The federal tax reform law passed on dec. The 2017 tax bill limited that deduction to $10,000 per year, creating what is known as the salt cap.

Californias Workaround To The Federal Cap On The State Tax Deduction Mgo

We speak of the $10,000 cap on the state and local tax deduction, or salt, designed to drain revenues from the likes of california, new york, new jersey and massachusetts.

/cdn.vox-cdn.com/uploads/chorus_image/image/57356573/657004826.0.jpg)

Salt tax deduction wikipedia. You can deduct as much sales tax you paid off of your gross income. If the democrats can engineer a change to the salt deduction that is retroactive to cover 2021 taxes, those incumbents can campaign on having provided a. The most you are able to claim the salt deduction for state and local income taxes paid is $80,000, but the sales tax doesn’t have a limit.

The l atest c ase in point is the current push from democrats to lift the c ap on the federal tax deduction for state and local taxes (salt)— which would be a. House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for. A guide to all the ways the house spending bill would affect america

22, 2017, established a new limit on the amount of state and local taxes (salt) that can be deducted on a federal income tax return. The revised salt deduction is designed to raise revenue, at least on paper, because both plans would restore the $10,000 cap for all after 2025. The salt deduction is a large tax expenditure, meaning it is among the provisions in the tax code that provides a special deduction, credit, exclusion, or other tax preference that wouldn’t be included in a “normal” tax code.

The united states federal state and local tax (salt) deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and. Under current law, the cap would expire that year. House speaker nancy pelosi (l) has defended raising the $10,000 cap on the state and local tax (salt) deduction.

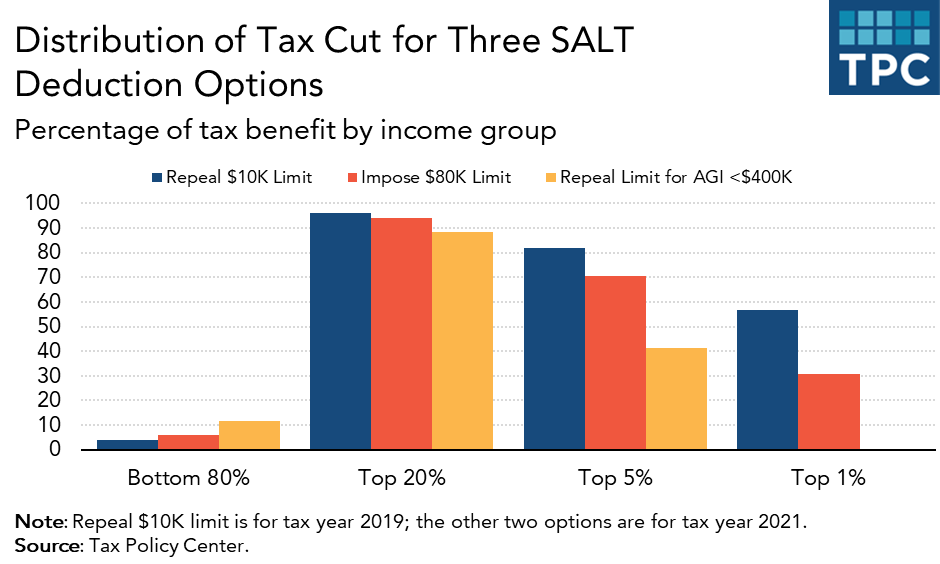

Raising the salt cap from $10,000 to $80,000 would almost exclusively benefit the highest 20% of tax filers, who are households earning more than $175,000 a year, according to an analysis thursday. Economists say it would benefit those living in high salt districts, which include. This limit applies to single filers, joint filers, and heads of household.

If you take the standard deduction on your federal income tax return, you can’t write off the state and local taxes paid. The deduction has a cap of $5,000 if your filing status is married filing separately. The belief was that if.

The bbba would raise the salt deduction limitation from $10,000 per year to $80,000 per year from 2022 through 2030, lower it to $10,000 in 2031, and then eliminate it. The tax policy center says that the salt deduction “provides an indirect federal subsidy to state and local governments by decreasing the net. Beginning in 2018, the itemized deduction for state and local taxes paid will be capped at $10,000 per return for single filers, head of household filers, and married taxpayers filing jointly.

The cap on the salt deduction started in 2018 because of the tax cuts and jobs act, a tax reform passed in 2017. No, the salt deduction isn't actually about salt, but it does affect many taxpayers in the u.s. 53 rows the salt deduction also generally benefits states that have relatively.

This cap remains unchanged for your 2020 and 2021 taxes. The salt (state and local tax) deduction is the most pertinent of them all.

Gate Way To Heaven Travel Couple Bali Travel Travel

What Is The Effective Tax Rate - Quora

Lev0wfj1qcrgim

Tax Noncompliance - Wikiwand

Chye-ching Huang Dashching Twitter

How To Prepare For Trumps Middle Class Tax Hike - Financial Samurai

Calls To End Salt Deduction Cap Threaten Passage Of Bidens Tax Plan

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions Us Tax Forms Irs Tax Forms Income Tax

What Is The Effective Tax Rate - Quora

Applicability Of Charitable Deductions For Estates And Trusts Marcum Llp Accountants And Advisors

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained - Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained - Vox

The Tax Break-down Intangible Drilling Costs Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained - Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

Income Tax - Wikiwand

/cdn.vox-cdn.com/uploads/chorus_image/image/57356573/657004826.0.jpg)

The State And Local Tax Deduction Explained - Vox

What Is The Effective Tax Rate - Quora