Missouri’s gas tax increased by 2.5 cents on october 1, but missourians are being told they won’t. The measure would add 2.5 cents per gallon to the gas tax starting october but drivers can apply for a refund.

Missouris First Gas Tax Increase Since The 1990s Goes Into Effect Friday Fox 2

The state will incrementally increase the gas tax by 2.5 cents annually, with the funds earmarked for road and bridge repairs.

Missouri gas tax rebate. Missouri’s new gas tax hassle. Latest missouri gas tax plan includes rebates for drivers. Friday's increase will bring missouri's gas tax to 19.5 cents.

Missouri’s first motor fuel tax increase in more than 20 years takes effect on oct. The tax does not apply to fuel dyed in accordance with the irs guidelines such as dyed diesel or dyed kerosene. Missouri's new gas tax would add 2.5 cents per gallon until it hits 29.5 cents per gallon in 2025.

Under ruth’s plan, the gas tax would rise by two cents per gallon on jan. The increase would go into effect in october of this year. By elias tsapelas on oct 22, 2021.

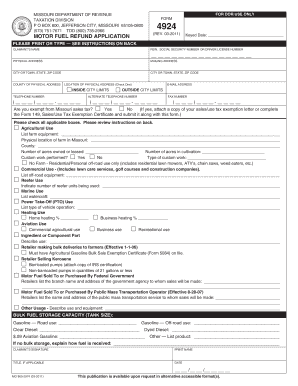

1, and there will be additional hikes of 2.5 cents per year for the next four years, for a. 1, but missourians seeking to keep that money in their pockets can apply for a rebate program. Refunds must be filed on or after july 1 but not later than september 30 following the fiscal year for which the refund is claimed.

The price of all motor fuel sold in missouri also includes federal motor fuel excise taxes, which are collected from the manufacturer by the irs and are used to support the federal highway administration. Bulk storage (tank size) if no bulk storage, explain how fuel is received: The tax on gasoline sales in missouri went up by 2.5 cents on oct.

Once fully implemented in 2025, the tax. Drivers filling up their tanks in missouri will pay an additional 2.5 cents per gallon of gas effective friday. Vehicle weighs less than 26,000 pounds.

It will continue to rise by 2.5 cents each. Once a year, people who buy gas for vehicles weighing less than 26,000 pounds will be able to submit a claim for a refund that is equal to the amount of the increase in the gas tax. Daniel mehan with the missouri chamber of commerce said.

Missouri voters haven’t approved of a gas tax increase since 1996. People looking to be reimbursed will. On october 1, 2021 missouri’s motor fuel tax rate increased to 19.5 cents per gallon.

Start saving those receipts when you pump gas, that is if you want a rebate on the new gas tax that went into effect last week. Becky ruth, chair of the house transportation committee. Use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for.

Federal excise tax rates on various motor fuel products are as follows: — individuals who drive through or in missouri could receive a refund for the increased gas taxes paid under a new plan put forth by rep. Missouri bill would boost gas tax but offer rebates to drivers february 9, 2021 by alisa nelson a proposed fuel tax increase could come with a rebate option for drivers who fill up in missouri.

Gas buyers in missouri used to pay 17 cents per gallon in taxes, one of lowest rates in the country. Gas tax increased 2.5 cents a gallon last friday Mike parson signed the increase into law in july.

Missouri’s fuel tax rate is 17 cents a gallon for all motor fuel. Missouri's fuel tax rate is 17 cents a gallon through september 30, 2021 for all motor fuel, including gasoline, diesel, kerosene, gasohol, ethanol blended with gasoline, biodiesel (b100) blended with clear diesel fuel, etc. Missouri's gas tax will go up by 12.5 cents over the next five years, 2.5 cents a year, starting this october.

You may be eligible to receive a refund of the 2.5 cents tax increase you pay on missouri motor fuel if: Missouri's gasoline tax has gone up, but you could get it back with receipts. Now, the tax has increased to 19.5 cents per gallon.

The tax, which was signed into law by gov. Mike parson in july, raises the price missouri drivers pay on gasoline by an additional 2.5 cents per gallon every year until 2025, for a total of 12.5.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

10 Ways To Wisely Manage Your Tax Refund Tax Refund Single Mom Money Personal Finance Bloggers

Motorists Give Mixed Reaction To Refund Plan For Missouri Fuel Tax Hike

How To Save Money With The Fuel Tax Increase

Missouris Gas Tax Is Going Up How Much And When The Kansas City Star

Missouri Raises Gas Tax How Can Drivers Get Refunds - The Missouri Times

Gas Tax Going Up In Missouri - Koam

Governor Signs Legislation To Increase Missouri Gas Tax Lathrop Gpm Consulting

Gas Tax Hike Taking Effect Dailyjournalonlinecom

How To Save Money With The Fuel Tax Increase

Gas Tax Brass Tacks What Drove Missouris First Fuel Tax Increase In 25 Years Kbia

Missouri Fuel Tax Increase Goes Into Effect On October 1

Missouri Gas Tax Refund Form 4925 - Fill Online Printable Fillable Blank Pdffiller

Latest Missouri Gas Tax Plan Includes Rebates For Drivers

Gas Tax Brass Tacks What Drove Missouris First Fuel Tax Increase In 25 Years News Columbiamissouriancom

Motorists Give Mixed Reaction To Refund Plan For Missouri Fuel Tax Hike

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

Es La Temporada De Los Impuestos Utilice Su Reembolso Para Comenzar A Ahorrar Su Cuota Inicial Tax Refund Tax Season Down Payment

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax