The maximum an employee will pay in 2021 is $8,853.60. We will even make your tax payments and complete all quarterly and annual tax filing and reporting requirements.

Looking For A Form Nj-1040-es - Estimated Tax Worksheet For Individuals Check Our Website To Find Free Printable R Personalized Bible Cherished Memories Album

The garden state has a lot of things going for it, but low taxes are not among its virtues.

Nj employer payroll tax calculator. For employers for 2021, the wage base increases to $36,200. You need a federal employer identification number (fein) to withhold new jersey income tax. Free paycheck and tax calculators.

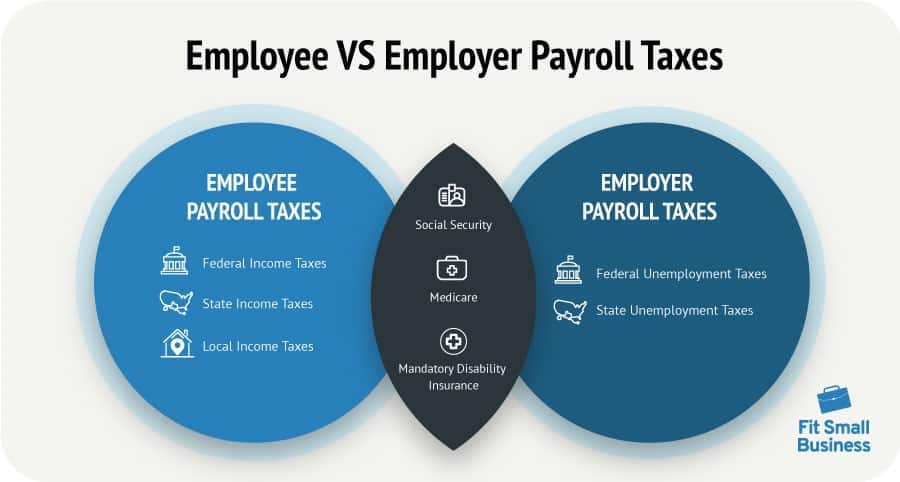

Also known as ‘paycheck tax’ or ‘payroll tax’, these taxes are taken from your paycheck directly and are used to fund social security and medicare. 401k, 125 plan, county or other special deductions; Based on a wage base for futa of $7,000 this amounts to.

The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for new jersey residents only. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. Calculates federal, fica, medicare and withholding taxes for all 50 states.

The 11.8% tax rate applies to individuals with taxable income over $1,000,000. 1, 2020 the wage base will be computed separately for employers and employees. Companies are responsible for paying their portion of payroll taxes.

New jersey new employer rate. New jersey state tax quick facts. The ins and outs of payroll taxes it can be a little daunting when it’s time to get out that calculator and run payroll.

These taxes are an added expense over and above the expense of an employee's gross pay. New jersey salary tax calculator for the tax year 2021/22 you are able to use our new jersey state tax calculator to calculate your total tax costs in the tax year 2021/22. The futa rate is 6.0 %, but new jersey businesses can take a credit of up to 5.4% for suta taxes that you pay (this is a state level calculation).

If you already registered your business and need to tell. This free, easy to use payroll calculator will calculate your take home pay. It simply refers to the medicare and social security taxes employees and employers have to pay:

You can apply for a fein on the irs’s website. Medicare and social security taxes together make up fica taxes. As the employer, you must also match your employees.

New jersey new employer rate includes: Supports hourly & salary income and multiple pay frequencies. This new jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis.

The withholding tax rates for 2021 reflect graduated rates from 1.5% to 11.8%. How to register as a new jersey employer you can register online. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates.

The new jersey payroll taxes new jersey is a little unique in that it charges a portion of the various payroll taxes to the employee as well as the employer. Free paycheck and tax calculators. The free online payroll calculator is a simple, flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

New jersey gross income tax. The employer portion of payroll taxes includes the following: The withholding tax rates for 2020 reflect graduated rates from 1.5% to 11.8%.

In new jersey, unemployment taxes are a team effort. New jersey hourly paycheck calculator. Check out our new page tax change to find out how.

If you are eligible for the maximum credit (and new jersey businesses are) your effective futa rate will be 0.6%. Managing payroll for a team of employees can be overwhelming. It is not a substitute for the advice of an accountant or other tax professional.

Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year. Get professional payroll & payroll tax calculation services in northfield, nj. Social security taxes of 6.2% in 2020 and 2021 up to the annual maximum employee earnings of $137,700.

How your new jersey paycheck works. 0.3825% unemployment compensation fund and 0.0425% workforce development fund for 2021. The 11.8% tax rate applies to individuals with taxable income over $5,000,000.

Chances are, it’s the last thing you want to think about, but getting it right is something that really matters to both your employees and your friendly neighborhood tax. With checkmark payroll services you can be confident that your payroll is safe hands. Keep track of your payroll.

Both employers and employees contribute. This is an employer tax only. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

1.1 to 2.8% for 2021. Information on employer payroll tax. The employee portion is withheld from your nanny’s wages and remitted to the state when you make your employer tax payments.

For example, in the fiscal year 2020 social security tax is 6.2% for employee and 1.45% for medicare tax. 10.50 cents per gallon of regular gasoline, 13.50 cents per gallon of diesel. Your employer will withhold 1.45% of your wages for medicare taxes each pay period and 6.2% in social security taxes.

The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. Your new jersey employer is responsible for withholding fica taxes and federal income taxes from your paychecks. The state of nj site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as google™ translate.

Computes federal and state tax withholding for paychecks; The wage base is computed separately for employers and employees. Flexible, hourly, monthly or annual pay rates, bonus or other earning items;

Switch to new jersey salary calculator.

Paycheck Calculator - Take Home Pay Calculator

What Are Employee And Employer Payroll Taxes Ask Gusto

2021 New Jersey Payroll Tax Rates - Abacus Payroll

2019 New Jersey Payroll Tax Rates - Abacus Payroll

Need A Deductions Working Sheet - Paper Size A3 Heres A Free Template Create Ready-to-use Forms At Formsbankcom Paper Size Deduction Sheet

2020 New Jersey Payroll Tax Rates - Abacus Payroll

New Jersey Payroll Tax Rates For 2017 - Abacus Payroll

Compliance Resources To Strengthen Your Business Life Cycles Strengthen Onboarding

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

How Much Does An Employer Pay In Payroll Taxes Examples More

New Jersey Payroll Tax Rates For 2016 - Abacus Payroll

20 Common Mistakes By Payroll Companies - Infographic Learn More About Internet Internet Marketing Infographics Infographic Marketing Business Marketing Plan

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Asesoria Fiscal Y Tributaria Barcelona Herencias Y Sucesiones Bookkeeping Services Assignment Writing Service Accounting Services

2021 Federal State Payroll Tax Rates For Employers

2018 New Jersey Payroll Tax Rates - Abacus Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Salary

Paycheck Calculator - Take Home Pay Calculator