Property tax consultants are licensed and regulated by the texas department of licensing and regulation. The texas department of licensing & regulations requires that all property tax consultants complete 12 hours of continuing education.

2

Prior to joining rainbolt and co, he was an appraiser at comal central appraisal district for 4 years and harris county appraisal district for 1 year.

Property tax consultant license texas. Pat earned a master of business administration from harvard university. Paladin tax consultants moved to san antonio in 2016 and continues to mitigate the tax burden on properties throughout texas and surrounding states. You can obtain it on the irs's website.

If no, you are required to take the property tax consultant exam. Consultants are also licensed by the texas real estate commission. Texas doesn't have any specific business license or permit requirements.

We choose to focus exclusively on the valuation of real and personal property. Yes, if you hold an active real estate broker, salesperson license by the texas real estate commission or a real estate appraiser certified by the texas appraiser licensing & certification board, you may apply for a property tax consultant's registration. Texas laws and rules are also covered.

(1) a registered senior property tax consultant; Finish in less than 12 hours! Certificate emailed immediately upon completion!

You will need to take a four (4) hour classroom course on the texas laws and legal issues relating to property tax consulting. Property tax consultants is a full service property tax consulting firm. Tx property tax ce requirements:

Introduction to property tax administration is one of two courses designed to introduce students to the elements of the texas property tax system. Further information regarding licensing, registration, education and examination requirements for property tax professionals can be found on tdlr’s website. Modern property tax consultants, llc is a real estate valuation company located in plano, texas.

Or by contacting tdlr at ce@tdlr.texas.gov. Sixteen hours on appraisal and valuation; Eight hours on the laws and rules relating to property tax consulting;

If yes, you are not required to take the property tax consultant exam, but you must complete at least four hours of courses on texas laws and legal issues related to property tax consultant services prior to the date you submit your application. He holds a mai, the highest achievable designation from the appraisal institute, and is a licensed senior property tax consultant. Eight hours on property tax.

In 2001, he authored the first definitive consumer guide to texas property taxes, cut your texas property taxes. Hirschy, mai, ccim, is highly educated in valuation work. Property photographs were provided by shutterstock.com.

Or (2) an attorney who is licensed to practice law in this state and who has successfully completed the senior property tax consultant registration examination required under section 1152.160. When acting as a property tax consultant and/or a real estate broker, he is not acting as an appraiser. According to the texas property tax code, a tax bill mailed after january 10th has a delinquency date of:

(b) subsection (a) does not apply to a person who is registered under section 1152.156(a)(2) or 1152.158. He is a graduate of texas a&m university with a degree. Our successes are based on the extensive amount of knowledge, skills and experience we have gained from the property tax industry since 1983.

The property tax consultants are licensed by the texas dept of licensing regulation. Tax consultants are not appraisers. Jeff is a licensed registered professional appraiser (rpa) who brings 5 years of appraisal experience to the team.

Select your license type💇♀️ cosmetology⚡ electrician👨🔧 a/c & hvac contractor🅿️ tow operator🏡 property tax consultant🛗 elevator responsible party📢 auctioneer💧 water well driller & pump installer♿ registered accessibility specialist. Property photographs were provided by shutterstock.com. The course covers tax appraisal guidelines and requirements as well as best practices and useful business information.

Property tax consultants are licensed and regulated by the texas department of licensing and regulation. Since property tax appeals often involve the judicial process at some point, most property tax consultants have affiliations with lawyers who will represent the client should the appeal need. • 21 days from the mailing date of the bill (before jan.

We represent property owners throughout the state of texas. Hirschy, mai, ccim, is highly educated in valuation work. Even if you decide to operate as a sole proprietor, you should obtain a federal tax id number, also known as an employer identification number (ein).

For information regarding education or instructor approval, contact the comptroller’s office at ptpedu@cpa.texas.gov. For property tax consultants in texas it is by the license renewal date, every year. When acting as a property tax consultant and/or a real estate broker, he is not acting as an appraiser.

In that state, 40 hours of classroom instruction is required unless applicants have related, documented experience. Our staff has a diverse array of knowledge to challenge our clients property tax assessments. It is intended to satisfy education requirements for a first year texas department of licensing and regulation (tdlr) registrant working towards the registered professional appraiser (rpa), registered.

This 12 hour online course meets all tdlr requirements for property tax consultants to renew their license in texas. Only texas requires a license to become a property tax consultant;

Pb Taxand - Your Trusted Tax Advisor Partner

Property Tax - Five Stone Tax Advisers

Do You Need A Property Tax Attorney Or Consultant Propertytaxeslaw

Commercial Property Tax Professionals Lane Property Tax

Evan Fetter - Lower My Texas Property Taxes Llc

About - Lower My Texas Property Taxes

Texas Property Tax Consultants Inc Building Relationships For Life

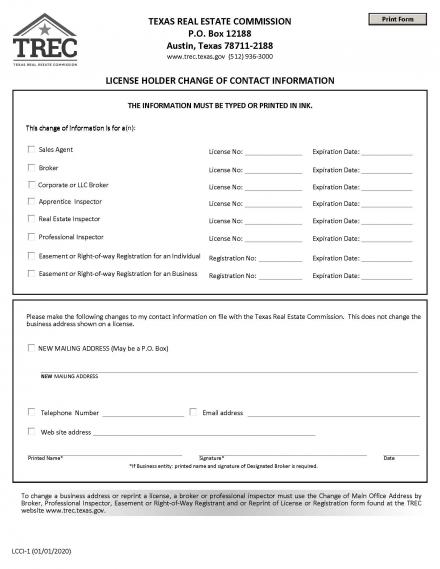

License Holder Change Of Contact Information Trec

10 Best Property Tax Protest Companies In Corpus Christi Tx Reviews Ratings Top Corpus Christi Appeal Reduction Service Consultants Near Me

Education Events Taptporg

Diy Property Tax Appeal - Property Tax Appeal Training Course

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/YQ4MISXALBKJWNHCZY7GIH3F2A.jpg)

Property Tax Consultant Wins Watchdogs Appraisal Appeal Shows Texas System Still Unfair

10 Best Property Tax Protest Companies In Corpus Christi Tx Reviews Ratings Top Corpus Christi Appeal Reduction Service Consultants Near Me

2

2

Premier Property Tax Management Consulting Property Tax Consultants Property Tax Appeals Property Tax Protest

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/Z5V56U3APBZQ2IAXABSMR5IK4E.jpg)

Property Tax Consultant Wins Watchdogs Appraisal Appeal Shows Texas System Still Unfair

Evan Fetter - Lower My Texas Property Taxes Llc

Property Tax Consultant Wins Watchdogs Appraisal Appeal Shows Texas System Still Unfair