immediately. How long can the irs collect back taxes? The irs is limited to 10 years to collect back taxes, after that, they are barred by law from continuing collection activities against you.

Irs is subjected to a 10 year statute of limitations on its tax collections, limiting the time span available to recover all the debts. Medicare payroll taxes and the Generally, under irc § 6502, the irs will have 10 years to collect a liability from the date of assessment.

Have the following information available: (updated 39 days ago) they only have so long to collect…. Thus, if one responsible person pays the penalty in full, any other responsible persons do not need to pay that amount.

For example, when the time or period for collection expires. The internal revenue code (tax laws) allows the irs to collect on a delinquent debt for ten years from the date a return is due or the date it is actually filed, whichever is later. In general, the internal revenue service (irs) has 10 years to collect unpaid tax debt.

There is an irs statute of limitations on collecting taxes. Some of these taxes are almost 20 years old! But that 10 year period may be longer than you expect, given lengthy suspensions, the irs’s date of tax assessment versus your last return, and whether or not you have been keeping up to date with your tax returns since the debt period began.

In other words, there would be two csed statutes running. A fairly lengthy list of actions can occur that will allow the irs to extend that 10 year period, however. The location of court, bankruptcy date, chapter and bankruptcy number.

It also can restart the collection timeline under certain circumstances. Thanks to csed csed stands for collection statute expiration date. The first notice you receive will be a letter that explains the balance due and demands payment in full.

22 mar, 2017 in irs debt / tax guide tagged back taxes / irs / regulation / state taxes / tax debt by robert kayvon, esq. The statute of limitations that the irs has for collecting tax debts from taxpayers is virtually unlimited as long as those returns remain unfiled. For most cases, the irs has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

How long can the irs collect back taxes? This is a long time when you consider that the irs only has 10 years to collect its tax debts. Moreover, even if the irs abates the penalty against one person, it may still collect from all other jointly liable responsible persons.

The standard expiration date of the statute is 10 years from the date the return is filed showing the balance, or 10 years from the date the irs files a return on behalf. This is called the irs statute of limitations (sol) on collections. The time to audit taxes can be extended.

Under certain circumstances, the irs will forgive tax debt after 10 years. Bankruptcy may not eliminate your tax debt, but we may temporarily stop collection. When a company has been assessed with delinquent payroll taxes, the irs has 10 years to collect what is owed under the collection statute.

However, the irs may only collect the tfrp once for a business' unpaid payroll taxes.

Resources Tony Ramos Law

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2020 Guide To Irs Tax Debt Relief - Get Free Help For Tax Problems Forget Tax Debt

Why Do I Owe Taxes This Year But Didnt Last Year - Debtcom

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa Pc

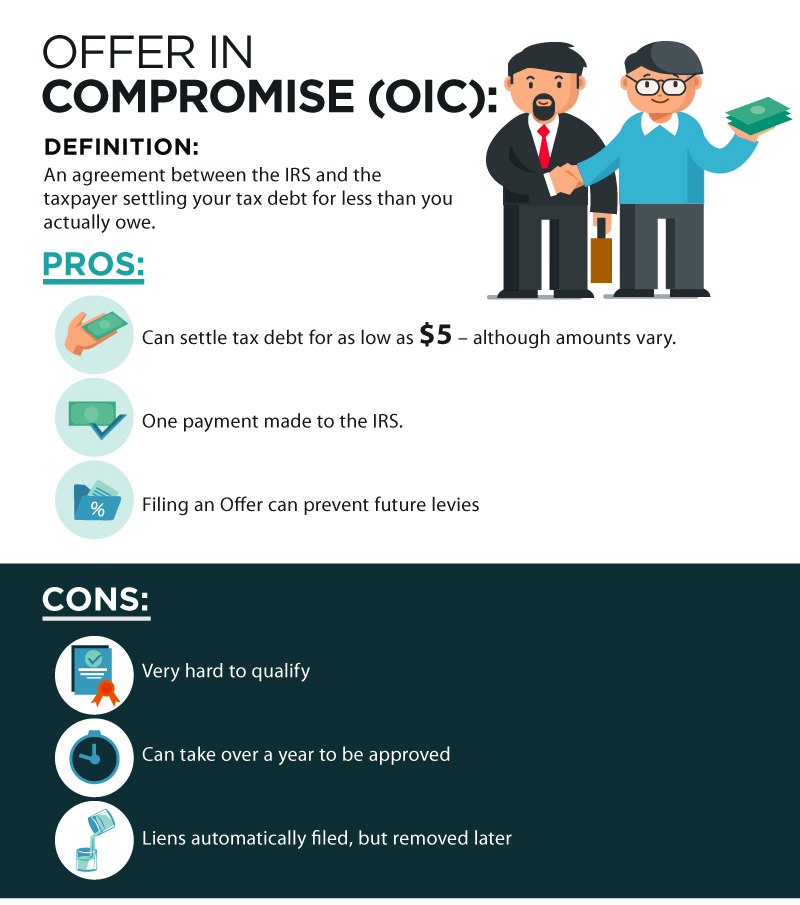

Offers In Compromise Attorney Services Polston Tax

Can The Irs Collect After 10 Years Fortress Tax Relief

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Know What To Expect During The Irs Collections Process - Debtcom

6 Common Irs Tax Penalties On Small Business Owners - Allbusinesscom

When Does An Irs Tax Lien Expire - Rjs Law - Tax And Estate Planning

Irs Tax Letters Explained - Landmark Tax Group

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

Irs Tax Relief Tax Attorney Helping You Settle Or Lower Your Back Taxes Stop The Irs Protect Your Bank Wages Today

5 Reasons Why You Shouldnt Worry Over An Irs Audit Tax Accountant Accounting Firms Cpa

How To Respond To An Irs Notice Or Letter Irs Tax Help Relief

Compliance Presence Internal Revenue Service